A significant shift is underway in Vietnam’s life insurance landscape as of July 1, with insurers discontinuing new sales of investment-linked products that don’t align with Decree No. 46/2023/ND-CP. This decree, which took effect in July 2023, allows investment-linked policies to cover only two core risks: death and total permanent disability, with additional protections offered through standalone riders.

While insurers had a two-year transition period to adapt, the recent deadline has prompted life insurers to introduce new universal life products. These changes are expected to foster more sustainable growth in the sector over the medium and long term.

Rebalancing the Life Insurance Sector

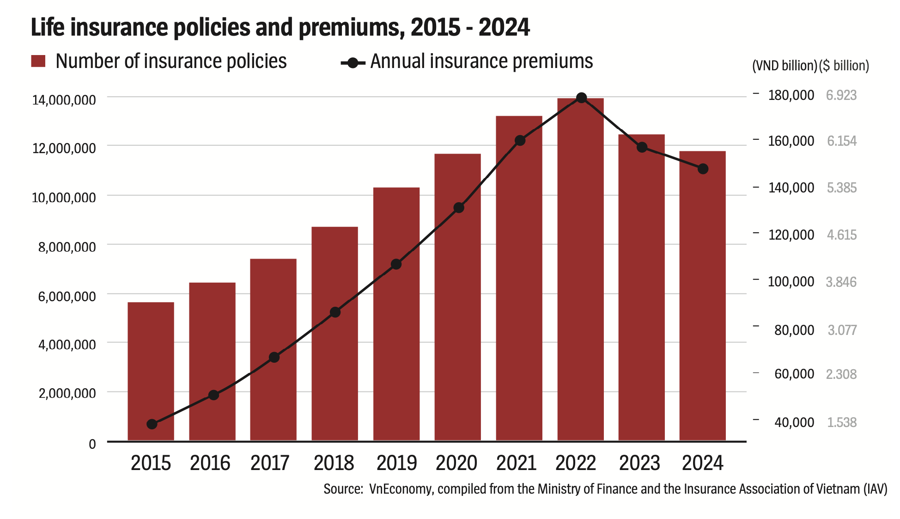

Vietnam’s life insurance market experienced robust growth from 2015 to 2021, with premiums climbing steadily and policy numbers reflecting market expansion and consumer adoption. However, growth slowed in 2022 and a downturn followed in 2023-2024, indicating the impact of economic headwinds and a loss of trust in investment-linked products and bancassurance. Decree No. 46 tightened rules on investment-linked contracts, addressing these concerns.

Mr. Ngo Trung Dung, Deputy Secretary General of the Insurance Association of Vietnam (IAV), noted that universal life products now dominate new policies. Customers aged 30 to 50 seek guaranteed interest and transparent, simple products over high returns. This shift in consumer preferences is also reflected in the story of Ms. Huong Lan, a 29-year-old from Hanoi, who prioritized guaranteed interest, high sum assured, and clear terms in her insurance research.

Mr. Luong The Vinh, Head of Product at Prudential Vietnam, echoed these sentiments, stating that customers now seek solid protection, attractive premiums, and sustainable accumulation, with flexibility being a key expectation.

Insurers have responded by discontinuing certain products and introducing new offerings that allow customers to tailor benefits, adjust premiums, and make partial withdrawals. Core coverage and riders are now clearly separated, and policies approved before July 1, 2023, remain valid with all agreed-upon benefits.

Positive Outlook for the Future

Despite a slight decline in total gross written premiums (GWP) expected in 2025, analytics firm GlobalData forecasts a market recovery from 2026 onwards. The life insurance sector is projected to achieve a compound annual growth rate (CAGR) of 3.2% between 2025 and 2029, reaching a market size of around VND165.4 trillion ($6.62 billion) by the end of the period.

Mr. Swarup Kumar Sahoo, a Senior Insurance Analyst at GlobalData, attributes the recovery to stricter regulations, evolving demographics, and a focus on restoring public trust. Vietnam’s life insurance penetration, currently at 1.3% of GDP, has room to grow compared to regional benchmarks. The adoption of emerging technologies is expected to enhance customer experience and accelerate the industry’s transformation.

Mr. Sahoo highlights the long-term prospects of Vietnam’s life insurance market, supported by a strengthened legal framework, growing digital capabilities, and product strategies that align with customer demands. Rising healthcare costs and an aging population will further shape a resilient and sustainable market.

Additionally, reforms in the revised Law on Insurance Business, such as the expanded definition of “insurable interest” and the ability for individuals to purchase policies for others with written consent, contribute to a positive outlook. These reforms address legal challenges, facilitate acts of goodwill, and safeguard the rights of policyholders and the insured.

Industry experts agree that progressive legal reforms are vital for revitalizing the sector and laying the foundation for long-term development, ensuring transparency, flexibility, and customer trust.