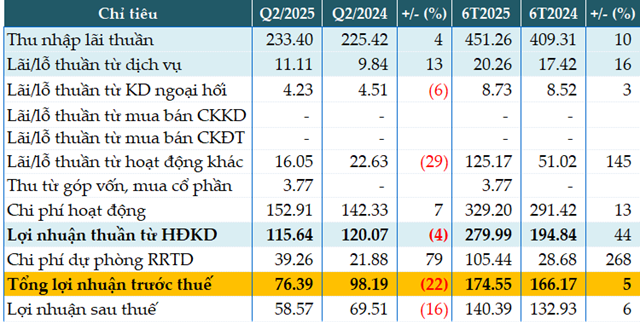

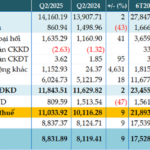

Saigonbank’s net interest income for the second quarter grew by only 4% year-on-year to VND 233 billion.

Service income increased by 13% to VND 11 billion, while other non-interest income sources declined, including forex income (-6%) and other business activities (-29%).

Operating expenses for the quarter rose by 7% to nearly VND 153 billion due to increased investment in upgrading its information technology system.

Consequently, net profit from business operations reached nearly VND 116 billion, a 4% decrease compared to the previous year.

Additionally, Saigonbank set aside VND 39 billion in credit risk provisions, a 79% increase. The bank explained that this was done to manage risks, enhance financial capacity, and contribute to long-term business stability. As a result, pre-tax profit for the quarter decreased by 22% to over VND 76 billion.

For the first six months of the year, pre-tax profit increased by 5% year-on-year to nearly VND 175 billion.

In relation to the full-year pre-tax profit target of VND 300 billion, Saigonbank has accomplished 58% in the first two quarters.

|

Saigonbank’s Q2 and 6M 2025 business results in VND billion

Source: VietstockFinance

|

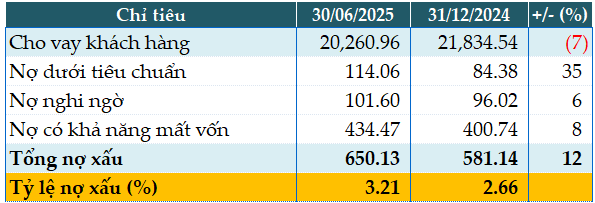

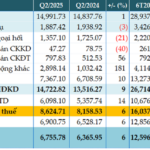

Total assets as of the end of Q2 reached VND 35,140 billion, a 6% increase from the beginning of the year. Loans to customers decreased by 7%, reaching VND 20,260 billion, while customer deposits rose by 5% to VND 25,595 billion.

As of June 30, 2025, Saigonbank’s total non-performing loans (NPLs) amounted to VND 650 billion, a 12% increase from the beginning of the year. The NPL ratio increased from 2.66% to 3.21% during this period.

The NPL ratio as per Circular 31/2024/TT-NHNN dated June 30, 2025, was 2.27%.

|

SGB’s loan quality as of June 30, 2025, in VND billion

Source: VietstockFinance

|

Han Dong

– 08:13, August 4, 2025

Reverse Engineering Profits: Unraveling Bac A Bank’s Strategy for a 49% Surge in Pre-Tax Profits

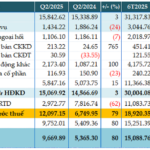

“Bac A Bank (HNX: BAB) announced a remarkable 49% year-over-year increase in its second-quarter 2025 consolidated profit, amounting to nearly VND 304 billion. This impressive performance is attributed to the bank’s successful diversification strategy, evident in the growth of non-interest income, coupled with a prudent reduction in credit risk provisions.”

Profiting from Services: OCB Records an 11% Rise in Q2 Profit

The recently released consolidated financial statements for the second quarter of 2025 reveal that Orient Commercial Joint Stock Bank (HOSE: OCB) has achieved remarkable financial performance. The bank reported a remarkable pre-tax profit of over VND 999 billion, reflecting an 11% increase compared to the same period last year. This impressive growth is attributed to the bank’s strategic focus on core income growth and a robust performance in its services division.

Vietcombank Reports 9% Rise in Q2 Pre-Tax Profit, Attributed to Reduced Provisions

The recently released consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Foreign Trade of Vietnam, commonly known as Vietcombank (HOSE: VCB). The bank reported a remarkable pre-tax profit of over VND 11,034 billion, reflecting a 9% increase compared to the same period last year. This outstanding performance is attributed to a significant reduction in risk provisions.

BIDV Posts 6% Pre-Tax Profit Increase in Q2, Total Assets Near VND 3 Quadrillion

The consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Investment and Development of Vietnam, better known as BIDV (HOSE: BID). The bank posted a remarkable pre-tax profit of nearly VND 8,625 billion, reflecting a 6% increase compared to the same period last year. As of the end of the second quarter, BIDV’s total assets stood at over VND 2.99 million billion.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”