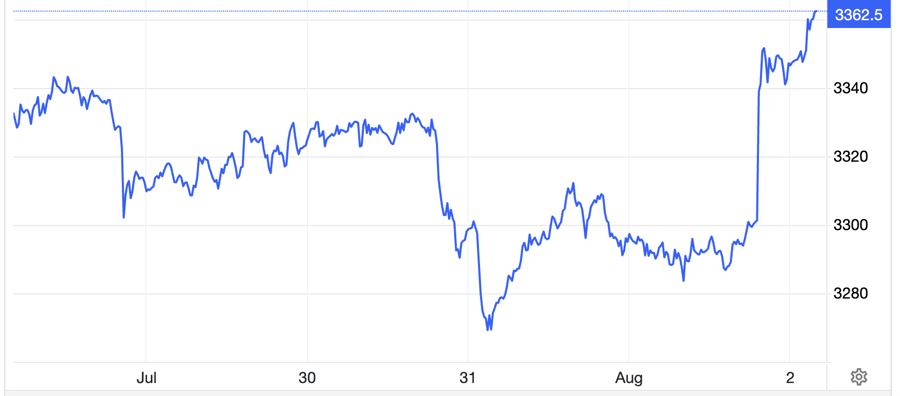

Gold prices surged during Friday’s trading session (August 1st) as weaker-than-expected US employment data increased the likelihood of an interest rate cut by the Federal Reserve in their September meeting. The US dollar witnessed a sharp decline following consecutive rallies, while the massive SPDR Gold Trust ETF continued its small-scale sell-off.

At the close of trading in New York, spot gold prices rose by $73 per ounce compared to the previous session’s close, equivalent to a gain of over 2.2%, reaching $3,363.5 per ounce, according to data from the Kitco exchange. When converted using Vietcombank’s selling rate, this price corresponds to VND 106.9 million per tael, reflecting an increase of VND 2.3 million per tael compared to the previous day’s morning session.

Vietcombank’s USD exchange rates ended the week at VND 26,000 (buying) and VND 26,390 (selling), up VND 10 from Friday morning, and a VND 70 increase on both buying and selling rates during the week.

Over the week, spot gold prices climbed by 0.76%, while gold prices in VND terms rose by VND 1 million per tael.

Friday’s rally pushed gold prices to their highest level in a week. The catalyst for this breakthrough was the non-farm employment report, which fell short of market expectations.

The US Labor Department’s employment report revealed that the country’s non-farm sector added only 73,000 new jobs in July, significantly lower than the forecast of 100,000 new jobs anticipated by economic experts in a Dow Jones poll. Moreover, job figures for previous months were also significantly revised downward, with June’s figure adjusted to 14,000 from 147,000, and May’s figure reduced to 19,000 from 125,000.

These figures heightened expectations for an earlier-than-projected interest rate cut by the Fed to bolster the economy. Following the report’s release, the interest rate futures market indicated an 86% probability of a Fed rate cut in September, according to the FedWatch Tool from CME Group. Additionally, markets anticipate two rate cuts this year, each by a quarter of a percentage point.

The US dollar experienced a substantial decline after the employment report was published. The Dollar Index fell by nearly 1.3%, ending the week at 98.69 points.

Gold, being a non-interest-bearing asset priced in US dollars, benefits from these developments. Earlier in the week, gold prices faced downward pressure due to the hawkish stance of Fed Chairman Jerome Powell and the strong rally in the US dollar. Despite the dollar’s decline on Friday, the Dollar Index still climbed by nearly 1.1% for the week.

On the COMEX exchange, gold futures prices rose by 1.9%, ending Friday’s session at $3,413.4 per ounce.

“The reported employment figures fell short of expectations, increasing the likelihood of a Fed rate cut this year,” remarked Bart Melek, head strategist at TD Securities. “With rising tariff-induced inflationary pressures and a weakening jobs market, a Fed rate reduction would significantly benefit gold prices.”

Additionally, Trump’s announcement on July 31st regarding new retaliatory tariffs against multiple countries and territories further fueled the demand for gold as a safe-haven asset.

However, the world’s largest gold ETF, SPDR Gold Trust, continued its sell-off on Friday, offloading 1.4 tons of gold and reducing its holdings to 953.1 tons, according to data from the fund’s website. For the week, the ETF sold 4 tons of gold, following purchases of 13.5 tons in the previous week.

Gold Prices Dip on Monday, but Short-Term Outlook Remains Positive

The outlook for gold prices is looking brighter, with the precious metal poised to reclaim the $3,400/oz mark. This is according to market analysts who foresee a short-term boost for the commodity.

The Price of Gold Plummets as Investors Rush to Cover Stock Market Losses

The US dollar index and Treasury yields fell during the session, but failed to buoy the precious metals market.