Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1.3 billion shares, equivalent to a value of more than 32.8 trillion VND; HNX-Index reached over 151.7 million shares, equivalent to a value of more than 2.6 trillion VND.

VN-Index opened the afternoon session with a tug-of-war between buyers and sellers, with the latter maintaining a slight upper hand, causing the index to plunge and close in the red. In terms of impact, VIC, VHM, TCB, and VCB were the codes with the most negative influence on the VN-Index, with a loss of over 12.2 points. On the other hand, VPB, HVN, LPB, and HPG remained in the green and contributed over 4.2 points to the overall index.

| Top 10 stocks with the most significant impact on the VN-Index on July 21, 2025 (in points) |

Similarly, the HNX-Index also witnessed a rather pessimistic performance, with the index being negatively impacted by NVB (-2.61%), PVS (-2.34%), CEO (-3.1%), and SHS (-2.38%)…

|

Source: VietstockFinance

|

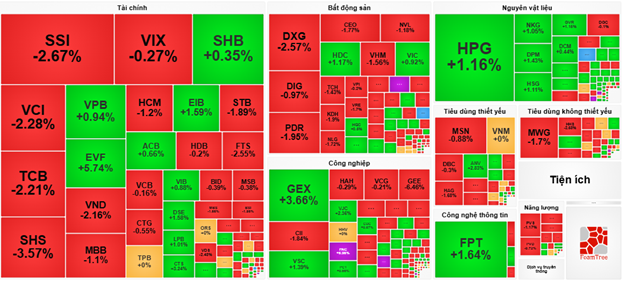

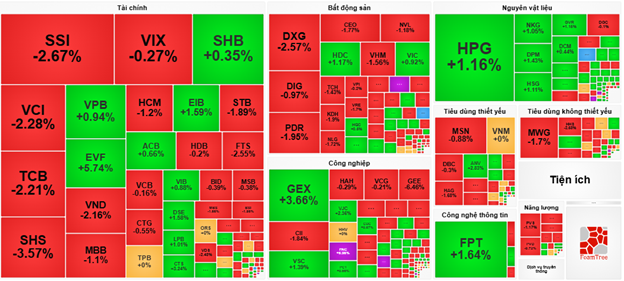

The real estate industry was the group with the most significant decline in the market, falling by 3.37%, mainly due to VIC (-5.88%), VHM (-4.17%), BCM (-1.33%), and VRE (-1.53%). This was followed by the media and consumer essentials sectors, which decreased by 2% and 1.35%, respectively. On the contrary, the materials sector was the only group to remain in the green, rising by 0.93%, driven by HPG (+1.16%), GVR (+0.66%), KSV (+0.64%), and MSR (+4.33%).

In terms of foreign trading, they returned to net buying with over 23 billion VND on the HOSE exchange, focusing on VPB (164.47 billion), VIC (76.71 billion), SSI (68.49 billion), and NVL (65.81 billion). On the HNX exchange, foreign investors net bought over 13 billion VND, mainly investing in CEO (49.1 billion), NTP (10.37 billion), LAS (4.13 billion), and PLC (2.26 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: Market Polarization

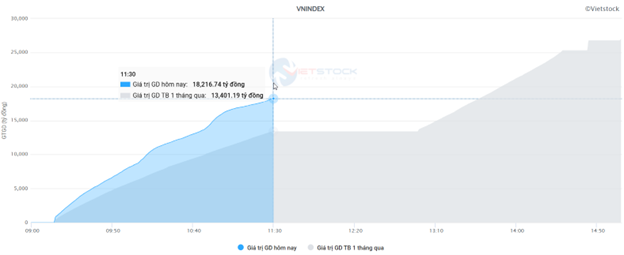

The tug-of-war around the reference level continued until the end of the morning session. At the midday break, the VN-Index paused slightly below the reference level at 1,494.98 points, down 0.15%; HNX-Index fell 0.53% to 246.45 points. The number of declining stocks gradually increased, with 374 stocks falling and 324 rising.

The morning session’s liquidity remained high. Specifically, the trading volume of the VN-Index reached over 774 million units, equivalent to a value of 18 trillion VND, while the HNX-Index recorded nearly 84 million units with a value of 1.4 trillion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, VHM and TCB were the two codes with the most negative impact, taking away a total of 2.7 points from the index. Conversely, HVN and VIC made the most positive contributions, adding 1 point each to the overall index.

In terms of sector performance, the information technology group temporarily led the market with a 1.5% increase, driven mainly by stocks such as FPT (+1.64%), DLG (+1.02%), VEC (+1.87%), and HPT (+3.15%). This was followed by the materials sector, which also rose nearly 1%, with notable gainers including HPG (+1.16%), GVR (+1.15%), MSR (+4.33%), DPM (+1.43%), HSG (+1.11%), ACG (+1.46%), and HT1 (+4.23%).

Source: VietstockFinance

|

On the other hand, the media and communications sector temporarily lagged with selling pressure concentrated in stocks such as VGI (-0.94%), FOX (-3.39%), and VNZ (-2.98%).

