I. VIETNAMESE STOCK MARKET WEEKLY REVIEW: JULY 21-25, 2025

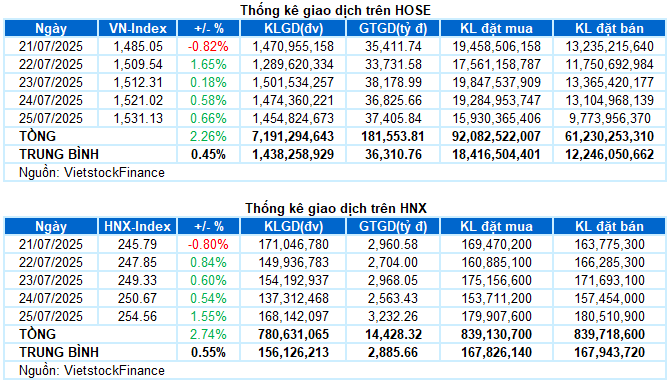

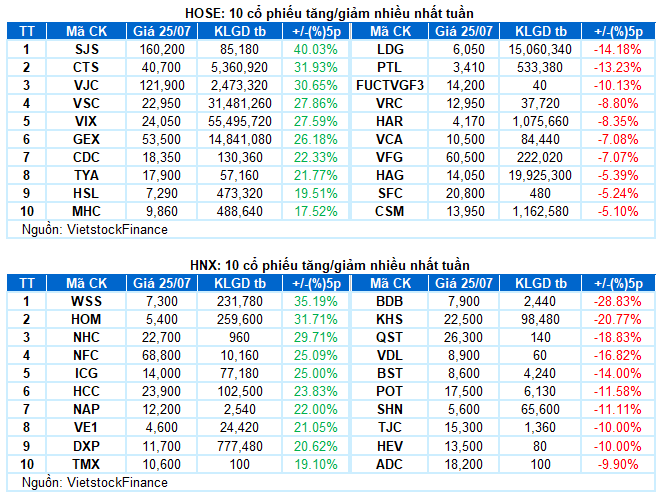

Trading: The main indices continued to surge in the last session of the week. The VN-Index closed the week at 1,531.13, up 0.66% from the previous session; HNX-Index also rose sharply by 1.55%, reaching 254.56 points. For the whole week, the VN-Index gained a total of 33.85 points (+2.26%), while the HNX-Index added 6.79 points (+2.74%).

Despite the pressure of profit-taking at the historical peak, the VN-Index ended the week on a positive note with 4 out of 5 gaining sessions. It seemed to have failed to surpass the 1,500-point threshold after a correction early in the week, but strong buying pressure quickly returned, led by pillar industry groups. The steady rise in the remaining sessions helped the index end the week at a new historical peak of 1,531.13 points.

In terms of impact, VHM was the main driver in the last session, contributing 1.7 points to the VN-Index. This was followed by VJC, VPB, and SSI, which together brought an additional 3 points. On the contrary, VIC became the biggest drag, taking away 1.7 points from the overall index.

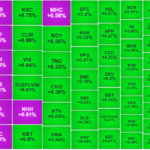

The positive sentiment was evident across most sectors, with the media and communications sector leading the gains with a 2.13% increase. Notable performers in this sector included VGI (+3.21%), YEG (+2.21%), TTN (+1.16%), VTK (+0.88%), EID (+1.17%), and ADG (+1%).

The industrial group stood out with a series of purple lights across stocks such as VJC, GEX, VCG, VGC, VSC, and CRC. Additionally, the financial sector was also active as money flowed into securities stocks, pushing VIX, VND, and APS to the ceiling price, while SSI rose by 6.25%, VCI by 3.73%, SHS by 4.49%, HCM by 2.39%, MBS by 6.67%, FTS by 3.21%, and BSI by 2.52%. Along with this, many “king stocks” also recorded outstanding gains of over 2%, including VPB, HDB, EIB, MSB, BVB, NAB, ABB, SSB, and VAB, which hit the ceiling price.

