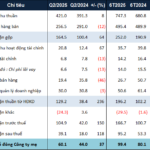

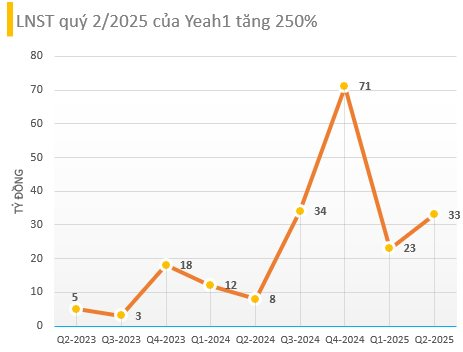

According to the consolidated financial report for Q2 2025, Yeah1 Corporation (stock code: YEG) recorded a revenue of over 455.7 billion VND, a 116.3% increase compared to the same period last year. After deducting the cost of goods sold, the gross profit reached nearly 55 billion VND, a 225.4% increase.

During this period, the company earned more than 5.2 billion VND in financial activity revenue, an 87.3% decrease from the beginning of the year.

Yeah1’s financial expenses were positive at over 5.2 billion VND, while in the same period last year, it was negative at more than 6.1 billion VND. Operating expenses decreased from 32.3 billion VND to nearly 18 billion VND. In contrast, selling expenses increased from 4.6 billion VND to 9.3 billion VND.

As a result, Yeah1 reported a net profit of nearly 33.3 billion VND, 3.5 times higher than the same period last year.

The company attributed these positive results mainly to the growth in the advertising, event organization, music programs, and entertainment content segments, which attracted a large audience and significantly boosted revenue and profits.

Notable programs held this year include a series of concerts by “Anh Trai Vượt Ngàn Chông Gai” and two new TV shows, “Tan Binh Toan Nang” and “Gia Đình Haha.”

For the first six months of 2025, Yeah1’s cumulative revenue reached nearly 673.5 billion VND, 2.4 times higher than the same period in 2024. The after-tax profit was nearly 56.6 billion VND, 2.6 times higher than the previous year.

In another development, Yeah1 has announced a report on changes in large shareholder ownership of Pyn Elite Fund.

Specifically, during the trading session on July 24, 2024, Pyn Elite Fund successfully purchased 1 million YEG shares, increasing its ownership from over 13.2 million shares to over 14.2 million shares, equivalent to a percentage increase from 6.91% to 7.43% of Yeah1’s capital.

Based on the closing price of YEG shares on July 24, 2025, at 13,600 VND per share, it is estimated that Pyn Elite Fund spent approximately 13.6 billion VND to purchase the registered number of shares mentioned above.

“Repayments Begin: The Saga of Quốc Cường Gia Lai and Sunny Island”

In Q2 2025, Quoc Cuong Gia Lai began refunding Sunny Island to reclaim the Phuoc Kien project. Conversely, QCG borrowed an additional VND 240 billion from two major corporations.

The Debt Swap Deal Could Cost Hai Phat a Whopping Sum

“Oceanic Realty is set to undergo a significant debt-to-equity swap, exchanging 212 billion VND in loans for 21.2 million HQC shares of Hoang Quan Real Estate. However, with HQC shares currently trading at just 3,800 VND per share, the swap could result in a substantial loss for Hai Phat Investment. If the swap were to go through at the current market price, Hai Phat Investment would face an immediate 62% loss on the loan value, amounting to 131.44 billion VND.”

“Insider Trading: Chairman-Linked Entity Seeks to Increase Stake in SAM as Prices Hit 2-Year High”

National Securities Incorporation (NSI) aims to strengthen its foothold in SAM Holdings Joint Stock Company (HOSE: SAM) by acquiring an additional 5 million shares from August 6 to September 4.