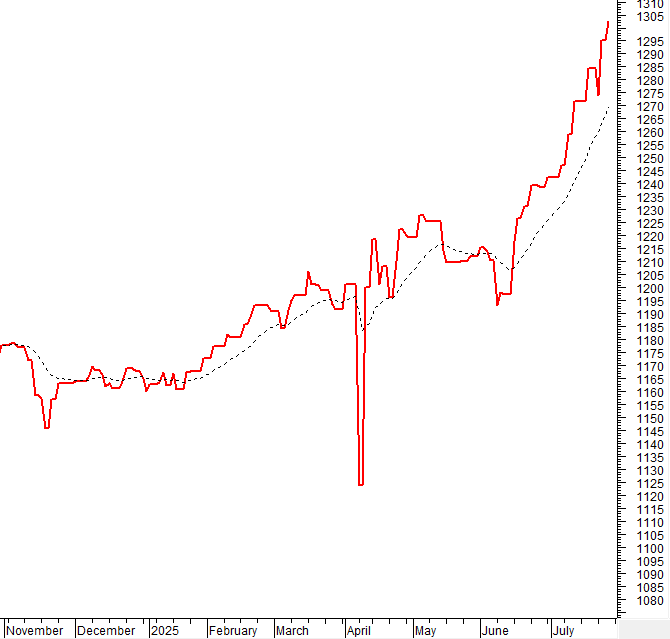

I. MARKET ANALYSIS OF STOCKS AS OF JULY 24, 2025

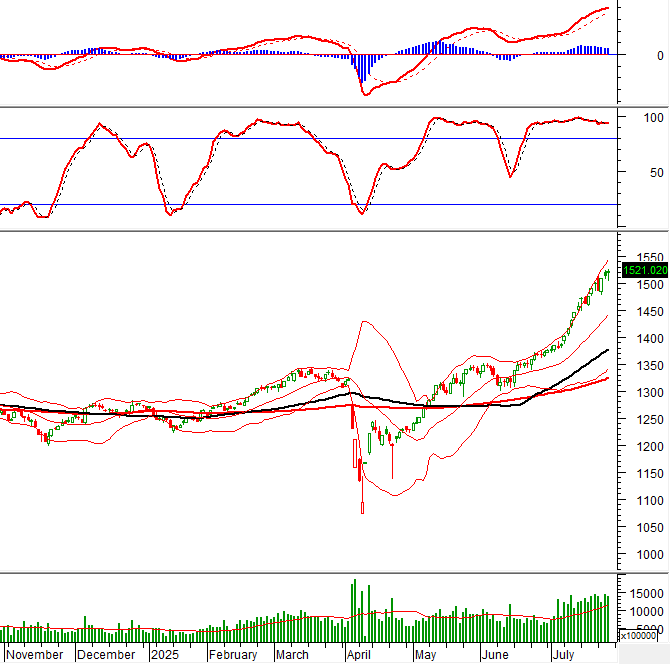

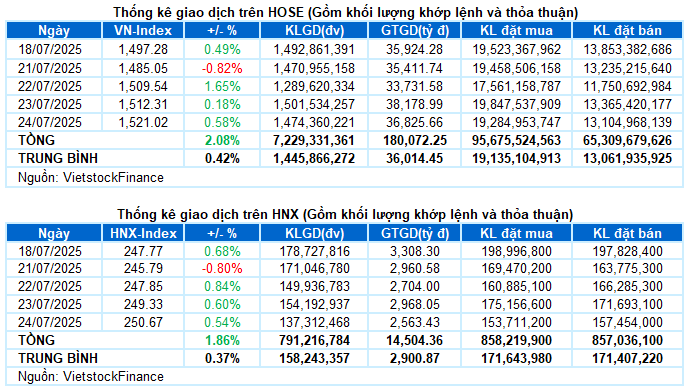

– The market closed in the green during the July 24 trading session. Specifically, the VN-Index increased by 0.58% from the previous session, reaching 1,521.02 points; the HNX-Index also rose by 0.54%, ending at 250.67 points.

– The matching volume on the HOSE decreased by 3.4%, reaching 1.39 billion units. The HNX also recorded 136 million units, a decrease of 11.3% compared to the previous session.

