Cashless Payments in Vietnam: Embracing Innovation for a Brighter Future

Cashless payments in Vietnam are witnessing a remarkable surge in popularity, particularly amidst the nation’s robust digital transformation. Whether it’s purchasing groceries at the local market or indulging in luxury shopping, Vietnamese citizens can now effortlessly utilize a myriad of cashless payment methods. Digital wallets, QR codes, and bank cards have become ubiquitous tools, empowering individuals to conduct transactions swiftly and securely.

From grocery shopping at the market to purchasing candies at a convenience store, cashless payments offer convenience for all transactions.

According to a 2024 report, Vietnam boasts an impressive 86.97% bank account ownership rate, with over 204 million personal transaction accounts and 154 million bank cards in circulation. This robust foundation has paved the way for the proliferation of cashless payment methods such as QR codes, e-wallets, and Mobile Money.

In the first quarter of 2025, Vietnamese citizens executed over 5.5 billion cashless transactions, with 4.5 billion transactions occurring through digital channels, amounting to a staggering VND 40,000 trillion. Notably, QR code payments witnessed explosive growth, surging by 104% in transaction volume and 97% in value compared to 2024. Initiatives such as the 4.0 market and cashless commercial streets further empower consumers to access modern payment services.

With a vast cashless ecosystem, it’s no surprise that Vietnamese consumers are swiftly embracing this trend.

2025 marks a pivotal year for digital payments and fintech in Vietnam, as super-apps and e-wallets continuously introduce groundbreaking features that reshape spending behaviors and foster a culture of cashless transactions. Emerging technologies such as interbank QR codes, NFC, e-wallets, biometric authentication, and tokenized cards are gaining momentum, not only expanding payment acceptance but also offering enhanced convenience and security.

Technological Breakthroughs in Payments

In 2025, prominent e-wallets including MoMo, ZaloPay, VNPay, and VPBank Neo have been at the forefront of driving cashless payment innovations in Vietnam:

MoMo

harnesses the power of artificial intelligence (AI) to deliver personalized payment experiences. By leveraging AI to analyze user behavior, the app provides tailored financial service suggestions, helping users save time and optimize their spending. Additionally, MoMo’s collaboration with Visa expands QR code payment options at millions of retailers nationwide.

ZaloPay

, a digital wallet integrated with the Zalo social network, has developed a versatile QR ZaloPay technology. This innovation enables payments from any e-wallet or bank via QR codes, simplifying the payment process and broadening the scope of contactless transactions.

VNPay

is a pioneer in implementing the VietQR standard, an interbank QR code system that connects consumers to hundreds of thousands of shops and services. Notably, VNPay has cultivated an expansive payment ecosystem, collaborating with banks and e-wallets to offer maximum flexibility to users.

VPBank Neo

introduces the Pay by Account feature, allowing customers to pay directly from their bank accounts without the need for physical cards. In partnership with Mastercard, this feature facilitates swift payments at all Mastercard-accepted locations, offering unparalleled convenience and security. This marks a significant stride towards a digital payment model, reshaping spending habits and propelling cashless transactions in Vietnam.

Aside from these four powerhouses, Vietnamese consumers have a plethora of e-wallet and super-app payment options to choose from.

Breakthrough Cashless Payment Solutions: Advanced Technologies

Breakthrough Cashless Payment Solutions

at the Better Choice Awards 2025 will applaud products and services that have the potential to transform the spending behaviors of Vietnamese citizens and foster a culture of cashless transactions. The game-changing technologies anticipated to make a significant impact include:

Interbank QR Codes

: This solution enables users to make payments via QR codes without worrying about compatibility issues between different bank payment systems. VietQR by VNPay is a prime example of this trend.

NFC / Tap-to-Phone

: Technologies like NFC allow users to pay swiftly by tapping their devices without inserting cards into POS machines, saving time and reducing payment risks.

Biometrics and Tokenized Cards

: The utilization of biometrics (e.g., facial recognition) and tokenized card technology enhances transaction security and mitigates fraud risks.

Pay-by-Face

: This facial recognition payment technology is increasingly adopted in supermarkets and stores, offering convenience and security to users.

