BTC: Positive Outlook Remains

On the weekly chart, BTC continues to hug the upper bound of its long-term Bullish Price Channel. The MACD indicator is pointing upwards and sits above the zero line, providing a buy signal while the ADX indicator remains in the strong trend region (ADX>25), indicating the long-term bullish prospect of BTC is still in play.

Currently, prices are consolidating near the Fibonacci Projection level of 161.8% ($119,000-$120,000 USD). Should BTC successfully breach this level in the coming period, the uptrend will be further reinforced.

BTC Weekly Chart 2021 – 2025 – Source: TradingView

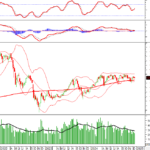

Switching to the daily chart, after successfully breaking above the May 2025 high ($110,000-$111,000 USD), the price has reached the Fibonacci Projection level of 78.6% ($118,000-$120,000 USD) as mentioned in the Crypto Report for June 2025 (Issue 1).

At present, the Bollinger Bands are beginning to narrow (Bollinger Band Squeeze) while the ADX line oscillates within the grey region (20<> indicating a potential pause in the current momentum.

In summary, the writer believes that the uptrend remains the dominant trend for this coin, and short-term consolidations will make the uptrend more sustainable.

BTC Daily Chart 2024 – 2025 – Source: TradingView

ETH: Short-Term Prospects Face Challenges

On the weekly chart, the ETH price recovered to near the December 2024 high ($3,900-$4,000 USD) and is currently testing the long-term downward trend line. The Stochastic Oscillator has entered the overbought region, and if it provides a sell signal and falls from this area in the coming period, the risk of a downward adjustment will increase.

ETH Weekly Chart 2021-2025 – Source: TradingView.

Returning to the daily chart, the MACD line has crossed below the signal line, giving a sell signal, while the Stochastic Oscillator is also in the process of forming a bearish divergence. On the other hand, the Golden Cross that just appeared in July 2025 has reduced the likelihood of a sharp correction. This group of SMA lines can provide good support for the price if a correction scenario occurs in the coming period.

In summary, the writer believes that the price of this coin may weaken at the December 2024 high ($3,900-$4,000 USD). Investors should refrain from trading in this area and observe further.

ETH Daily Chart 2024 – 2025 – Source: TradingView.

Technical Analysis Department, Advisory Board Vietstock

– 13:00 02/08/2025

“When Blockchain and Digital Assets Tap the Financial Nervous System”

“Cryptoassets, once deemed ‘heretical’, are now marching into the mainstream financial system. From JPMorgan embracing crypto for repo transactions to BlackRock launching its first tokenized fund and the Monetary Authority of Singapore (MAS) building an entire on-chain financial platform, the integration is evident and accelerating.”

“Regulator and Large Financial Institutions’ Involvement Makes the Digital Asset Market More Efficient, Says SSI’s Director.”

“The crypto market in Vietnam is currently dominated by individual investors, with almost 100% of transactions originating from this demographic. Major institutions like Dragon Capital, VinaCapital, and SSI have yet to fully engage in asset management roles within this space. ‘When this changes, the market will mature and become more regulated,’ says Thomas Nguyen, SSI Securities’ Overseas Markets Director.”

“Technical Analysis for August 4th: Proceeding With Caution”

The VN-Index and HNX-Index both climbed, while trading volume dipped compared to yesterday’s morning session, indicating investors remain cautious.

The Vietstock Weekly: Short-Term Risks Linger

The VN-Index concluded a less-than-optimistic trading week, as it continued to lose points and dip below the Middle Bollinger Band. This downward trajectory is further exacerbated by a decline in trading volume, falling below the 20-week average, indicating a limited flow of capital into the market. Adding to the bearish sentiment, the MACD indicator is poised to generate a sell signal, having narrowed its gap with the Signal Line. Should this materialize in the coming period, the index’s outlook will turn increasingly negative.