Per the initial agreement, Sunny Island was to transfer a total of VND 4.8 trillion in installments to QCG in exchange for corresponding land use rights. However, after disbursing VND 2.88 trillion, this partner halted payments, stalling the transaction for several years. This incident is part of a series of violations involving Ms. Truong My Lan and the Van Thinh Phat Group.

At the 2024 annual general meeting, CEO Nguyen Quoc Cuong stated that the Phuoc Kien project is a key development focus for QCG. As such, the company needs to repay the full amount of VND 2.88 trillion to retrieve the files, documents, and red books for the 65 hectares of land previously transferred to Sunny Island. A year later, Mr. Cuong affirmed that the recovery plan is still underway, expected to be carried out in multiple installments, starting in Q3 2025 and completing in the first half of 2027.

QCG CEO Nguyen Quoc Cuong shares about one of QCG’s critical projects at the 2025 annual general meeting – Photo: Tu Kinh

|

In addition to the planned two-year “instalment” option, the enterprise leaves open the possibility of accelerating repayment if conditions are favorable. To facilitate this repayment, Mr. Cuong states that QCG must divest from the hydropower sector to ensure cash flow. However, the semi-annual report shows that this divestment has not yet taken place.

At the end of June 2025, the long-term unfinished investment value at the Phuoc Kien project increased slightly to over VND 5.42 trillion. Currently, the enforcement agency is holding some documents related to compensation and site clearance for this project to ensure Ms. Truong My Lan’s enforcement obligations under the pronounced judgments. Therefore, QCG temporarily classifies the receivable from Sunny Island as long-term on the balance sheet.

According to Mr. Cuong, Phuoc Kien spans nearly 100 hectares with over 1.5 million square meters of floor area, connecting vital traffic routes to Can Gio, the Mekong Delta, and Long Thanh Airport. Mr. Cuong compares the project’s scale to “half of Phu My Hung,” emphasizing its long-term development potential despite the investment volume exceeding QCG’s current capacity. As of May 2025, compensation work reached approximately 85% of the total area.

QCG Shareholder Meeting: Multiple Installment Payments May Be Made to Retrieve Phuoc Kien Project

Mr. Nguyen Quoc Cuong Discusses QCG’s Repayment Sources for Sunny Island

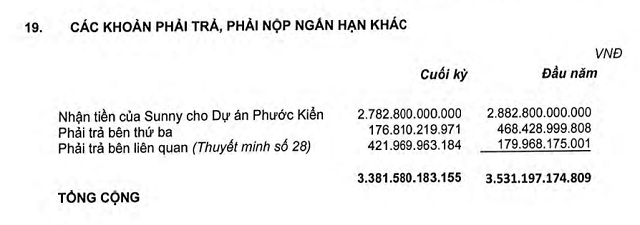

QCG recorded a reduction in the amount payable to Sunny Island to approximately VND 2.78 trillion. Source: QCG’s Consolidated Financial Statements for Q2 2025

|

In terms of financial results, QCG reported a net profit of nearly VND 7.4 billion in Q2 2025 due to apartment deliveries, while the same period last year incurred a loss. Revenue reached VND 131 billion, nearly five times higher than Q2 2024, with the real estate segment contributing VND 98 billion, a significant increase from VND 2 billion in the previous year. However, profits were narrowed by compensation and penalty amounts exceeding VND 13 billion.

For the first six months, QCG’s net profit was nearly VND 17 billion, compared to a loss of VND 15 billion in the same period last year. Nevertheless, this performance only achieved about 7% of the annual profit target, and revenue also reached just 12% of the VND 2 trillion plan.

As of the end of June, QCG’s total assets approached VND 9.5 trillion, an increase of VND 600 billion from the beginning of the year. “Short-term receivables from customers” increased by over VND 700 billion to VND 1.1 trillion. Inventories slightly decreased to VND 1.2 trillion. Notably, “Unrecognized Short-term Revenue” amounted to VND 803 billion, while this item was not recorded at the beginning of the year.

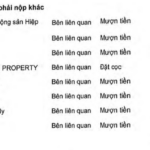

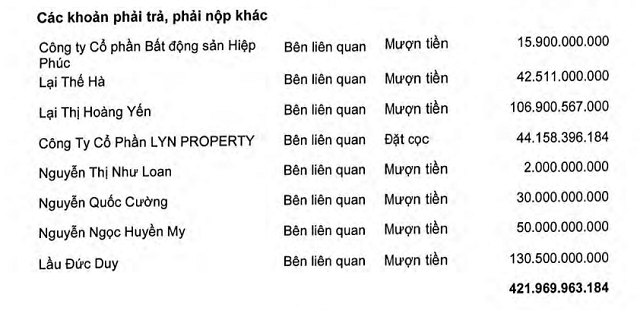

On the liability side, “Short-term payables to related parties” increased significantly from VND 180 billion to VND 422 billion, with QCG borrowing the most from Mr. Lau Duc Duy, brother-in-law of Mr. Nguyen Quoc Cuong, at VND 130 billion, and VND 107 billion from Ms. Lai Thi Hoang Yen, daughter of Chairman Lai The Ha. Meanwhile, the obligation of “Payables to Third Parties” decreased by a nearly equivalent amount.

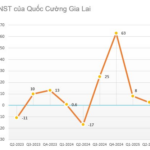

| QCG’s Most Positive First Half in the Last 3 Years |

QCG borrows hundreds of billions from individuals and related parties. Source: QCG’s Consolidated Financial Statements for Q2 2025

|

|

On May 7, the Da Nang Construction Department announced that 34 houses with floor areas ranging from 147 to 446 square meters at the real estate and marina project in Da Nang (commercially known as Marina Da Nang), developed by Marina Da Nang JSC, a subsidiary of QCG, are eligible for sale as future homes. This project accounts for the majority of the “Unfinished Real Estate” item valued at VND 568 billion in QCG’s Q2 2025 financial statements. |

– 15:21 04/08/2025

“Repayments Begin: The Saga of Quốc Cường Gia Lai and Sunny Island”

In Q2 2025, Quoc Cuong Gia Lai began refunding Sunny Island to reclaim the Phuoc Kien project. Conversely, QCG borrowed an additional VND 240 billion from two major corporations.