These results are based on an independent assessment that considered quantitative financial criteria, media reputation, and surveys of key players in the financial and banking market.

Sacombank Representative Receiving the Award

Mark of a Comprehensive and Sustainable Developing Bank

Consecutively ranking in multiple prestigious listings is a testament to Sacombank’s resilience amid an ever-changing economy. With stable financial capabilities, robust technological foundations, and a flexible growth strategy, Sacombank continuously innovates to meet the evolving needs of individuals, businesses, and investors.

Beyond maintaining effective business operations, Sacombank excels in transparency, adhering to international standards for corporate governance, and embracing sustainable development through the integration of ESG (Environmental, Social, and Governance) frameworks.

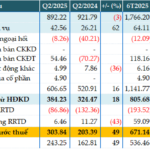

Significant Growth in Pre-Tax Profit for Q2 2025 Compared to the Previous Year

As per the consolidated financial report for Q2 2025, Sacombank recorded a pre-tax profit of VND 3,657 billion, marking a 36% increase year-over-year. For the first half of the year, the bank’s pre-tax profit reached VND 7,331 billion, equivalent to 50% of the target assigned by the Annual General Meeting of Shareholders. This growth is driven by substantial improvements in net interest income and service income.

As of June 30, 2025, net interest income stood at VND 13,448 billion, reflecting an 11.4% increase. Meanwhile, net income from services witnessed a significant surge of 30.8%, amounting to VND 1,647 billion. Total assets also grew by 7.9% from the beginning of the year, reaching VND 807,339 billion. Customer loan balances increased by 9% to VND 587,960 billion, while customer deposits rose by 10.1% to VND 624,315 billion. Adequate provisioning helped maintain the non-performing loan ratio at 2.14%, showcasing Sacombank’s ability to manage asset quality during its restructuring phase.

Unprecedented: Two Vietnamese Banks Reach the 2 Million Billion Dong Deposit Milestone

Customer deposits in the banking system currently exceed 15 trillion dong. Of this, deposits at just these two banks amount to over 4 trillion dong.

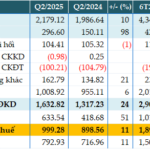

KienlongBank Announces Q2 2025 Financial Results: Multiple Business Indicators Achieve Over 90% of Targets

KienlongBank (UPCoM: KLB) has announced its Q2 2025 financial results, boasting impressive performance. The bank’s consolidated pre-tax profit reached VND 565 billion, with key business indicators such as total assets, mobilized capital, and credit outstanding achieving over 90% of the year’s set plan.

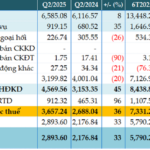

Reverse Engineering Profits: Unraveling Bac A Bank’s Strategy for a 49% Surge in Pre-Tax Profits

“Bac A Bank (HNX: BAB) announced a remarkable 49% year-over-year increase in its second-quarter 2025 consolidated profit, amounting to nearly VND 304 billion. This impressive performance is attributed to the bank’s successful diversification strategy, evident in the growth of non-interest income, coupled with a prudent reduction in credit risk provisions.”

Profiting from Services: OCB Records an 11% Rise in Q2 Profit

The recently released consolidated financial statements for the second quarter of 2025 reveal that Orient Commercial Joint Stock Bank (HOSE: OCB) has achieved remarkable financial performance. The bank reported a remarkable pre-tax profit of over VND 999 billion, reflecting an 11% increase compared to the same period last year. This impressive growth is attributed to the bank’s strategic focus on core income growth and a robust performance in its services division.

“Sacombank’s Strategic Cost Management Pays Off: A 36% Jump in Pretax Profit for Q2”

The consolidated financial statements for the second quarter of 2025 revealed impressive results for the Saigon Thuong Tin Commercial Joint Stock Bank, more commonly known as Sacombank (HOSE: STB). The bank demonstrated its resilience and strong performance by recording a remarkable pre-tax profit of over VND 3,657 billion, reflecting a significant 36% increase compared to the same period last year, despite substantially bolstering its risk provisions.