The VN-Index closed July 2025 at 1,502.5 points, a significant increase of 126.5 points or 9.19% compared to the previous month. This surge was accompanied by a 76% spike in the average matched trading value, reaching VND 32,827 billion, and a resurgence of foreign capital inflows.

The average trading value across the three exchanges peaked at VND 39,450 billion in July 2025. Specifically, the matched trading value averaged VND 36,659 billion, marking a 75.8% jump from the previous month and an impressive 80% increase from the previous five-month average.

Foreign investors recorded a net buy of VND 8,717.8 billion, with a net buy of VND 10,949.6 billion in matched transactions. Their primary focus was on the Banking and Financial Services sectors, with top net buys including SSI, VPB, SHB, HDB, VNM, FUEVFVND, VND, NVL, TPB, and VIC.

On the other hand, the Foreign sector’s top net sells through matched transactions were in the Basic Resources sector, with stocks like HPG, KDH, FPT, GEX, VHM, E1VFVN30, VHC, GVR, and BID.

Individual investors sold a net of VND 7,324.1 billion, with a net sell of VND 11,260.5 billion through matched transactions. In terms of matched transactions, they bought a net of 7 out of 18 industries, mainly in the Construction and Materials sectors. Their top net buys included DBC, BSR, PDR, KDH, HPG, ClI, VPL, VHC, VND, and GVR.

Meanwhile, their top net sells through matched transactions were in 11 out of 18 industries, predominantly in the Banking, Food and Beverage sectors. Stocks like MSN, MWG, EIB, MBB, VNM, GEX, VIX, HDB, and VPB were among their top net sells.

Proprietary trading resulted in a net sell of VND 409.3 billion, but a net buy of VND 3,982.7 billion in matched transactions. Focusing on matched transactions, proprietary trading bought a net of 13 out of 18 industries, with the strongest sectors being Information Technology and Banking. Top net buys included FPT, MWG, MBB, E1VFVN30, TCB, HPG, VNM, GMD, PNJ, and MSN. The Financial Services sector was their top net sell, with stocks like FUEVFVND, VPB, BSR, VIB, VSC, VCI, SSI, HAG, MSH, and VGC.

Domestic institutional investors sold a net of VND 984.5 billion, with a net sell of VND 3,671.8 billion in matched transactions. Looking at matched transactions, domestic institutions sold a net of 9 out of 18 industries, with the highest value in the Financial Services sector. Their top net sells included SSI, SHB, VND, VPB, VIC, DXG, DBC, NVL, HDB, and NLG. Conversely, their largest net buys were in the Industrial Goods & Services sector, with top stocks being GEX, MSN, EIB, HPG, VIX, VIB, MBB, KDH, HAH, and VCB.

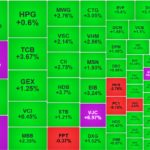

Analyzing the sector weight changes over the month reveals an increase in financial sectors (Banking and Securities) and Steel, while other sectors witnessed a decrease, notably in Real Estate, Food, Agriculture & Seafood, Chemicals, Retail, Information Technology, Oil & Gas, and Electricity.

The standout trend in July was the resurgence of capital inflows into Banking, Securities, and Steel sectors. The Securities sector, in particular, experienced a robust recovery for three consecutive months, rising from 12.6% in May to 12.8% in June and an impressive 18.5% in July. This sector also outperformed the market in July, surging by 35%.

Similarly, the Steel sector witnessed a third consecutive month of recovery from a low of 4.14% in May, with a corresponding 10.7% increase in its price index. This indicates a positive shift in investor sentiment towards the industry.

On the flip side, sectors like Real Estate and Export (Seafood and Textile) continued to witness weak capital inflows, especially after a brief recovery in June. Real Estate, for instance, might be entering a phase of adjustment after a strong upward movement.

The capital allocation among large-cap (VN30), mid-cap (VNMID), and small-cap (VNSML) stocks remained relatively unchanged from June 2025. This stability indicates a sustained focus on these segments. However, small-cap stocks became relatively less attractive, with their capital weight declining from 9.7% to 8.8%.

In terms of liquidity, the average trading value increased significantly for both the VN30 and VNMID groups, surging by VND 6,180 billion (a 74.1% increase) and VND 6,523 billion (an 84.7% increase), respectively. Meanwhile, the VNSML group saw a more modest increase of VND 1,067 billion, representing a 58.8% rise. Regarding price movements, the VNMID index led the way with a 17.04% gain, followed by VN30 (+9.19%) and VNSML (+8.09%).

“Blue-Chip Stocks Surge: VN-Index Recaptures the 1,500-Point Milestone”

Despite a significant decline in liquidity, today’s session witnessed an exuberant market performance. The largest blue-chip stocks witnessed a robust surge, propelling the VN-Index not only to reclaim the 1500-point mark lost last week but also to surpass 1528.19 points, reigniting hopes of testing the historical peak once again.

The Flow of Capital: The Rhythm of Adjustment Endures

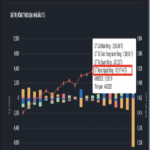

The market has experienced its most significant correction since the April lows, following a remarkable 42% surge in the VN-Index. The abrupt 4.1% decline on July 29, accompanied by record-breaking trading volumes, signaled the conclusion of a short-term cycle. It’s essential for the market to cool off and consolidate before embarking on the next upward trajectory.

“Foreigners net-sell $10 billion, mostly in matched deals.”

Today, foreign investors net-sold $4.3 million, with gross selling of $43.5 million and gross buying of $39.2 million. On the matching side, they net-sold $11.6 million.

The Great Unloading: Corporate Leaders Race to Sell Shares, HIG Bids Farewell to the Stock Exchange

“In a recent development, four top executives at Petrosetco have signaled their intent to offload nearly 1 million PET shares between August 6 and September 4, through matching and negotiated transactions. This move comes as Hà Đức Hiếu, a member of the Board of Management at Dat Xanh Group, also registers to sell 6.355 million DXG shares to reduce his equity holdings.”