Foreign investors continued to net sell with a value of over 77 billion VND on all three exchanges, focusing their selling on VIX with a value of 90.83 billion. Meanwhile, VPB led the net buying list with a value of 89.52 billion VND.

10:30 am: Investor Hesitation Emerges

Investors exhibited a cautious attitude, causing the main indices to fluctuate around the reference level after a strong opening. As of 10:30 am, the VN-Index rose 6.85 points, trading around 1,504 points. The HNX-Index increased by 0.13 points, trading around 247 points.

The breadth of the VN30-Index basket showed a slight bias towards gainers. Specifically, on the positive side, HPG added 2.91 points, VIC gained 2.35 points, FPT rose by 2.23 points, and VJC climbed 1.34 points. Conversely, only a few stocks continued to face selling pressure, including VHM, TCB, MWG, and STB, which collectively dragged the index down by more than 4.6 points.

Source: VietstockFinance

|

The materials sector continued to maintain its strong performance and kept the overall market in positive territory, led by stocks such as HPG (+2.12%), GVR (+1.32%), DGC (+0.29%), KSV (+1.21%), and MSR (+5.29%)…

Notably, the two key sectors of finance and real estate also contributed positively to the market despite the ongoing polarization. On the buying side, prominent gainers included VCB (+0.32%), BID (+0.13%), VPB (+0.94%), MBB (+0.37%), VIC (+1.26%), KBC (+0.53%), and SSH (+3.96%)… Conversely, the selling pressure persisted in certain stocks, including TCB (-1.24%), CTG (-0.22%), STB (-0.5%), VHM (-1.04%), BCM (-0.15%), and VRE (-0.85%)… However, their impact on the index was not significant.

In contrast, the media and communications sector underperformed with declines in leading stocks such as VGI (-0.4%), FOX (-2.09%), FOC (-0.42%), and TTN (-1.03%)…

Foreign investors continued net selling with a value of over 77 billion VND across all three exchanges, focusing their sales on VIX with a value of 90.83 billion. On the buying side, VPB led the net buying list with a value of 89.52 billion VND.

Opening: Money Flows into Materials and Industrials

In the early trading hours of July 21, as of 9:30 am, the VN-Index narrowed its gain to over 2 points, reaching 1,499 points. Meanwhile, the HNX-Index reversed course and dipped slightly below the reference level, falling by 0.09 points to 247 points.

The market witnessed a predominance of green on the screen as most sectors recorded gains. Notably, the materials sector, driven by steel stocks such as HPG (+3.09%), HSG (+3.06%), and NKG (+2.1%)…, took the lead in guiding the overall market higher.

Large-cap stocks, including FPT, VIC, VCB, and VPB, topped the list of index contributors, adding over 3.3 points to the index. Conversely, NLG, SAB, ORS, and ASM weighed on the market, but their impact was negligible.

The industrials sector demonstrated stable growth, with most stocks maintaining positive territory despite the ongoing polarization. Notable gainers within the sector included ACV (+1.48%), HVN (+6.94%), VJC (+1.07%), VEA (+0.26%), and GEX (+0.59%)…

– 15:23 21/07/2025

Vietstock Daily: Embracing Challenges, August 1st, 2025

The VN-Index retreated after a volatile session, relinquishing early gains. Despite this pullback, the index remains above the middle Bollinger Band, a critical support level to sustain its upward trajectory. Meanwhile, the Stochastic Oscillator has begun to descend from overbought territory, indicating that the short-term outlook may encounter challenges ahead.

Market Beat: VN-Index Makes a Dramatic U-Turn, Soaring Nearly 9 Points at the Close

The market opened the afternoon session on a shaky note, with the index dropping more than 9 points at one point and flirting with the 1,500-point threshold. However, the latter half of the afternoon painted a different picture, as the index staged a steady recovery, erasing the losses from earlier in the day.

“Market Mayhem: The Wild Ride”

The VN-Index witnessed a volatile session, forming a Doji candlestick pattern, which indicates a tug-of-war between buyers and sellers at higher levels. Trading volume continued to set new records, reflecting the vibrant participation of cash flow. Currently, the Stochastic Oscillator has provided a fresh buy signal, while the MACD is narrowing its gap with the Signal line. If the buy signal is validated in the upcoming sessions, the positive outlook in the short term is likely to prevail.

Market Beat July 29: Profit-taking Pressure Mounts, VN-Index Down 64 Points

The selling pressure intensified during the afternoon session, driving the market deeper into negative territory. The downward trend gained momentum towards the closing bell, with the VN-Index plunging 64 points to close at 1,493.41. The HNX-Index also witnessed a sharp decline, falling over 8 points to end the day at 255.36.

Market Beat Aug 01: Caution Creeps In, VN-Index Wobbles at 1,500 Mark

The trading session concluded with the VN-Index shedding 7.31 points (-0.49%), settling at 1,495.21. Likewise, the HNX-Index witnessed a decline of 1.41 points (-0.53%), closing at 264.93. The market breadth tilted towards decliners, as 423 stocks closed in the red versus 366 advancers. The VN30 basket echoed a similar sentiment, with 15 stocks losing ground, 10 advancing, and 5 remaining unchanged.