For the week ending July 25, the USD Index (DXY) – a measure of the greenback’s strength against a basket of six major currencies – fell 0.79 points from the previous week’s close to 97.67, ending a two-week winning streak.

The US dollar’s weakness reflects investors’ cautious sentiment amid escalating trade tensions. The market fears that higher tariffs could have negative consequences for US economic growth. In this scenario, the Federal Reserve may be forced to cut interest rates to support the economy, thereby diminishing the appeal of the US dollar in the international market.

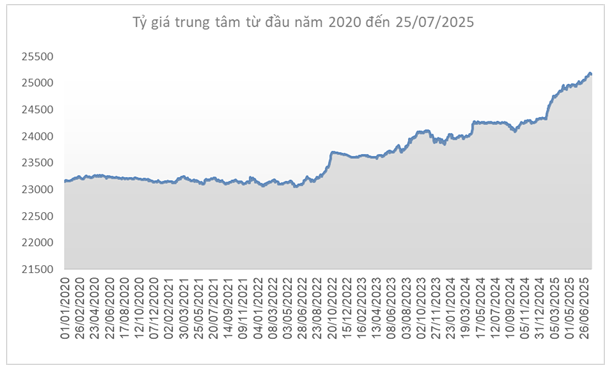

Source: SBV

|

In the domestic market, the State Bank of Vietnam set the daily reference exchange rate on July 25 at 23,164 VND per USD, down 21 VND from the previous week. With a 5% fluctuation band, USD/VND exchange rates at commercial banks are allowed to trade within the range of 23,906– 26,422 VND/USD.

The USD/VND reference exchange rate at the State Bank of Vietnam’s Foreign Exchange Management Department also decreased to 23,956– 26,372 VND/USD (buying – selling), down 20 VND and 22 VND, respectively, from the previous week.

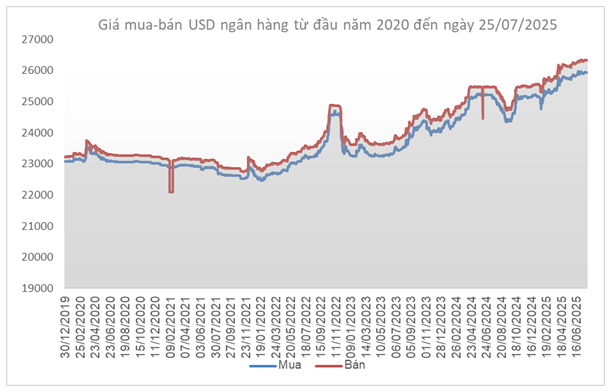

Source: VCB

|

At Vietcombank, the exchange rate on July 25 was listed at 25,930 – 26,320 VND/USD (buying – selling), a decrease of 20 VND in both directions.

Source: VietstockFinance

|

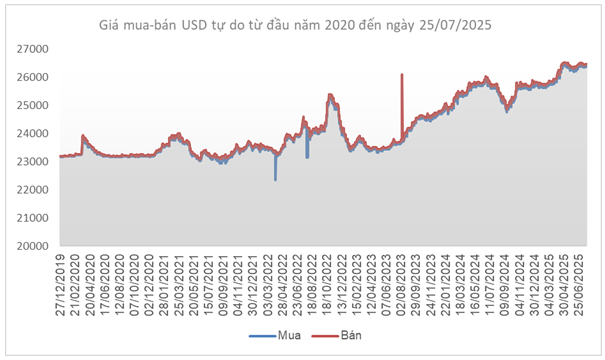

In the free market, the USD rose by 30 VND in buying price and 40 VND in selling price, trading around 26,380 – 26,460 VND/USD (buying – selling).

– 19:43 27/07/2025

The Greenback Surges.

“During the week of July 28 to August 1, 2025, the US dollar surged as the Federal Reserve maintained interest rates in its July meeting, coupled with positive economic data from the US. The Fed’s decision to stand pat on rates, for now, comes amid a backdrop of encouraging economic indicators, signaling a resilient American economy.”