Dalat Lan Anh Acquires 13.1% Stake in No Va My Dinh

Amid financial restructuring, Novaland Group JSC (Novaland, code: NVL on HoSE) continues to sell projects or transfer subsidiaries.

Novaland’s consolidated financial statement for Q2 2025 shows that the company has reduced its ownership in No Va My Dinh Real Estate Company to 54.05%.

According to Resolutions No. 06/2025-NQ HĐQT-NVLG dated March 21, 2025, and No. 35/2025-NQ HĐQT-NVLG dated June 25, 2025, Novaland completed the transfer of a 13.108% stake in No Va My Dinh Real Estate Company (No Va My Dinh) for a total value of VND 2,817.6 billion.

The difference between the total transfer value and the book value of No Va My Dinh’s net assets was recognized in post-tax profit retained in the consolidated balance sheet.

Following this transaction, NVL holds 70% of the voting rights in Thanh My Loi JSC. Therefore, Thanh My Loi JSC remains a subsidiary of the Group.

Previously, in March 2025, Novaland also transferred over 7.635% of its stake in No Va My Dinh to Dalat Lan Anh Real Estate JSC (Dalat Lan Anh).

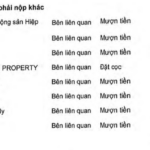

At the same time, NVL reduced its holdings in related companies, including: Real Estate Dinh Phat JSC (from 67.13% to 59.5%), Real Estate Investment and Development 350 JSC (from 67.14% to 59.5%), Real Estate Investment and Development CQ89 LLC (from 66.86% to 59.26%), and Thanh My Loi JSC (from 51.48% to 47.23%). The total value of these transfers exceeded VND 1,641.2 billion.

According to PV’s data, on March 24, 2025, Novaland and Dalat Lan Anh signed a capital contribution transfer contract, No. 2403-HDCN-LA, valued at VND 1,641.2 billion, for the transfer of a 7.635% stake in No Va My Dinh.

On March 31, 2025, Dalat Lan Anh pledged the entire capital contribution at VPBank Transaction Center 2 under Pledge Contract No. BCLC-4938/HDTCPVG.

Although the transfer contract was valued at VND 1,641.2 billion, the 7.635% stake in No Va My Dinh actually corresponds to a capital contribution of VND 576.5 billion.

On June 30, 2025, Novaland and Dalat Lan Anh signed another capital contribution transfer contract, No. 0625-HDCN-LA, for the transfer of a 5.473% stake in No Va My Dinh. The contract was valued at VND 1,176.4 billion.

Subsequently, Dalat Lan Anh pledged the capital contribution at VPBank Transaction Center 2 under Pledge Contract No. BCLC-8309/PVG dated July 10, 2025.

Regarding the new shareholder of No Va My Dinh, Dalat Lan Anh was established in May 2020 and registered for short-term accommodation services.

Initially, the company had a charter capital of VND 20 billion, with Mr. Bui Trong Nghia (born in 1991) holding 99.98% and serving as Chairman of the Board of Directors. The remaining 0.01% was held by two individuals, Le Thi Hong Xuan and Huynh Van Phuoc.

In April 2021, the company’s charter capital surged to VND 450 billion. Ms. Le Thi Hong Xuan (born in 1989) replaced Mr. Bui Trong Nghia as Chairman of the Board of Directors.

In June 2025, Dalat Lan Anh changed its main business line from short-term accommodation services to real estate business.

Apart from being the controlling shareholder of Dalat Lan Anh, Mr. Bui Trong Nghia also holds shares in several other companies, according to PV’s sources.

As of August 2020, the young entrepreneur held 7 million shares in Dia Oc Ngan Hiep JSC. By March 2021, his holdings had decreased to 26 shares, which were pledged at MB Bank’s North Saigon branch.

Mr. Nghia also owned 15.1 million shares of SGB of Saigon Commercial Bank. As of June 2021, he used these shares as collateral at SCB.

As of February 2025, Mr. Nghia held 1,300 shares, equivalent to 0.01% of Hoang Khang Binh Thuan JSC. These shares were added as collateral at PVCombank’s Saigon branch.

Similarly, Ms. Le Thi Hong Xuan, apart from being the Chairman of Dalat Lan Anh, also holds shares in multiple businesses.

As of February 2025, Ms. Xuan held 1,300 shares, or 0.01%, of Hoang Khang Binh Thuan JSC. These shares were added as collateral at PVCombank’s Saigon branch under a contract signed in November 2020.

As of August 2020, Ms. Xuan owned 7 million shares in Dia Oc Ngan Hiep JSC. By March 2021, her holdings had decreased to 26 shares, which were pledged at MB Bank’s North Saigon branch.

Ms. Xuan also owned 416 shares in Quoc Te Hoang Long Tourism JSC, 540 shares in Dau Tu Du Lich Ngoc Son JSC,… Notably, she was also a shareholder and a member of the Board of Directors of Bat Dong San Unity Investment JSC before Novaland acquired the company.

Who are the Two Enterprises that Acquired 32.84% Stake in No Va My Dinh?

Turning back to No Va My Dinh, the company was established in 2010 with Mr. Bui Dat Chuong (younger brother of NVL Chairman Bui Thanh Nhon) as Chairman of the Board of Directors. The company has a charter capital of VND 8,165 billion.

In December 2024, Novaland completed a transfer of a 32.84% stake in No Va My Dinh for a total value of nearly VND 7,060 billion. The buyers were Bat Dong San Nha Xinh Development JSC and Bat Dong San Bach Duong Investment and Development JSC.

The difference between the total transfer value and the book value of the assets was recognized in post-tax profit retained.

As of April 2025, Bat Dong San Nha Xinh and Bat Dong San Bach Duong each held a 16.419% stake in No Va My Dinh, while Mr. Bui Dat Chuong and Mr. Nguyen Ngoc Tuan each owned 0.004%.

Interestingly, Bat Dong San Nha Xinh is chaired by Mr. Nguyen Quoc Hien, while Bat Dong San Bach Duong is chaired by Ms. Vo Thi Kim Khoa. Both individuals were previously shareholders or held management positions in companies related to the Novaland Group.

Mr. Hien and Ms. Khoa were co-founders of Sun City Real Estate Investment and Development Company Ltd., which used to be a member of NVL.

The Great Unloading: Corporate Leaders Race to Sell Shares, HIG Bids Farewell to the Stock Exchange

“In a recent development, four top executives at Petrosetco have signaled their intent to offload nearly 1 million PET shares between August 6 and September 4, through matching and negotiated transactions. This move comes as Hà Đức Hiếu, a member of the Board of Management at Dat Xanh Group, also registers to sell 6.355 million DXG shares to reduce his equity holdings.”

“Repayments Begin: The Saga of Quốc Cường Gia Lai and Sunny Island”

In Q2 2025, Quoc Cuong Gia Lai began refunding Sunny Island to reclaim the Phuoc Kien project. Conversely, QCG borrowed an additional VND 240 billion from two major corporations.

The Bleak Fate of Saigon’s Renowned Textile Enterprise

Once a powerhouse in the garment industry, Garmex Saigon JSC boasted an impressive 5 factories and 70 production lines, working with renowned international brands. However, the company now finds itself in a dire situation, plagued by losses and facing the potential delisting of its stock.