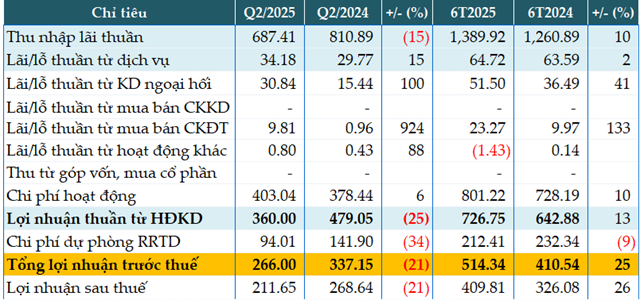

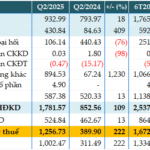

Vietbank’s second-quarter interest income witnessed a 15% decline compared to the same period last year, settling at just over VND 687 billion.

Conversely, non-interest income sources displayed robust growth. Service income rose by 15% to over VND 34 billion. Foreign exchange trading income doubled from the previous year, reaching nearly VND 31 billion. Despite constituting a minor portion of the revenue, investment securities income amounted to nearly VND 10 billion, a significant surge from the VND 958 million recorded in the same period last year; other operating income stood at VND 802 billion, up from VND 427 million.

Operating expenses climbed by 6% to VND 403 billion. Consequently, the bank’s net income from business activities dipped by 25%, settling at VND 360 billion. During this quarter, Vietbank also reduced its credit risk provision expenses by 34%, allocating only VND 94 billion. Thus, pre-tax profit dipped by 21%, amounting to nearly VND 266 billion.

Accumulated with the positive results from the first quarter, the six-month cumulative pre-tax profit as of June 30, 2025, witnessed a 25% increase compared to the same period last year, totaling over VND 514 billion.

In relation to the target of VND 1,750 billion in pre-tax profit for the full year of 2025, Vietbank has accomplished 29% of the plan in the first two quarters.

|

VBB’s Business Results for Q2 and the First Half of 2025. Unit: VND billion

Source: VietstockFinance

|

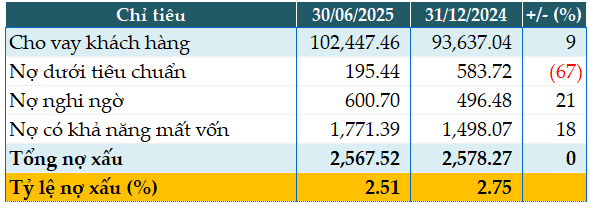

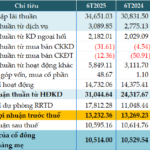

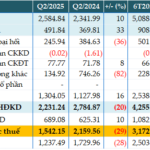

As of the end of the second quarter, Vietbank’s total assets increased by 10% from the beginning of the year to VND 178,671 billion. Loans to customers rose by 9% to VND 102,447 billion, while customer deposits climbed by 10% to VND 104,208 billion.

The lone bright spot for Vietbank was perhaps the quality of its loan portfolio, with total non-performing loans as of June 30, 2025, remaining nearly unchanged from the beginning of the year at VND 2,568 billion. Substandard loans decreased, leading to a decline in the non-performing loan ratio from 2.75% at the beginning of the year to 2.51%.

|

VBB’s Loan Quality as of June 30, 2025. Unit: VND billion

Source: VietstockFinance

|

Han Dong

– 08:44, August 4, 2025

Profiting from Services: OCB Records an 11% Rise in Q2 Profit

The recently released consolidated financial statements for the second quarter of 2025 reveal that Orient Commercial Joint Stock Bank (HOSE: OCB) has achieved remarkable financial performance. The bank reported a remarkable pre-tax profit of over VND 999 billion, reflecting an 11% increase compared to the same period last year. This impressive growth is attributed to the bank’s strategic focus on core income growth and a robust performance in its services division.

BIDV Posts 6% Pre-Tax Profit Increase in Q2, Total Assets Near VND 3 Quadrillion

The consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Investment and Development of Vietnam, better known as BIDV (HOSE: BID). The bank posted a remarkable pre-tax profit of nearly VND 8,625 billion, reflecting a 6% increase compared to the same period last year. As of the end of the second quarter, BIDV’s total assets stood at over VND 2.99 million billion.

Profits Soar and Bad Debt Declines: ABBank’s Impressive First Half of the Year

The recently released Q2 2025 consolidated financial statements reveal that An Binh Joint Stock Commercial Bank (ABBank) posted a remarkable performance with a pre-tax profit of VND 1,257 billion, tripling its figure from the previous year. This outstanding result brings the bank’s half-year pre-tax profit to VND 1,672 billion, achieving 92% of its annual target.

Agribank’s Pre-Tax Profit for H1 2025 Exceeds VND 13,232 Billion, with Improved Non-Performing Loan Ratio

The consolidated financial statements for the first half of 2025 reveal that the Vietnam Bank for Agriculture and Rural Development (Agribank) recorded a pre-tax profit of over VND 13,232 billion for the period, a figure almost identical to the same period last year. Non-performing loans at the end of the second quarter showed improvement compared to the beginning of the year.