The Significance of an Expansive Ecosystem

Beyond technological breakthroughs, another crucial factor that sets these payment products and services apart is their ability to

expand the scale of payment acceptance

. They not only focus on feature development but also strive to build a payment ecosystem that is easily accessible everywhere, from supermarkets and stores to online services. This enhances their popularity and ease of use, encouraging cashless transactions to become second nature to Vietnamese citizens.

Against this backdrop, the Better Choice Awards 2025 – a prestigious annual consumer choice awards program – will introduce a new category: Breakthrough Cashless Payment Solutions. This category will shine a spotlight on innovative initiatives in the payments industry, focusing on solutions that not only revolutionize technology but also embrace widespread acceptance, going beyond short-term promotional campaigns.

Better Choice Awards 2025: Celebrating Creativity and Innovation

Better Choice Awards 2025

is more than just an awards ceremony; it is a platform that acknowledges and celebrates creative, cutting-edge products and services. The

Breakthrough Cashless Payment Solutions

category will be a highlight, reflecting the dynamic growth of Vietnam’s fintech and digital payments landscape. The emergence of interbank QR codes, NFC, e-wallets, and biometric payments promises to transform the spending habits of Vietnamese citizens and presents opportunities for innovative businesses to craft accessible and secure payment solutions.

The synergy of advanced payment technologies and widespread acceptance models is pivotal to accelerating cashless transactions in Vietnam and reshaping consumer spending behaviors.

Better Choice Awards is an esteemed national awards program organized by VCCorp JSC in collaboration with the National Innovation Center, under the guidance of the Ministry of Finance. With this year’s anticipated theme, “”Soaring High,”” and the overarching spirit of “”Proud to be Vietnamese,”” the awards emphasize breaking through boundaries, fostering innovation, and shattering old barriers.

Amidst the transformative advancements in personal finance, ranging from digital banking and fintech to insurtech, the proposed Consumer Finance Awards category aims to recognize and encourage financial initiatives geared towards individual consumers. This category will serve as a prestigious platform for healthy competition among outstanding financial organizations and products, disseminating intelligent financial solutions that elevate experiences and enhance the quality of life for Vietnamese citizens.

The awards program is expected to commence in early August and conclude in October 2025, currently in its registration phase, starting from July 24, 2025. For any queries regarding the preparation and submission process, please contact us at 093.981.7900 or via email at [email protected] (Ms. Vi Hạnh).

“VPBank Secures a Monumental $350 Million Agreement for Sustainable Growth.”

“VPBank joins forces with renowned global development institutions, SMBC, BII, EFA, FinDev Canada, and JICA, in a groundbreaking partnership. Together, they have secured a landmark loan, a pivotal step towards financing Vietnam’s sustainable and eco-friendly future. This collaboration marks a significant milestone in the country’s journey towards a greener tomorrow.”

Vietnam’s Public Debt Management: A Stellar Performance, Says World Bank

The World Bank’s report applauds Vietnam’s remarkable progress in enhancing its legal framework to effectively manage public debt. The country’s efforts to strengthen its debt management practices have been recognized, with its legal framework now serving as a solid foundation for sustainable debt management. Vietnam’s dedication to improving its financial systems is a testament to its commitment to economic stability and long-term growth.

“VPBank Secures $350 Million Loan to Boost Sustainability Efforts”

On July 29, 2025, VPBank (HOSE: VPB), one of the leading joint-stock commercial banks in Vietnam, announced the successful signing of a syndicated loan worth USD 350 million. This loan was made possible through a collaboration with Sumitomo Mitsui Banking Corporation (SMBC) and prominent development finance institutions (DFIs), including British International Investment (BII), Export Finance Australia (EFA), FinDev Canada, and the Japan International Cooperation Agency (JICA). SMBC acted as the coordinator and authorized co-lead arranger for this significant financing endeavor.

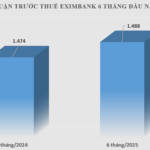

“Forex Trading Success: Eximbank’s Profits Soar to $1.488 Billion in H1 2025”

In the first half of 2025, Eximbank’s foreign exchange business soared, with an impressive net interest income of VND 364 billion, a 76% surge compared to the same period last year. The bank’s international payments business thrived, with a remarkable transaction volume of USD 3.9 billion.