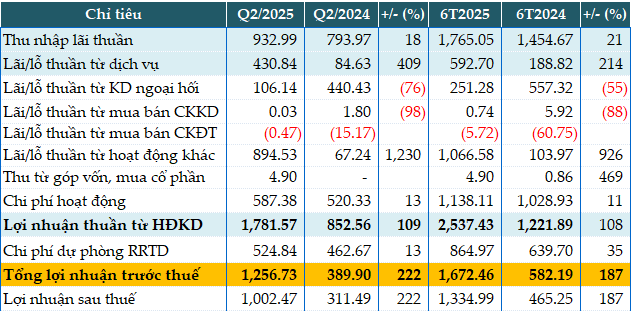

ABBank’s second-quarter net interest income reached nearly VND 933 billion, an 18% increase compared to the same period last year.

Non-credit income sources also witnessed a significant surge, with service income reaching nearly VND 431 billion, a fivefold increase year-on-year. Other operating income amounted to nearly VND 895 billion, compared to just VND 67 billion in the previous year.

On the other hand, foreign exchange trading income decreased by 76% to VND 106 billion, and securities investment income dropped by 98%.

Operating expenses for the quarter rose by 13% to VND 587 billion, resulting in a CIR of 31.29%. Consequently, the bank’s net income from operating activities stood at VND 1,782 billion, doubling that of the previous year.

ABBank set aside VND 524 billion in provisions for credit risks, a 13% increase. Nevertheless, the bank’s pre-tax profit reached VND 1,257 billion, triple that of the same period last year.

For the first six months of the year, ABBank’s pre-tax profit exceeded VND 1,672 billion, nearly 2.9 times higher than the previous year. With a target of VND 1,800 billion in pre-tax profit for the full year, the bank has already achieved 92% of its plan in just six months. The ROE ratio stood at 18.3%, while the CAR ratio remained above 8%. The bank maintained a high level of liquidity, with an LDR of 62.82%.

Pham Duy Hieu, CEO of ABBank, commented: “The significant improvement in ABBank’s performance in the second quarter of 2025 can be attributed to the effective utilization of internal strengths and the positive impact of our decisive operational reforms. For the second half of the year, ABBank aims to continue this strong growth trajectory in credit, deposit, and service activities, with an expected pre-tax profit exceeding the planned VND 1,800 billion. Additionally, we remain focused on credit governance and stringent bad debt control.”

|

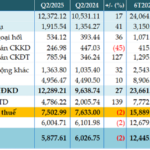

ABBank’s Q2 and six-month business results for 2025 in units of VND billion

Source: VietstockFinance

|

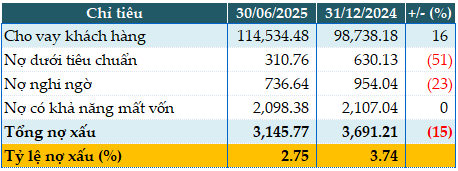

As of the end of the second quarter, the bank’s total assets increased by 16% from the beginning of the year to VND 204,917 billion. Credit balance reached VND 122,364 billion, an increase of over 11%, with a focus on individual customers, the bank’s strategic segment. Customer lending rose by 16% to VND 114,534 billion.

Customer deposits and issuances of debt instruments reached VND 149,587 billion, a 36% increase compared to the beginning of the year. Customer deposits, in particular, witnessed a significant surge of 36%, totaling VND 123,056 billion.

The improvement in loan quality added a positive highlight to ABBank’s business performance in the first half of the year. As of June 30, 2025, total non-performing loans decreased by 15% to nearly VND 3,146 billion, with a reduction across all debt groups. As a result, the ratio of non-performing loans to total loans decreased from 3.74% at the beginning of the year to 2.75%. The bad debt ratio was lowered to 1.9%.

|

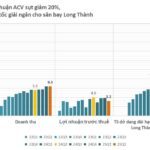

ABBank’s loan quality as of June 30, 2025, in units of VND billion

Source: VietstockFinance

|

Fined and back-taxed VND 8.6 billion

In a separate development, on July 23, ABBank received a decision on administrative sanctions for tax violations from the Tax Authority. ABBank was found to have made incorrect tax declarations, resulting in an underpayment of taxes, and had also made incomplete or inadequate declarations in tax dossiers, although this did not lead to an underpayment of taxes.

Consequently, ABBank was fined nearly VND 1.24 billion, including VND 1.23 billion for the underpayment of taxes and VND 13 million for incomplete or inadequate declarations.

Additionally, the bank was required to pay back taxes of over VND 6.13 billion, adjust VND 130 million of VAT still available for deduction in the next period, and pay late payment interest of over VND 1.12 billion.

The total amount of fines and back taxes that ABBank had to pay was over VND 8.6 billion.

Agribank’s Pre-Tax Profit for H1 2025 Exceeds VND 13,232 Billion, with Improved Non-Performing Loan Ratio

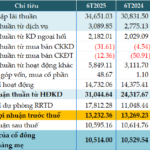

The consolidated financial statements for the first half of 2025 reveal that the Vietnam Bank for Agriculture and Rural Development (Agribank) recorded a pre-tax profit of over VND 13,232 billion for the period, a figure almost identical to the same period last year. Non-performing loans at the end of the second quarter showed improvement compared to the beginning of the year.

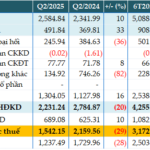

Unlocking the Mystery: CASA’s 26.78% Achievement and MSB’s Profit Plunge

The consolidated financial statements of the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) revealed a profit before tax of nearly VND 3,173 billion for the first half of 2025, a 14% decrease compared to the same period last year.

“A Surge in Semiannual Profits: CASA Rises by 37.9%, MB by 18%”

The consolidated financial statements reveal that Military Commercial Joint Stock Bank (MB, HOSE: MBB) recorded a remarkable performance in the first six months of 2025. The bank’s profit before tax stood at VND 15,889 billion, reflecting an impressive 18% year-over-year growth. This outstanding result can be attributed to the robust growth across various revenue streams.

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.