## Market Review: VN-Index Surges Past Historic Highs, Robust Momentum Expected to Continue

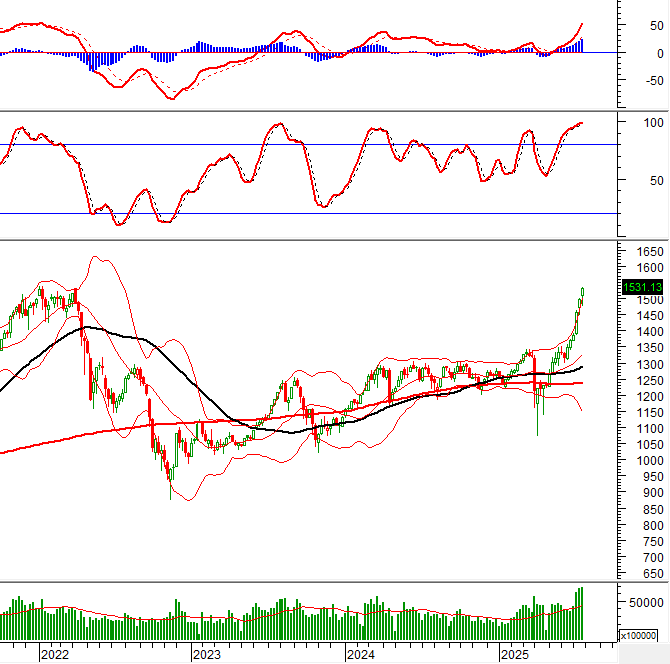

For the week of July 21-25, 2025, the VN-Index showcased impressive gains, officially surpassing the peak reached in early 2022. Turnover remained robust, averaging above the 20-week norm, indicating substantial capital inflows. The MACD indicator extended its lead over the signal line since the mid-May buy signal, reinforcing the bullish mid-term outlook. However, the stochastic oscillator eased in the overbought zone, suggesting potential technical corrections at elevated levels in the coming weeks.

Technical Analysis

Trend and Price Oscillation Analysis

VN-Index – Re-testing April 2022 Peak

On July 25, 2025, the VN-Index rose for the fourth consecutive session, with volume persistently above the 20-day average, reflecting vibrant trading sentiment. Additionally, the index re-tested the April 2022 high (1,515-1,535 zone) while the MACD continued its ascent after issuing a buy signal. Should this positive momentum persist and the index decisively surpasses this zone, it would establish a solid support level for the VN-Index going forward.

HNX-Index – MACD Forms Higher Highs and Higher Lows

During the July 25 session, the HNX-Index advanced with rising volume, surpassing the 20-day average, indicative of prevailing investor optimism. Moreover, the index closely tracked the upper band of the Bollinger Bands as the MACD formed higher highs and higher lows. This combination underscores the sustained positive outlook. Currently, the HNX-Index is re-testing the September 2023 peak (252-260 zone). A decisive breakthrough of this zone would establish a robust support level for the index in the near term.

Money Flow Analysis

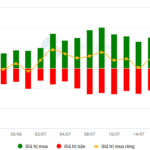

Smart Money Flow Variations: The Negative Volume Index for the VN-Index resides above the 20-day EMA. Should this stance hold in the upcoming session, the likelihood of abrupt downturns (thrust down) would diminish.

Foreign Capital Flow Dynamics: Foreign investors maintained net selling on July 25, 2025. A continuation of this trend in subsequent sessions could further dampen market sentiment.

Technical Analysis Department, Vietstock Consulting

– 16:58 27/07/2025

Vietstock Weekly 21-25 July 2025: Marching Towards Historic Highs

The VN-Index rallied for the fifth consecutive week, eyeing the historic peak reached in early 2022 (1,500-1,530 points). Last week’s trading volume hit a record high, indicating vigorous market participation. The MACD indicator continues to widen the gap with the signal line after giving a bullish signal in mid-May 2025, reinforcing the intermediate uptrend. Nonetheless, investors should be cautious of potential short-term fluctuations as the Stochastic Oscillator ventures deeper into overbought territory.

Market Beat July 31st: Holding the 1,500-Point Mark Triumphantly

The VN-Index faced significant challenges during the morning session, with constant struggles and adjustments, suggesting a deep decline at the closing bell. However, a remarkable turnaround took place in the afternoon session, as the market staged a strong recovery, recouping much of the lost ground. The index ultimately closed at 1,502.52, limiting the damage to a modest 5.11-point loss.

The Vietstock Daily: Celebrating 25 Years with New Peaks

The VN-Index soared during the trading session commemorating the 25th anniversary of Vietnam’s stock market. The high trading volume, maintained above the 20-session average, indicates robust momentum in the flow of funds, despite the impressive rally witnessed recently. With the MACD indicator continuing to widen the gap above the signal line after providing a buy signal in mid-June 2025, the VN-Index is poised to extend its upward trajectory, finding strong support around the 1,500-point level.

Stock Market Insights: Has the Tide Turned?

The VN-Index retreated, forming a Bearish Engulfing candlestick pattern as it encountered resistance at the psychological level of 1,500 points. This retreat indicates significant profit-taking pressure. Additionally, the Stochastic Oscillator has provided a sell signal within the overbought territory. Investors should exercise caution in the near term as a fall below this level could trigger increased short-term corrective pressure.

Market Beat: VN-Index Soars Over 26 Points, Setting a New Record High

The trading session concluded with significant gains, as the VN-Index surged by 26.29 points (+1.72%), closing at 1,557.42. Simultaneously, the HNX-Index displayed robust performance, climbing 9.23 points (+3.63%) to finish at 263.79. The market breadth was overwhelmingly positive, with 537 advancing stocks versus 247 declining ones. This bullish sentiment was echoed in the VN30 basket, where 26 constituents rose, 3 fell, and 1 remained unchanged, painting a predominantly green picture for the day’s trading activities.