MB plans to issue over 1.95 billion new shares as dividend payments to existing shareholders at a ratio of 32% (for every 100 shares held, shareholders will receive 32 new shares). The issuance source will be from the Bank’s undistributed accumulated profits for 2024. With a par value of VND 10,000 per share, the total expected issuance value is nearly VND 19,726 billion.

If successful, MB’s charter capital will increase by VND 19,726 billion, from over VND 61,023 billion to VND 80,550 billion.

Concurrently, MB will pay a cash dividend of 3% (equivalent to VND 300 per share). The payment will be made starting August 21.

On the HOSE exchange, MBB shares surged to the daily limit of VND 29,700 per share in the morning session of August 05, with a total trading volume of more than 38.7 million shares and a value of over VND 1,137 billion as of 10:30 am.

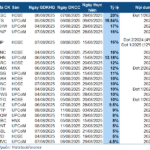

Source: VietstockFinance

|

| MBB Share Price Movement Since the Beginning of the Year |

– 10:44 05/08/2025

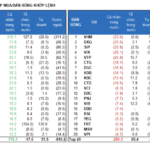

Week 04-08/08: Highest Dividend Yield at 20%

There are no standout names when it comes to dividends for the week of August 4-8, 2025. Specifically, 23 businesses will be finalizing the dividend payout with cash, and the highest rate stands at 20% – that’s 2,000 VND for every share owned.

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the middle Bollinger Band. If the index manages to hold its ground above this level in upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.

The Foreigners’ Sudden Sell-Off: A Tale of Contrasting Strategies in the Market

Foreign investors unexpectedly ramped up net selling today, offloading FPT shares worth nearly VND 312 billion. This marked the largest net sell-off by this group in nine sessions on the HoSE. In contrast, individual investors net bought VND 801.1 billion worth of shares.

Stock Market Blog: The Market is Accumulating Nicely

The market witnessed its second consecutive flat day following a robust surge on December 25th. The banking sector’s resilience helped anchor the index, while mid-cap and small-cap stocks experienced continued selling pressure. This shift in fund flow is likely to conclude by year-end, paving the way for fresh expectations in January 2025.