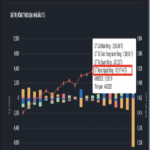

The market experienced its strongest adjustment week since the April bottom, with the VN-Index rising over 42%. The shocking 4.1% reversal on July 29th, with record-breaking liquidity, signaled the end of a short-term cycle. The market needed to cool down and consolidate before entering a new uptrend.

While the VN-Index adjusted by 2.3% last week, the decline was concentrated on July 29th, with the remaining three days hovering around the 1500-point mark. Experts acknowledged the presence of bottom-fishing demand around this level, resulting in a certain recovery. However, this wasn’t indicative of a balanced supply and demand dynamic, and the likelihood of the market forming a range around 1500 points was low.

One of the reasons for the experts’ caution was the lack of a strong enough recovery response from the bottom-fishing demand, despite sustained high liquidity. The supporting factors at this point had become significantly less compelling, and many stocks reported positive second-quarter profits but still underperformed. The market awaited newer, more positive information or required more time to build a balanced accumulation zone. The expected support level was relatively consistent, ranging from 1400 to 1450 points.

Regarding opportunities, experts were already cautious the previous week, reducing allocations or employing automatic profit-taking thresholds; hence, the substantial decline on July 29th reinforced this view. Currently, stock allocations are reduced to low to medium levels, awaiting new investment opportunities after the market undergoes evident adjustments and accumulations.

Nguyen Hoang – VnEconomy

The market underwent a significant adjustment, but the VN-Index hovered successfully around the 1500-point mark. In your opinion, is this adjustment sufficient, or is it merely a technical pause before further decline? What could be the potential target?

In my view, the second-quarter earnings results are unlikely to be a strong enough factor to help the market establish a solid bottom at this point. The primary reason is that the market has been “buying on expectations,” and most positive news has already been reflected in the previous strong gains.

Nghiem Sy Tien

Nguyen Viet Quang – Director of Business, Yuanta Securities

The market witnessed a substantial adjustment in the VN-Index last week, with record-breaking liquidity being the aftermath of the market’s continuous rise since late April. Although there was bottom-fishing demand around the 1500-point level, I believe this is merely the first dip in a downward trend and the formation of the first bottom. Technically, the VN-Index remains above the 20-day moving average, and there’s a possibility of retesting the 1560-point peak next week. Nonetheless, the short-term downward trend is relatively evident, and in my opinion, the destination lies in the 1400-point region before the market resumes its long-term upward trajectory.

Le Duc Khanh – Director of Analysis, VPS Securities

In an upward trend, the market often takes “breaks,” especially after a streak of 2-3 consecutive weeks of gains, breaking new highs and historical records. Typically, surpassing peaks and then “testing” old peaks is common within a few sessions before reverting to the upward trajectory. I assessed last week’s short-term support zone at 1480-1485 points, with another robust support zone around 1400 +/-. In both scenarios, the market will rebound and continue toward the 1550-1600-point range in the upcoming period.

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

In my opinion, the index’s fluctuation around the 1500-point mark after a substantial weekly decline leans more toward a technical pause than the conclusion of the adjustment phase. The selling pressure in the previous week was intense, and the market will require more time to absorb this supply. Bottom-fishing demand emerged at the 1500-point level but lacked the strength and breadth to forge a solid bottom. Therefore, the likelihood of the market experiencing another dip to test lower support levels is relatively high.

The destination for this adjustment phase, in my view, could be a more stable equilibrium zone of 1450-1460 points. This area served as a previous accumulation base and could attract sufficient bottom-fishing demand to conclude the downward trajectory.

Money Flow Trend: What to Do If You’re Holding Cash Now?

970 Enterprises Announced 2Q/2025 Profits, Up 33.6% – the Highest in 1.5 Years

US Announced Adjusted Tariffs Before “Zero Hour,” Negotiations Continue

Nguyen The Hoai – Branch Director of Dong Nai, Rong Viet Securities

The market’s fluctuation around the 1500-point mark is normal after a substantial rise. It’s challenging to determine if the market’s adjustment is sufficient. However, we can assert that the market has entered a medium and long-term upward trend, and during this ascent, there will be adjustment periods. I don’t predict peaks or troughs. We should allocate portfolio weights and purchasing power reasonably when the market and some stock groups have risen significantly.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities JSC

Observing the movement, we can see that the VN-Index reversed quickly with a substantial drop as it barely surpassed the historical peak. Liquidity also hit a record high, with over 70,000 billion on HOSE during the July 29th session. Despite the current discount rate, incoming funds seem cautious in their buying sentiment, reflected in the matching orders and the modest recovery. The index’s weekly close was on par with the declining candle during the plunge. Moreover, the VN30, representing large-cap stocks, is still trading below the drop on that day.

I believe there are currently insufficient catalysts for the market, as most positive news has already been factored in. The market may enter a more challenging phase. I anticipate the index stabilizing around the 1500-point mark, but if buying momentum remains weak, we cannot rule out the possibility of further cooling and a decline to the lower support zone of around 1460-1470 points.

Nguyen Hoang – VnEconomy

Second-quarter earnings results are pouring in. However, prices have already risen sharply beforehand. Is this information sufficient to support the market in forming a bottom?

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

In my opinion, the second-quarter earnings results are unlikely to be a strong enough factor to help the market establish a solid bottom at this point. The primary reason is that the market has been “buying on expectations,” and most positive news has already been reflected in the previous strong gains.

