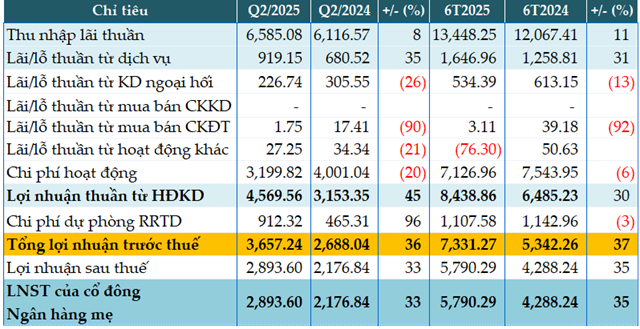

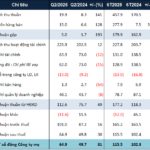

Sacombank’s core revenue for Q2 witnessed an 8% year-on-year increase, earning over VND 6,585 billion in net interest income.

Service income surged by 35% to VND 919 billion. Despite constituting a small portion of non-interest income, other non-credit income sources witnessed a decline, including foreign exchange trading income (-26%), investment securities income (-90%), and other operating income (-21%).

A notable highlight of Sacombank’s Q2 performance was a 20% reduction in operating expenses, totaling VND 3,199 billion. Consequently, profit from business operations increased by 45% to VND 4,570 billion.

Sacombank significantly increased its credit risk provision expenses by 96% to VND 912 billion, resulting in a 36% year-on-year increase in pre-tax profit, amounting to VND 3,657 billion.

For the first six months of the year, Sacombank’s pre-tax profit reached VND 7,331 billion, a 37% increase year-on-year. Compared to the full-year pre-tax profit target of VND 14,650 billion, Sacombank has accomplished 50% of its goal in the first two quarters.

|

STB’s Q2 and six-month business results for 2025 in VND billion

Source: VietstockFinance

|

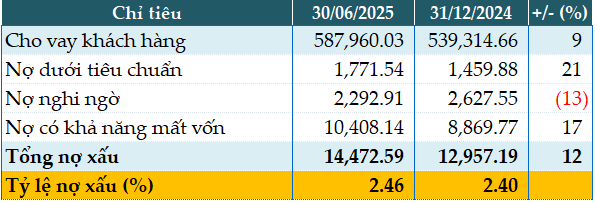

As of the end of Q2, Sacombank’s total assets expanded by 8% from the beginning of the year to VND 807,339 billion. Customer lending increased by 9% to VND 587,960 billion, while customer deposits grew by 10% to VND 624,314 billion.

Sacombank’s total non-performing loans as of June 30, 2025, amounted to VND 14,472 billion, a 12% increase from the beginning of the year. The non-performing loan ratio slightly increased from 2.4% at the beginning of the year to 2.46%.

|

STB’s loan quality as of June 30, 2025, in VND billion

Source: VietstockFinance

|

Han Dong

– 21:34 30/07/2025

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”

“A Surge in Semiannual Profits: CASA Rises by 37.9%, MB by 18%”

The consolidated financial statements reveal that Military Commercial Joint Stock Bank (MB, HOSE: MBB) recorded a remarkable performance in the first six months of 2025. The bank’s profit before tax stood at VND 15,889 billion, reflecting an impressive 18% year-over-year growth. This outstanding result can be attributed to the robust growth across various revenue streams.

Vingroup’s Unprecedented Wealth: Holding Over 82,000 Billion VND in Cold Hard Cash, Total Assets Nearing the 1,000 Trillion VND Milestone

Vingroup’s total assets have consistently demonstrated resilience, maintaining an upward trajectory since its listing. With its impressive performance, the conglomerate helmed by billionaire Pham Nhat Vuong is poised to become Vietnam’s second non-financial enterprise to surpass the remarkable milestone of 1 million billion dong in assets, hot on the heels of Petrovietnam.