“Land Prices in Vietnam: A Tale of Two Regions”

According to Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, in the second quarter of 2025, there was a 19% decrease in interest for land across the market. In June alone, land searches in Hanoi dropped by 47%, Ho Chi Minh City by 28%, and other provinces by an average of 33%. Supply also decreased accordingly: the number of land sale listings in Hanoi decreased by 15%, and in Ho Chi Minh City by 9%.

This cooling-down trend is observed in both the North and the South, but regional polarization is becoming more pronounced. The North continues to lead in price increases, with hotspots including Hai Phong, Bac Ninh, Hung Yen, and Bac Giang, while the South revolves around Ho Chi Minh City and its satellite provinces such as Binh Duong, Dong Nai, Long An, and Ba Ria – Vung Tau (pre-merger).

In terms of price levels, the Northern region currently records significantly higher prices compared to the South. In Bac Ninh, land prices fluctuate around VND 36 million/sq.m, Hung Yen is approximately VND 35 million/sq.m, while Vinh Phuc and Bac Giang are around VND 24 million/sq.m. In the South, the average price in Binh Duong is about VND 31 million/sq.m, while provinces like Ba Ria – Vung Tau and Kien Giang hover around VND 16 million/sq.m.

Looking at the rate of price increases from the beginning of 2023 to mid-2025, many northern provinces have recorded impressive growth: Hoa Binh increased by 200%, Bac Giang doubled, and Hung Yen rose by 75%. In contrast, southern localities saw more modest increases, ranging from 18-36%. Some places, like Tay Ninh and Binh Phuoc, remained almost unchanged.

Mr. Nguyen Quoc Anh believes that the second-quarter slowdown does not signify a recession but rather a necessary restructuring. The market is entering a selective phase, as investors become more cautious and prioritize areas with completed infrastructure, clear legal frameworks, and planning potential. In the long term, transportation and urban development factors will continue to determine the resilience of each region.

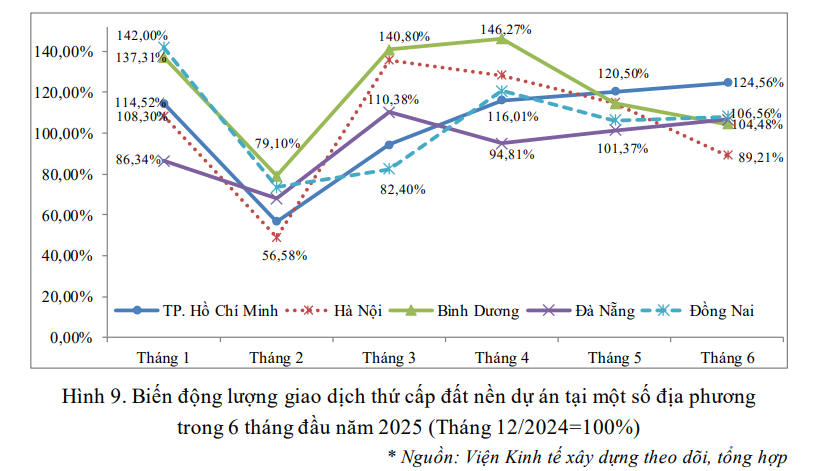

The report on the Real Estate Market Developments in the First Half of 2025 by the Institute of Building Economics (Ministry of Construction) also mentions the emergence of land fever in some localities such as Bac Giang, Phu Tho, Ninh Binh, Thai Binh, Hung Yen, Hai Phong, and Dong Nai. The main reason for this is the information about the merger of provinces and the rearrangement of administrative units, which caused speculators to take advantage by “surfing” through deposit transactions.

However, local authorities quickly stepped in with warnings, tightened management, and curbed speculation, causing the land fever to cool down rapidly from May 2025.

“A Brewing Headache: The Conundrum of the Latest Coffee Craze”

“As coffee prices surge, farmers rejoice while businesses brace for a challenging season ahead. The upcoming harvest looms large, with rising costs putting pressure on an industry already facing a slew of economic hurdles. With input expenses climbing, the future looks uncertain for those tasked with bringing our favorite brew to the masses.”

“Skyrocketing Condo Prices: Why I Chose a Home in a Quiet Hanoi Cul-de-Sac, Accessible by Car”

After an exhaustive search for an apartment, I decided to switch gears and purchase a house in a car-accessible alley. The steep hike in apartment prices was just too much to bear.

“Inflation’s Steady Climb: CPI Rises 4.04% in the First Eight Months of 2024, With Core Inflation Up 2.71% Year-on-Year.”

Consumer goods and service prices in August exhibited a mixed bag of fluctuations. Compared to July 2024, the prices of staple foods and rental housing witnessed an uptick, while domestic fuel prices declined in tandem with the global trend. Overall, the consumer price index (CPI) for August 2024 remained stable relative to the previous month. August’s CPI reflected a 1.89% increase from December 2023 and a 3.45% year-over-year rise. On average, the first eight months of 2024 saw a 4.04% CPI increase compared to the same period last year, with core inflation climbing by 2.71%.