|

Public companies and special purpose acquisition companies (SPACs) are now targeting cryptocurrencies beyond bitcoin – Image: FT montage/Dreamstime

|

No longer limited to bitcoin, numerous listed companies are now continuously acquiring various cryptocurrencies such as former US President Donald Trump’s memecoin, HYPE tokens, litecoin, and more to diversify their portfolios and boost their stock prices in the market.

The fever for issuing stocks or bonds to raise capital to buy bitcoin has spread globally this year as more businesses want to follow the digital asset speculative strategy of billionaire Michael Saylor, who heads MicroStrategy, a company with a market capitalization of up to $116 billion.

However, many listed companies and SPACs are now shifting their focus to tokens other than bitcoin to create their own mark in the context of hundreds of other businesses already holding bitcoin.

Brittany Kaiser, former director of Cambridge Analytica, is raising $200 million in equity capital through a public shell company to buy Toncoin at a more favorable price than the current market. This deal is done in collaboration with RSV Capital, a Canadian investment fund. Toncoin is a cryptocurrency on the Telegram messaging platform’s blockchain, developed by founders like Pavel Durov.

“TON is currently the exclusive blockchain serving Telegram, a platform with over 1 billion monthly active users, so the potential for demand growth is enormous,” said Kaiser, adding that the deal would focus on developing Telegram’s ecosystem.

In another development, the Avalanche blockchain platform is also experimenting with a similar model by planning to sell a portion of its tokens to a publicly listed shell company. After the deal is completed, the company will hold and stake AVAX tokens to earn yields, hoping to attract new investors, according to sources. Avalanche representatives also chose to remain silent when asked to comment on the deal.

The trend of businesses expanding their investments beyond bitcoin comes as the world’s largest cryptocurrency recently hit a new high of over $123,000, partly due to the open digital asset policy during Trump’s presidency. Notably, last week, Washington passed a significant cryptocurrency bill, marking a historic step in the process of bringing crypto into the mainstream financial flow.

Bitcoin continues to assert its dominance by recording an impressive 77% growth over the past year, far surpassing ether’s 6% and litecoin’s 52% gains over the same period. This gap has prompted some businesses to consider investing in cryptocurrencies other than bitcoin.

In some notable deals recently, freight management company Freight Technologies has raised $20 million through the issuance of convertible bonds to invest in $TRUMP, the official coin of the US President. Javier Selgas, CEO of the company, said that buying this coin would help “diversify the digital asset portfolio in the treasury and attract attention to trade policies.”

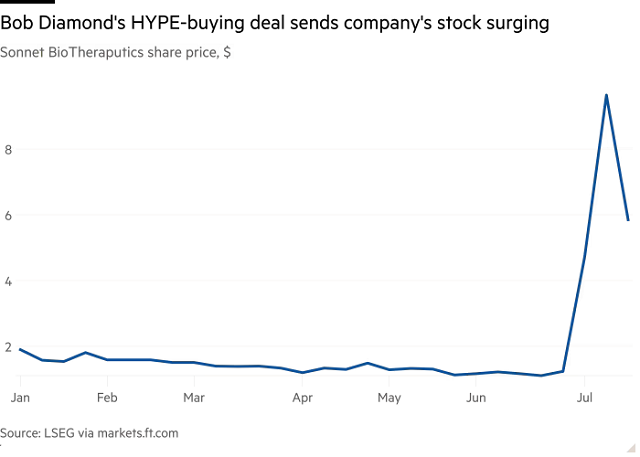

In the pharmaceutical industry, cancer treatment company Sonnet BioTherapeutics signed an $888 million merger agreement with a representative company backed by former Barclays CEO Bob Diamond to acquire HYPE tokens on the Hyperliquid blockchain. Sonnet’s stock price once soared 200% after the deal was announced, although it has since shown signs of correction.

Sonnet BioTherapeutics stock price, USD. Source: LSEG via markets.ft.com

|

However, many experts still express skepticism about the sustainable value of smaller coins in the market.

Eric Benoist, a technology and data researcher at Natixis CIB, said that investing in coins other than bitcoin and ether is highly speculative. He also believes that struggling businesses cannot expect to salvage their situation by buying tokens, which is not a long-term strategy.

“In this way, they will also find it difficult to survive in the long run. Ultimately, the value of the enterprise will only depend on the volume [of crypto] recorded on the balance sheet,” he emphasized.

