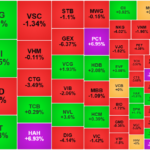

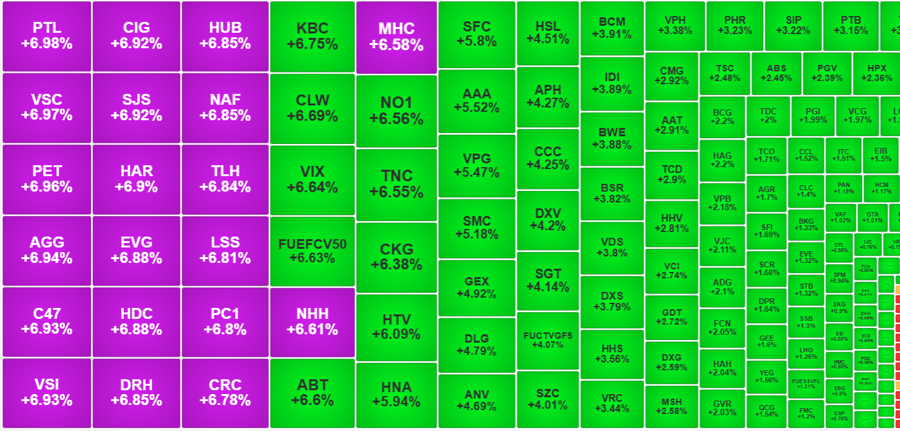

While the blue-chip group’s weakness dragged down the overall index, mid- and small-cap stocks surged. 21 stocks hit the ceiling and nearly 100 others rose more than 1%, a strange phenomenon amidst the VN-Index’s decline.

The VN30-Index best represents this polarized situation. The lackluster performance of blue-chips caused a 0.95% drop in the index, while the VN-Index fell by 0.34%. In contrast, the Midcap rose by 1.1%, and the Smallcap increased by 0.44%.

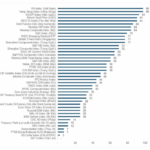

Out of the top 15 capitalized stocks on the HoSE, only three showed gains: VPB rose by 2.18%, MBB increased by 0.18%, and GVR climbed by 2.03%. The rest were in the red. The largest stocks underperformed: VCB fell by 1.15%, VIC dropped by 3.65%, VHM declined by 1.64%, TCB decreased by 1.45%, HPG slid by 1.77%, FPT dipped by 1.98%, and VPL shrank by 3.05%…

Even within the VN30 basket, mid- and small-cap stocks outperformed their larger counterparts. SHB hit the ceiling, BCM rose by 3.91%, VJC climbed by 2.11%, and SSB increased by 1.3%… These moves had a minimal impact on the index. For instance, SHB’s ceiling gain contributed just over 1 point to the VN-Index, while VIC’s drop took away 3.6 points.

Of course, if investors had avoided large-cap stocks, today’s market would have looked much better. The HoSE’s breadth at the end of the day showed 169 gainers and 150 losers, with 121 stocks rising by more than 1%. Among them, 21 hit the ceiling, mostly mid- and small-cap stocks, except for SHB. Many of these stocks had high liquidity, such as VSC, which matched 878.7 billion VND, HDC with 409.5 billion VND, and PC1 with 336.3 billion VND. Stocks with a few dozen billion VND in liquidity included PET, AGG, EVG, and NAF…

Among the stocks that rose sharply but didn’t hit the ceiling, over 20 had a liquidity of over 100 billion VND. VIX increased by 6.64%, VND climbed by 1.79%, KBC rose by 6.75%, DXG grew by 2.59%, HHS advanced by 3.56%, and GEX expanded by 4.92%… All of these stocks had a liquidity of over 600 billion VND.

On the other hand, almost 90 stocks on the HoSE fell by more than 1%, and nearly 30 had a liquidity of over 100 billion VND. Blue-chips featured prominently in this group, including HPG, MWG, FPT, TCB, VNM, and VHM. However, mid-cap stocks were also present: DIG, CII, NKG, DBC, DPM, and HDG, all with a liquidity above 200 billion VND.

This polarization indicates that money flows are operating in different ways. On one side, there is a higher risk appetite, with investors buying and pushing prices up while aggressively absorbing profit-taking volumes, resulting in high liquidity and price increases. On the other side, selling pressure outweighs buying power, pushing prices down with substantial liquidity. The money flow in this group is still strong but chooses a more cautious approach.

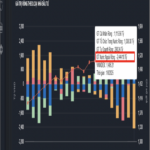

Today’s total matched orders on the two exchanges reached a very high level of 45,994 billion VND. However, the ability to maintain this polarization is a positive sign. It shows that investors’ views are conflicting rather than one-sided. Bottom-fishing activities continue to attract strong money flows. This level of liquidity is noteworthy, as in previous instances of a sudden shift in trading after a volatile session, liquidity tends to weaken quickly as investors opt to withdraw and observe from the sidelines.

A downside of today’s session was the large net selling by foreign investors, with HoSE recording a net sell figure of 1,919.4 billion VND. HNX and UpCOM also experienced net selling of over 300 billion VND. Notably, foreign investors net sold nearly 1,612 billion VND worth of stocks in the VN30 basket. The total selling value for stocks in this basket accounted for 14.8% of its total value.

The stocks that experienced heavy net selling were CTG (-380 billion VND), VPB (-236 billion VND), FPT (-230 billion VND), HPG (-217.2 billion VND), KBC (-210.8 billion VND), VCB (-125.8 billion VND), MWG (-110.7 billion VND), and STB (-84.9 billion VND). On the net buying side, we saw VIC (+140.2 billion VND), HAH (+88.7 billion VND), NVL (+66.5 billion VND), and HHS (+55.8 billion VND)…

The VN-Index closed today above the 1500-point mark at 1502.52 points, a favorable sign. This round number is considered a psychological support level, successfully conquered in the seven previous sessions. Yesterday’s and today’s trading activity indicates that when the index drops below this level, bottom-fishing forces become more active.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.

The July Record of VN-Index: Retail Investors Cash Out with 11,000 Billion Profit

Individual investors recorded a net sell-off of VND 7,324.1 billion, including a substantial VND 11,260.5 billion sold through matched orders in the past July.