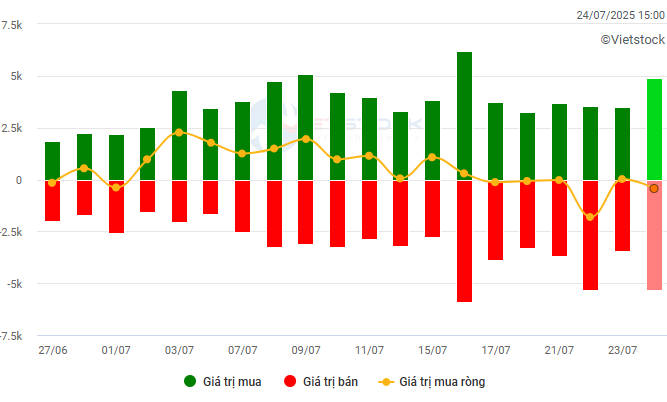

– Foreign investors returned to net selling with a value of VND 290 billion on the HOSE and nearly VND 50 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

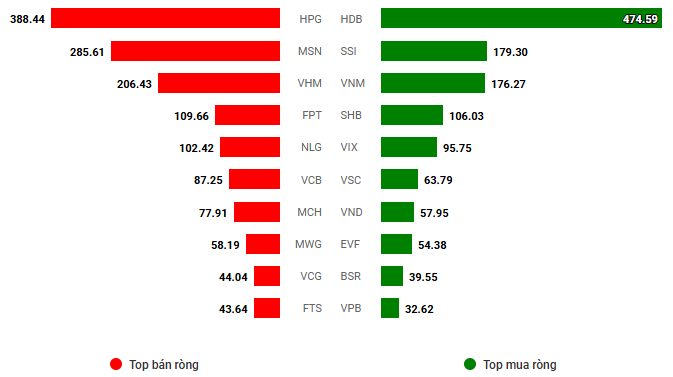

Net trading value by stock code. Unit: VND billion

– The market fluctuated continuously during the July 24 trading session. The VN-Index started positively but soon faced correction pressure as selling pressure at higher prices remained. The index fluctuated within a narrow range and gradually retreated to the reference level before the lunch break. In the afternoon session, the tug-of-war continued until buying demand suddenly increased sharply towards the end of the session, helping the VN-Index rebound. At the close, the index gained 8.71 points to 1,521.02.

– In terms of impact, MBB was the most supportive pillar, contributing 1.5 points to the VN-Index. This was followed by VNM, HDB, and VIC, which together added nearly 3 points to the gain. In contrast, HPG, MSN, and HVN were the three stocks with the most negative influence, causing the overall index to lose 1.6 points.

– The VN30-Index closed up 0.5%, reaching 1,661.23 points. The breadth of the basket tilted heavily towards buyers, with 22 gainers, 6 losers, and 2 unchanged stocks. Among them, VJC topped the chart with an outstanding increase of 4.8%. This was followed by HDB, MBB, VNM, and VIB, which all rose by more than 3%. Conversely, MSN and HPG were at the bottom with adjustments of 1.7% and 1.5%, respectively.

The green dominated most industry groups, but the divergent performance resulted in relatively modest fluctuations. The energy group led the positive side with an outstanding increase of 2.57%, thanks mainly to the gains in stocks such as BSR (+4.02%), PLX (+2.28%), PVS (+2.37%), OIL (+3.45%), PVD (+1.67%), PVC (+1.69%), and VTO (+1.54%).

With their large market capitalization, the financial and real estate groups contributed significantly to today’s gain, with buying demand focusing on stocks such as HDB (+4.15%), SHB (+2.73%), MBB (+3.65%), EVF (+6.08%), VIB (+3.09%); NLG (+1.63%), DIG (+1.97%), DXG (+2.07%), HDC (+2.33%), and SIP, which hit the ceiling price.

On the other hand, the information technology group ranked last with an adjustment of 0.56%, mainly influenced by the corrections in FPT (-0.63%), VEC (-1.89%), and HPT (-5.46%).

The VN-Index formed a Doji-like candle pattern, and the trading volume remained above the 20-session average, indicating investor indecision. In the near term, the index is likely to continue testing the historical peak around the 1,530-point level. However, investors should also be cautious of potential volatility at higher price levels as the Stochastic Oscillator indicator is weakening in the overbought zone.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Doji-like candle pattern emerges

The VN-Index formed a Doji-like candle pattern, and the trading volume remained above the 20-session average, indicating investor indecision.

