SHB’s Board of Directors has recently approved a resolution to set the record date for the 2024 dividend payment in shares as August 19, 2025. Accordingly, SHB will pay a 13% dividend for 2024, issuing 528.5 million new shares, and increasing its charter capital to over VND45,942 billion. This move solidifies SHB’s position within the top 5 largest private joint-stock commercial banks in the system. Previously, SHB completed the first 2024 dividend payment in cash at a rate of 5%. The total dividend rate for 2024, as approved by the SHB Annual General Meeting of Shareholders, is 18% and is expected to be maintained for 2025.

The increase in charter capital is of great significance as it bolsters the bank’s financial capacity, enhances SHB’s competitiveness in the process of international economic integration, and, most importantly, fulfills the expectations of shareholders.

In the stock market, SHB’s market capitalization reached the milestone of $3 billion on August 4, 2025, with share prices doubling since the beginning of the year and currently trading at around VND18,600 per share. SHB has witnessed numerous trading sessions with over 100 million shares exchanged, leading the VN30 group and the banking sector. Notably, on July 7, SHB recorded a record trading volume of nearly 250 million shares. SHB has also attracted foreign investors, with a net buy volume of over 100 million units in July 2025.

SHB’s stock performance over the past year

Throughout its 32-year history, SHB has consistently pursued safe, open, and transparent development, achieving sustainable profit growth and regularly increasing its charter capital. The bank’s safety, liquidity, and risk management indices have all surpassed the requirements set by the State Bank of Vietnam and international standards.

Breakthrough business results and enhanced asset quality

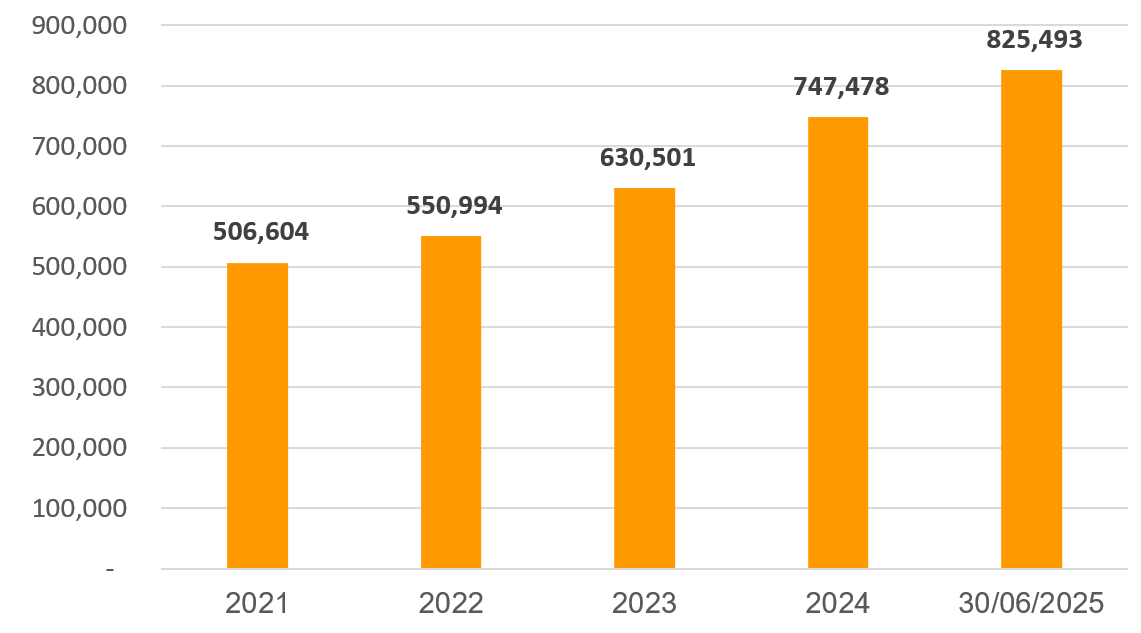

As of June 30, 2025, SHB’s total assets reached nearly VND825 trillion, with customer lending exceeding VND594.5 trillion, marking a 14.4% increase from the beginning of the year and a significant 28.9% surge compared to the same period last year.

SHB’s asset growth over the years (in VND billion)

For the first six months of 2025, SHB recorded a consolidated pre-tax profit of VND8,913 billion, a 30% increase compared to the same period in 2024, equivalent to 61% of the year’s plan. In the second quarter alone, pre-tax profit surpassed VND4,500 billion, a 59% increase year-over-year.

The bank’s operational efficiency has markedly improved, as evidenced by a Return on Equity (ROE) of over 18%. The bank impressively maintained its Cost-to-Income Ratio (CIR) at 16.4%, the lowest in the industry. SHB continues to rank among the top banks in terms of average pre-tax profit per employee, reaching VND1.3 billion, the highest in the system.

Safety indices remained well-managed. The Loan-to-Deposit Ratio (LDR) and the ratio of short-term capital used for medium and long-term loans were both within the limits set by the State Bank of Vietnam. The consolidated Capital Adequacy Ratio (CAR) remained stable at over 11%, well above the minimum requirement of 8%, ensuring sufficient capital adequacy for the bank’s operations.

Asset quality witnessed a significant improvement, with the bad debt ratio (NPL) as per Circular 31 being kept at a low level. Substandard debt decreased sharply to only 0.3%, indicating a substantial enhancement in asset quality.

For 2025, the bank aims for a pre-tax profit of VND14,500 billion, a 25% increase compared to 2024. The target total assets for the year are projected at VND832 trillion, with a milestone of VND1,000 trillion expected to be reached in 2026, signifying a robust advancement in scale and market position domestically and regionally. Over the years, SHB has consistently ranked among the top 5 banks contributing the largest amount of tax to the state and has always been proactive in aligning with the country’s policies and orientations.

The Stock Market Breakthrough: Unraveling the Power of Holistic Transformation and Sustainable Business Strategies

Over the past two months, SHB stock has surged with market-leading liquidity, attracting foreign investment. For years, SHB has consistently paid dividends at a rate of 10-18%. Recently, SHB announced breakthrough business results, showcasing significant changes in its strategic transformation implementation.

SHB Shareholders’ Meeting: Gifts Distributed to Attendees, Near 1,400 Present Before Opening

Today afternoon, April 25, Saigon – Hanoi Commercial Joint Stock Bank (SHB) held the 2024 Annual General Meeting of Shareholders at the Melia Hotel on Ly Thuong Kiet Street, Hoan Kiem District, Hanoi.