Currently, the market is undergoing an adjustment phase, and the general sentiment leans toward risk management. Hence, positive earnings results may only lead to stock differentiation, meaning they hold their value better or experience a mild recovery, but it’s challenging to reverse the short-term downward trend of the overall market.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities JSC

In my view, selling pressure still dominates. Although some enterprises report substantial profit growth, incoming funds are selective. High differentiation is occurring, and not every enterprise announcing good financial results achieves a substantial price increase. The market seems to have already factored in earnings results, making them less appealing at present. Future potential also depends on each enterprise’s specific expectations. Therefore, I believe earnings results only play a supportive role and are insufficient to propel the market upward, breaking free from the adjustment phase. Instead, we require more concrete catalysts, such as policies or governance.

I don’t consider the high matching orders on the market plunge day as indicative of robust bottom-fishing demand. This momentum needs to be sustained afterward to confirm this notion. However, the VN-Index has barely recovered more than half of the decline since July 29th, implying that selling pressure remains dominant.

Ms. Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business, Yuanta Securities

The emergence of positive second-quarter earnings results at this juncture could be a crucial supporting factor in bolstering investor confidence in the health of enterprises, potentially aiding the market in forming a bottom. However, prices have already risen sharply beforehand based on investor expectations, and selling pressure when the VN-Index reached its historical peak means that an immediate bottom formation is unlikely. Nonetheless, positive second-quarter earnings results will lay the foundation for continued capital flow in the market and sustain long-term growth.

Nguyen The Hoai – Branch Director of Dong Nai, Rong Viet Securities

After the release of second-quarter earnings results and some supportive news, there has been profit-taking in some stock groups that witnessed substantial gains. It’s challenging to determine if the market’s adjustment is complete, but I anticipate market accumulation around the 1500-point level, with capital shifting toward groups with more attractive valuations.

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, capital flow in this phase has begun to differentiate. Some stocks are rising, while others are adjusting or accumulating sideways. The VN-Index is likely to form a bottom next week and embark on a new growth phase until the end of Q3.

Nguyen Hoang – VnEconomy

Foreign investors net sold strongly last week, marking the second consecutive week of net selling. In previous discussions, you didn’t highly regard the long-term nature of this capital during the four weeks of net buying. Can we consider this strong net selling as a signal that short-term opportunities have concluded?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities JSC

Foreign capital remains uncertain, but compared to the net buying value since early July, the net selling activities in the past two weeks haven’t negated the overall positive status. However, the notable point is the substantial increase in foreign net selling value this week compared to the previous week, surging from 1600 billion to over 4700 billion on HOSE. We should monitor the situation in the coming weeks. If net selling remains robust, we cannot rule out the possibility of a foreign capital trend reversal. But if the selling pressure eases, we can still anticipate the resumption of net capital inflows.

The VN-Index is likely to form a bottom next week and embark on a new growth phase until the end of Q3.

Mr. Le Duc Khanh

Nguyen The Hoai – Branch Director of Dong Nai, Rong Viet Securities

The net selling of foreign investors in the past two weeks, if continued, will make the market challenging in the short term, but it doesn’t signify the conclusion of the medium and long-term trends. We can consider 2021-2022 as a similar case.

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

The decisive net selling action of foreign investors confirms my previous cautious stance. This capital has a short-term speculative nature: they buy when the market discounts tariff risks and sell when domestic investor enthusiasm pushes valuations higher. In my view, this is a relatively clear signal that short-term trading opportunities based on expectations have been fulfilled for them. Their proactive and robust profit-taking could be a risk indicator for the market at current price levels.

Nguyen Viet Quang – Director of Business, Yuanta Securities

Foreign investors have been net buying significantly in June-July, with approximately 3,500 billion VND, and when the VN-Index reached its historical peak, this group consecutively net sold in the past two weeks. Thus, we can conclude that this capital primarily engages in short-term speculation, taking advantage of the market’s recovery after the collapse in early April.

However, our market hasn’t heavily relied on this capital in the past year, so I believe short-term investment opportunities haven’t entirely concluded. Nonetheless, investors should be cautious with high-risk stocks and focus on those with solid fundamentals and outstanding second-quarter earnings results.

Le Duc Khanh – Director of Analysis, VPS Securities

When many stocks surge sharply and liquidity is high, not only domestic investors but also foreign investors may adjust their portfolios and reallocate weights. The phenomenon of net buying and net selling at certain times isn’t a significant concern. Instead, investors are more interested in the broader trend of net buying or net selling over an extended period. From the overall trading dynamics, many stock groups that haven’t risen in the previous phase become the focal point and investment opportunities in the upcoming week.

I anticipate market accumulation around the 1500-point level, with capital shifting toward groups with more attractive valuations.

Mr. Nguyen The Hoai

Nguyen Hoang – VnEconomy

Your cautious buying recommendation last week helped avoid the sharp decline this week. However, bottom-fishing demand remained robust, resulting in very high liquidity. The substantial decline on July 29th likely triggered automatic profit-taking thresholds. To what extent have you reduced your portfolio weights? What is the threshold for re-entry?

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

I’ve proactively lowered my portfolio weights to a safer level, currently at around 30-40% stocks. The threshold I observe for initiating reinvestment isn’t a specific point but rather when the market finds a new equilibrium, specifically the 1450-1460-point zone. However, it’s

The Great Unloading: Corporate Leaders Race to Sell Shares, HIG Bids Farewell to the Stock Exchange

“In a recent development, four top executives at Petrosetco have signaled their intent to offload nearly 1 million PET shares between August 6 and September 4, through matching and negotiated transactions. This move comes as Hà Đức Hiếu, a member of the Board of Management at Dat Xanh Group, also registers to sell 6.355 million DXG shares to reduce his equity holdings.”