Geoff Kendrick, Global Head of Digital Asset Research at Standard Chartered, said that the market for corporate bitcoin buying has become too crowded, and the shift to other tokens is just a “passing fad.” He warned that if the value of these tokens plummeted, “the loss would be borne by shareholders or bondholders.”

In addition, investment vehicles in digital assets are also becoming a channel for individuals with large crypto holdings to store their wealth with the expectation of future profits.

The case of Saylor’s MicroStrategy is a typical example: the company’s stock is currently trading at almost double the total value of the bitcoins they hold. Using financial leverage to serve crypto purchase deals benefits shareholders due to the expected price increase.

Recently, Andrew Keys, co-founder of Consensys Capital, completed a SPAC deal to buy ether, with a personal investment of about $645 million in ether and $800 million from major investors such as Pantera Capital and Blockchain.com.

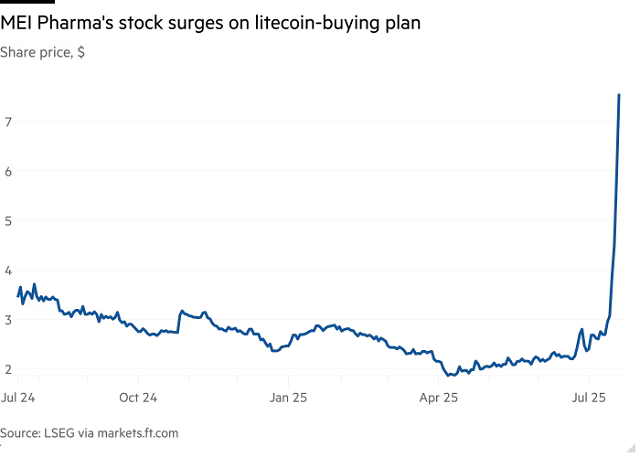

In another notable development, litecoin co-founder Charlie Lee invested $100 million in MEI Pharma to help the pharmaceutical company become “the first and only listed company to own litecoin.” Following the announcement, MEI Pharma’s stock surged 78% in just one week.

MEI Pharma stock price, USD. Source: LSEG via markets.ft.com

|

Meanwhile, YZi Labs, a fund backed by Binance co-founder Changpeng Zhao, recently announced it would support the establishment of a treasury company specializing in collecting BNB, the main token of the Binance exchange.

Many experts believe that bitcoin’s most significant attraction is its limited supply, with only 21 million coins to be mined forever, a rule “hard-coded” into its programming. However, most other tokens have no specific limit on their total supply, and the number can be increased at any time. This fact makes many analysts wonder about the sustainability of hoarding strategies for these tokens.

Many industry experts are also skeptical about the real prospects of most businesses pursuing this trend, whether it is bitcoin or other tokens.

A recent report by venture capital firm Breed predicts that more global businesses will adopt this strategy and even expand into other asset classes and use more leverage to seek success.

“However, most will fail. In the end, only a few rare businesses will be able to maintain a superior stock price,” the report emphasized.

Quan An (According to FT)

– 13:00 26/07/2025

Is it a Triple Dream or a Nightmare?

“The allure of quick riches through crypto asset trading has enticed many small-time investors in Vietnam. However, the highly volatile nature of the crypto market means that the line between doubling your wealth and a nightmare of losing it all is precariously thin. It’s a market where fortunes can be made or lost overnight.”

The Digital Asset Investment Frontier: Unlocking the Potential

Bitcoin has come a long way since its mysterious inception on October 31, 2008. Over the past 16 years, it has evolved from a niche digital currency to a global phenomenon, capturing the imagination of investors and financial experts worldwide. With its remarkable growth and widespread adoption, Bitcoin is challenging traditional financial systems and paving the way for a new era of digital assets and decentralized finance. So, is Bitcoin’s rise a mere fad or a harbinger of a revolutionary shift in global finance?

“When Blockchain and Digital Assets Tap the Financial Nervous System”

“Cryptoassets, once deemed ‘heretical’, are now marching into the mainstream financial system. From JPMorgan embracing crypto for repo transactions to BlackRock launching its first tokenized fund and the Monetary Authority of Singapore (MAS) building an entire on-chain financial platform, the integration is evident and accelerating.”

What Type of Digital Currency Should Vietnam Choose for its Pilot Program on Digital Asset Exchanges?

“When it comes to selecting digital assets for a pilot, our experts recommend focusing on liquidity, popularity, and other factors such as stock exchange listings. These criteria ensure a strategic and data-driven approach to choosing the right assets for your specific needs.”