While the supply of apartments in Hanoi has shown positive signs of recovery over the past year, it still falls short of meeting the actual demand. However, the structure of the supply is becoming increasingly imbalanced.

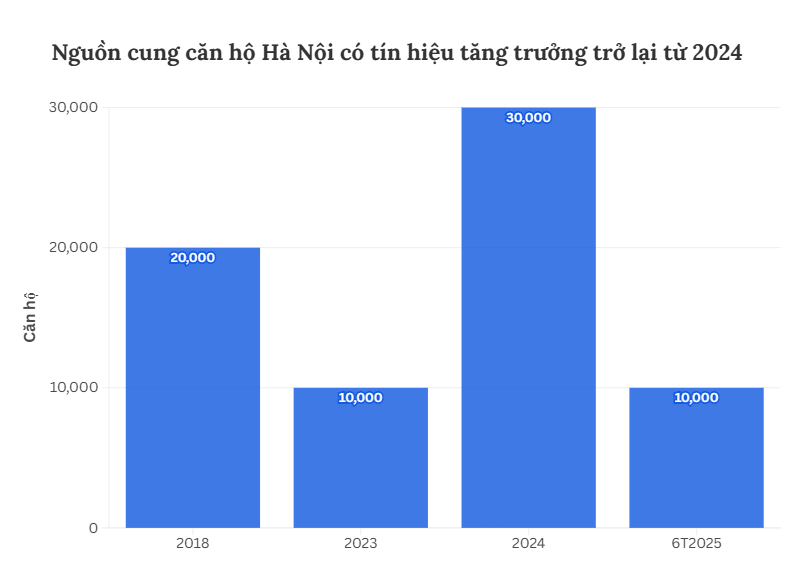

Research data from the Vietnam Real Estate Brokers Association (VARS) reveals a continuous decline in Hanoi’s apartment supply from 2018 to 2023. The number dropped from over 20,000 units in 2018 to approximately 10,000 new units for sale in 2023. Not only did the quantity decrease, but the structure of the apartment supply in the capital also became increasingly unbalanced. The proportion of new affordable apartments (<$25 million/m²) continuously decreased, from 35% in 2019 to its absence in 2023.

In early 2024, Hanoi’s apartment supply showed signs of recovery and maintained this upward trend until the present. In total, Hanoi recorded about 30,000 new apartments for sale in 2024, the highest in the five-year period. In the first half of 2025, more than 10,000 apartments were also released into the market.

While supply increased significantly, the structure of the supply became increasingly out of sync with demand. Specifically, in 2024, the supply of mid-range apartments ($25 – $50 million/m²) also became scarce, with more than 95% of new apartments for sale priced at $50 million/m² or higher. From the third quarter of 2024 to the present, Hanoi’s real estate market has not recorded any new apartment projects with prices below $60 million/m². In the first half of 2025, 60% of new apartment supplies were products priced above $80 million per m². Some apartment projects in the provinces surrounding Hanoi also had prices starting from $55 million/m².

Although in the future, affordable housing will return to Hanoi thanks to social housing projects developed through the determination of the Party, State, Government, and efforts of the business community, the imbalance will be challenging to improve as the number of apartments priced in the hundreds of millions per m² is increasing dramatically.

Affordable apartments are “extinct,” mid-range apartments are disappearing, and premium apartments with soft prices are becoming rarer

Overall, it can be affirmed that the supply of commercial affordable apartments (below $25 million/m²) has “gone extinct” in Hanoi. The supply of mid-range apartments ($25-50 million/m²) is also shrinking in some old apartment projects and is at risk of disappearing in the near future. Even premium products with new launch prices below $60 million/m² are becoming rarer. This reality pushes the market into a state of severe supply-demand imbalance, increasing pressure on prices and pushing the dream of home ownership out of reach for most urban residents, even for those with higher middle incomes.

The average selling price of apartments in Hanoi in Q2 2025 reached VND 75.5 million/m².

According to VARS research data, in Q2 2025, Hanoi continued to lead the country in the growth rate of apartment selling prices. The average selling price of apartments in Hanoi in Q2 2025 reached VND 75.5 million/m², an increase of about 7.7% compared to the previous quarter and a sharp increase of 87.7% compared to the base period (2019). The launch of new projects priced above VND 75 million/m² and the continued offering of inventory with adjusted prices contributed to the recovery of secondary apartment prices. However, secondary transaction liquidity did not improve significantly, with apartment transfers mainly recorded in master-planned communities that have been formed and attracted residents, with prices around VND 50 million/m², or in luxury apartments in the city center.

The current prices are not only beyond the reach of low-income groups but also unaffordable for those in the higher middle-income bracket. According to feedback from real estate brokers who are members of VARS, many young customers, despite having good incomes of VND 40-50 million/month, are still reluctant to buy property without financial support from their families. The burden of debt repayment, especially when interest rates surge after the preferential period, has become a significant psychological barrier for young people who value quality of life, living experiences, and flexibility in consumption rather than committing to long-term loans for decades to own a small apartment.

VARS believes that, in the short term, apartment prices in Hanoi will continue to rise due to increasing input costs and investors’ profit expectations remaining high. A large portion of investors currently do not face significant financial pressure, including pressure from borrowing costs, so they have no incentive to lower selling prices. On the contrary, expectations tend to increase in the context of low-interest rates, cheap money continues to be pumped into the market, and policies to promote public investment are strongly implemented, while the supply of real estate at affordable prices remains scarce.

This situation poses risks to the stability and healthy development of the real estate market and exacerbates income disparities and social inequality. As the opportunity to own a home becomes increasingly limited, especially for young people, they may feel financially lost. Some may choose to “live for the moment,” spending money on luxury items or short-term experiences because they believe that saving for a home is meaningless—a reality previously observed in South Korea.

Others may even choose to “give up,” lowering their expectations and reducing their motivation to strive in a context of rising living costs, similar to what is happening in China. Skyrocketing house prices also fuel the trend of “reluctance to marry and have children,” as previously reflected by VARS.

For a developing economy like Vietnam, which needs a dynamic young workforce, the lack of motivation among young people is a concerning sign. It not only affects the vitality of the real estate market but may also negatively impact long-term economic growth and sustainable social development.

The New Housing Revolution: 50 Investors Vie for Six Social Housing Projects in Dong Nai

A total of 50 investors, including consortia, have submitted proposals to develop six social housing projects in the southern province of Dong Nai, mostly in the old Bien Hoa area. The projects, with a total investment of over VND6.8 trillion ($292.6 million), will be built on more than 13 hectares of land.

The Property Boom: Anticipating a New Cycle of Growth

The real estate market in 2024 witnessed a surge in transactions for both apartments and individual housing units, as well as land plots, surpassing the numbers from 2023. There has been a notable upward trend in the supply of both social and commercial housing, indicating a thriving and expanding market.

Is the Real Estate Market Due for a Boom in 2025?

According to experts, the real estate market is projected to stabilize by 2025, presenting a low-risk landscape. However, to foster healthy growth, a myriad of synchronized tax policies and mechanisms need to be implemented.