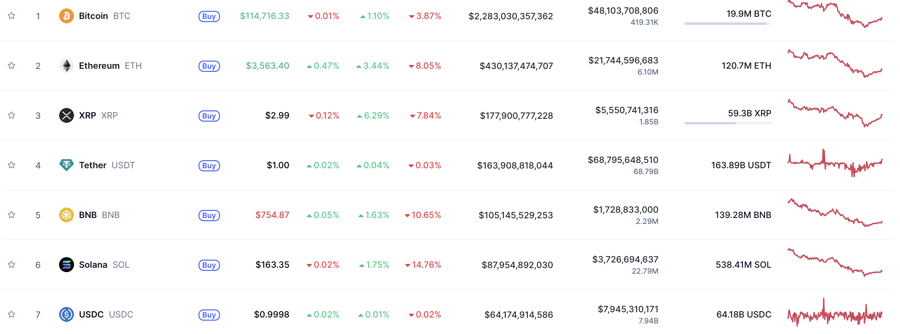

Bitcoin prices had dipped by 3%, falling to $113,231. Ethereum (ETH) witnessed a 6% decline, while Solana (SOL) lost 5%. The steep drop triggered a wave of automated liquidations on exchanges, forcing investors to sell their assets at market prices to meet margin calls, further exacerbating the downward pressure.

The fallout wasn’t limited to cryptocurrencies; stocks of companies associated with the industry also took a hit. Coinbase, a major US cryptocurrency exchange, plummeted by 16% after releasing disappointing financial results. Circle’s stock lost 8.4%, Galaxy Digital fell by 5.4%, and Bitmine Immersion, an Ethereum-focused investment company, dropped by 7.4%. Even MicroStrategy, often seen as a proxy for Bitcoin on the stock market, suffered a nearly 9% loss.

These developments came on the heels of Trump’s announcement of new tariffs ranging from 10% to 41%. The market feared that these policies would increase inflationary pressures, prompting the Federal Reserve to reconsider its plans for interest rate cuts. Amid macroeconomic uncertainties, investors tend to shy away from speculative assets like cryptocurrencies.

However, some experts argued that this correction was a natural response to the previous month’s sharp rally and didn’t signify a crisis.

“After the market’s overheating in July, this is a healthy and strategic adjustment phase. It’s not due to any grave crisis but rather… the absence of one. Capital is shifting from speculative assets to safer havens—a calculated pause,” remarked Ben Kurland, CEO of the DYOR crypto research platform.

Despite the short-term pressures, July remained a positive month for the cryptocurrency market. According to Coin Metrics, Bitcoin rose by 8%, while Ethereum surged by over 49% during the month.

Ethereum ETFs, in particular, attracted more than $5 billion in net inflows during July, recording only a minor outflow of $1.8 million on July 2. Year-to-date, these ETFs have accumulated nearly $9.7 billion in inflows.

Meanwhile, Bitcoin ETFs saw outflows of $114 million on the last day of the month but still managed to attract a total of $6 billion in inflows for July, bringing the year-to-date total to $55 billion.

At the time of writing, most popular cryptocurrencies have started to show signs of a mild recovery following the sharp correction. Bitcoin (BTC) is trading around the $115,000 mark, inching up by approximately 1%. Ethereum (ETH) is witnessing a more robust recovery, climbing by nearly 4% to reach $3,562. While the rebound is not yet strong, it indicates a return to stability after the short-term sell-off.