On the other hand, the information technology sector was the only one to end the week in negative territory due to pressure from two large caps in the industry, FPT (-0.36%) and CMG (-0.93%).

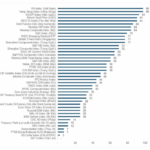

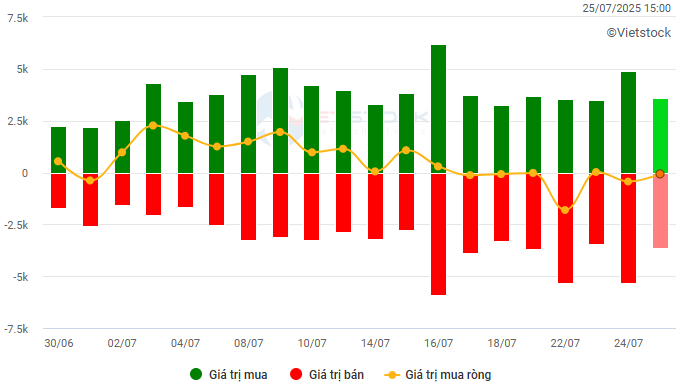

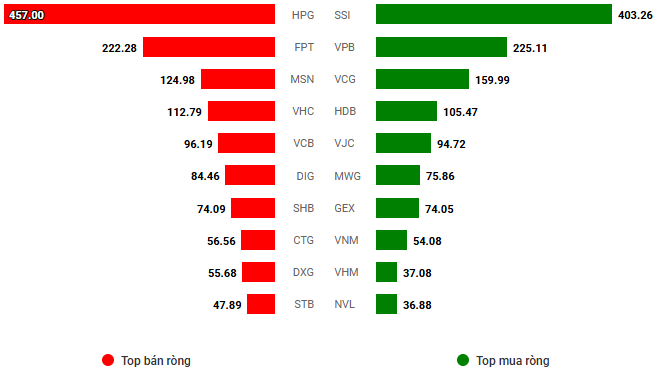

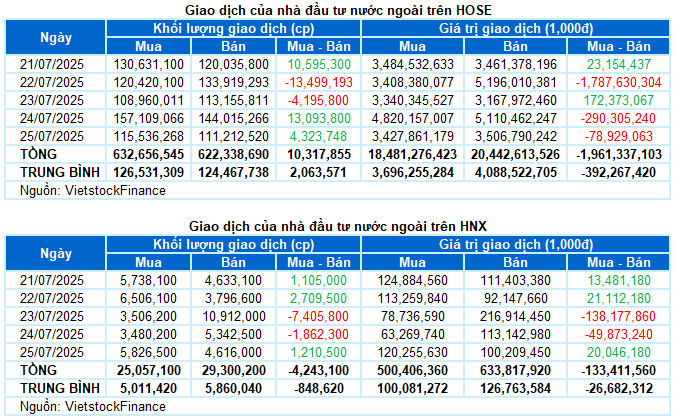

Foreign investors net sold over VND 2,000 billion on both exchanges during the week. Specifically, they net sold VND 1,960 billion on the HOSE and VND 133 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

Stocks with notable performance last week: CTS

CTS up 31.93%: CTS had an impressive trading week with all 5 sessions surging strongly. The strong upward momentum pushed the stock price above the upper Bollinger Band, reflecting the optimistic sentiment of investors.

Currently, the Stochastic Oscillator and MACD indicators continue to point upwards after giving buy signals, reinforcing the positive outlook in the short term.

Stocks with notable losses last week: HAR

HAR down 8.35%: HAR entered a technical correction phase after a strong rally in the previous two weeks. Trading volume has gradually decreased in recent sessions, indicating that money flow is becoming more cautious.

Investors should monitor the price reaction at the support area around the Middle line of the Bollinger Bands (equivalent to 3,850-3,900 VND) to assess the potential for a short-term recovery.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economics & Market Strategy Division, Vietstock Consulting and Research

– 17:14 25/07/2025

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

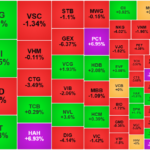

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.