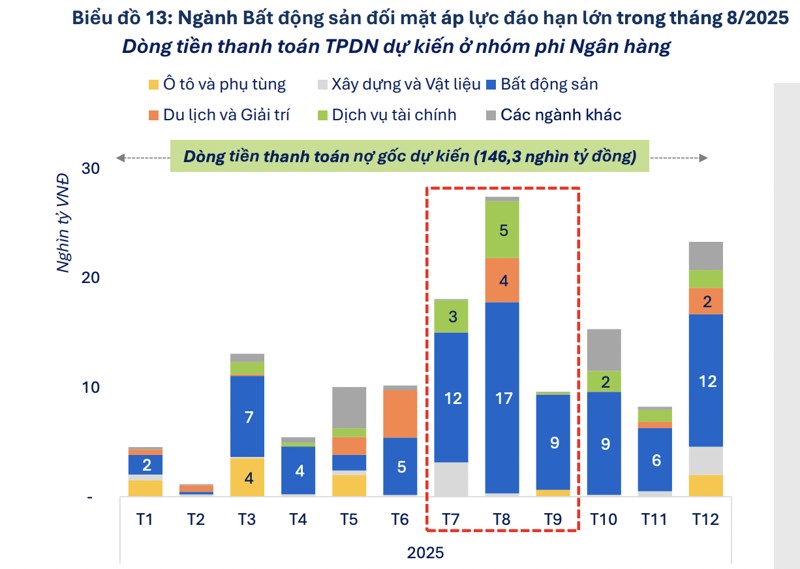

The real estate sector remains in the spotlight as it accounts for 63.8% of the total bond value due this month, equivalent to VND 17,500 billion – 3.8 times higher than the average maturity value in the first seven months (VND 4,600 billion).

Data from Fiingroup

Some notable companies with large maturity volumes include: Quang Thuan Investment (VND 6,000 billion), Trung Nam Land (VND 2,500 billion), and Setra – DV TM TP. Ho Chi Minh City (VND 2,000 billion). Interestingly, all three have faced credit events and payment obligation violations in the past.

The total face value of bond maturities in the second half of the year for non-bank businesses is expected to reach approximately VND 101,900 billion, double that of the first half (VND 44,400 billion). Of this, the real estate sector accounts for about 64%, or VND 65,300 billion, reflecting the increasing financial pressure and risk in this industry.

Commenting on the medium-term bond market, the analysis team at S&I Ratings believes that financial pressure on real estate businesses will persist over the next 12-18 months. This is due to the significant maturity value in the latter half of this year, coupled with nearly VND 143,000 billion in bonds maturing in 2026.

While the repayment pressure is evident, S&I Ratings anticipates a substantial increase in bond issuances going forward. The government’s efforts to resolve legal obstacles for real estate projects will, according to the analysts, enable businesses to resume project implementation and improve cash flow.

“Once the legal hurdles are cleared and projects are eligible for deployment, businesses can use the projects as collateral to secure bank loans,” explained the S&I expert. “The ability to commence sales and generate revenue will also enhance their capacity to repay bondholders.”

Vingroup is the real estate company with the largest bond issuance.

In the first half of the year, real estate businesses issued VND 43,000 billion worth of bonds, an 11% increase compared to the same period last year. The average interest rate stood at 10.5% per annum. However, the issuance value was significantly lower than the “golden period” of VND 77,500 billion in the first half of 2020 and VND 118,400 billion in the first six months of 2021.

According to MB Securities Company, Vingroup Joint Stock Company was the leading real estate issuer, with VND 18,000 billion, followed by TCO Real Estate Investment and Services Company, with VND 8,000 billion.

Dot Property Awards 2025: Celebrating Vietnam’s Real Estate Trailblazers

On July 31st, the Dot Property Vietnam Awards 2025 announcement ceremony took place at the prestigious The Reverie Saigon hotel. The event attracted over 200 guests, including prominent figures from the real estate industry, sector experts, award council advisors, and representatives from various media outlets.

The Future of Urbanization: E.City Tan Duc – A Strategic Leap Forward

On July 21, 2025, a strategic partnership was forged between the E.City Tan Duc project and reputable distribution companies. This momentous occasion took place at the Tan Tao Group’s office in Ho Chi Minh City, marking a pivotal step in the group’s real estate market expansion strategy and its journey towards realizing its vision of sustainable urban development.

Real Estate Legal Landscape Brightens, Project M&A Gains Traction

The first half of 2025 saw a cautious pace in the real estate market as Vietnam navigated the recent merger of localities and adapted to new regulations from three related laws that came into force. However, in recent times, project legality has been gradually improving and becoming a core pricing criterion driving mergers and acquisitions.

The 3-Month-Old BV Group’s Venture: A $170 Million Township Development in Bac Ninh

Northwest Bac Ninh Company, a proud member of the Bach Viet Group (BV Group), has been entrusted by the People’s Committee of Bac Ninh province to undertake a monumental project. Encompassing over 45 hectares, this ambitious urban development venture carries an investment of nearly VND 4.1 trillion.