In the near term, the index is likely to continue testing the historical peak around the 1,530-point level. However, investors should also be cautious of potential volatility at higher price levels as the Stochastic Oscillator indicator enters the overbought zone and shows signs of weakening.

HNX-Index – High Wave Candle pattern appears

The HNX-Index increased and formed a High Wave Candle pattern, reflecting the continued tug-of-war in the market.

Currently, the MACD indicator continues to trend upward after giving a buy signal in early July 2025, suggesting that the short-term uptrend remains intact. After breaking above the previous high in March 2025, the index’s next target will be the old peak in September 2023 (corresponding to the 251-257 point range).

Analysis of Money Flow

Fluctuations in smart money flow: The Negative Volume Index indicator of the VN-Index is currently above the 20-day EMA. If this condition persists in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Fluctuations in foreign capital flow: Foreign investors returned to net selling in the July 24, 2025, trading session. If foreign investors maintain this action in the coming sessions, the situation may become more pessimistic.

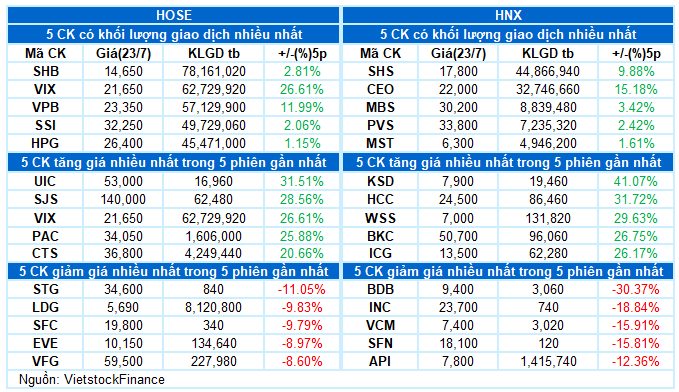

III. MARKET STATISTICS AS OF JULY 24, 2025

Economic and Market Strategy Division, Vietstock Consulting

– 16:38 24/07/2025

Market Beat: Foreigners Turn Net Buyers, VN-Index Holds Firm at 1,510 Points

The trading session concluded with the VN-Index climbing 2.77 points (+0.18%), reaching 1,512.31. Meanwhile, the HNX-Index witnessed a rise of 1.48 points (+0.6%), ending the day at 249.33. The market breadth tilted towards the bulls, as evident from the advance-decline ratio of 467:296. A similar trend was observed in the VN30 basket, with 17 gainers outpacing 13 losers.

The Market Breakthrough

The VN-Index soared to new heights, surpassing its previous record peak set in early 2022. Impressive liquidity has been sustained, with average volumes over the past 20 weeks reflecting a strong influx of capital into the market. The MACD indicator continues to widen the gap with the Signal line since the buy signal emerged in mid-May 2025, reinforcing the upward momentum in the medium term. However, the Stochastic Oscillator has begun to level off in the overbought region, suggesting a potential for technical corrections at elevated price levels in the coming weeks.

Vietstock Weekly 21-25 July 2025: Marching Towards Historic Highs

The VN-Index rallied for the fifth consecutive week, eyeing the historic peak reached in early 2022 (1,500-1,530 points). Last week’s trading volume hit a record high, indicating vigorous market participation. The MACD indicator continues to widen the gap with the signal line after giving a bullish signal in mid-May 2025, reinforcing the intermediate uptrend. Nonetheless, investors should be cautious of potential short-term fluctuations as the Stochastic Oscillator ventures deeper into overbought territory.

Market Beat July 31st: Holding the 1,500-Point Mark Triumphantly

The VN-Index faced significant challenges during the morning session, with constant struggles and adjustments, suggesting a deep decline at the closing bell. However, a remarkable turnaround took place in the afternoon session, as the market staged a strong recovery, recouping much of the lost ground. The index ultimately closed at 1,502.52, limiting the damage to a modest 5.11-point loss.

The Vietstock Daily: Celebrating 25 Years with New Peaks

The VN-Index soared during the trading session commemorating the 25th anniversary of Vietnam’s stock market. The high trading volume, maintained above the 20-session average, indicates robust momentum in the flow of funds, despite the impressive rally witnessed recently. With the MACD indicator continuing to widen the gap above the signal line after providing a buy signal in mid-June 2025, the VN-Index is poised to extend its upward trajectory, finding strong support around the 1,500-point level.