Vietnam’s Economic Rise and the Retail Sector’s Resilience

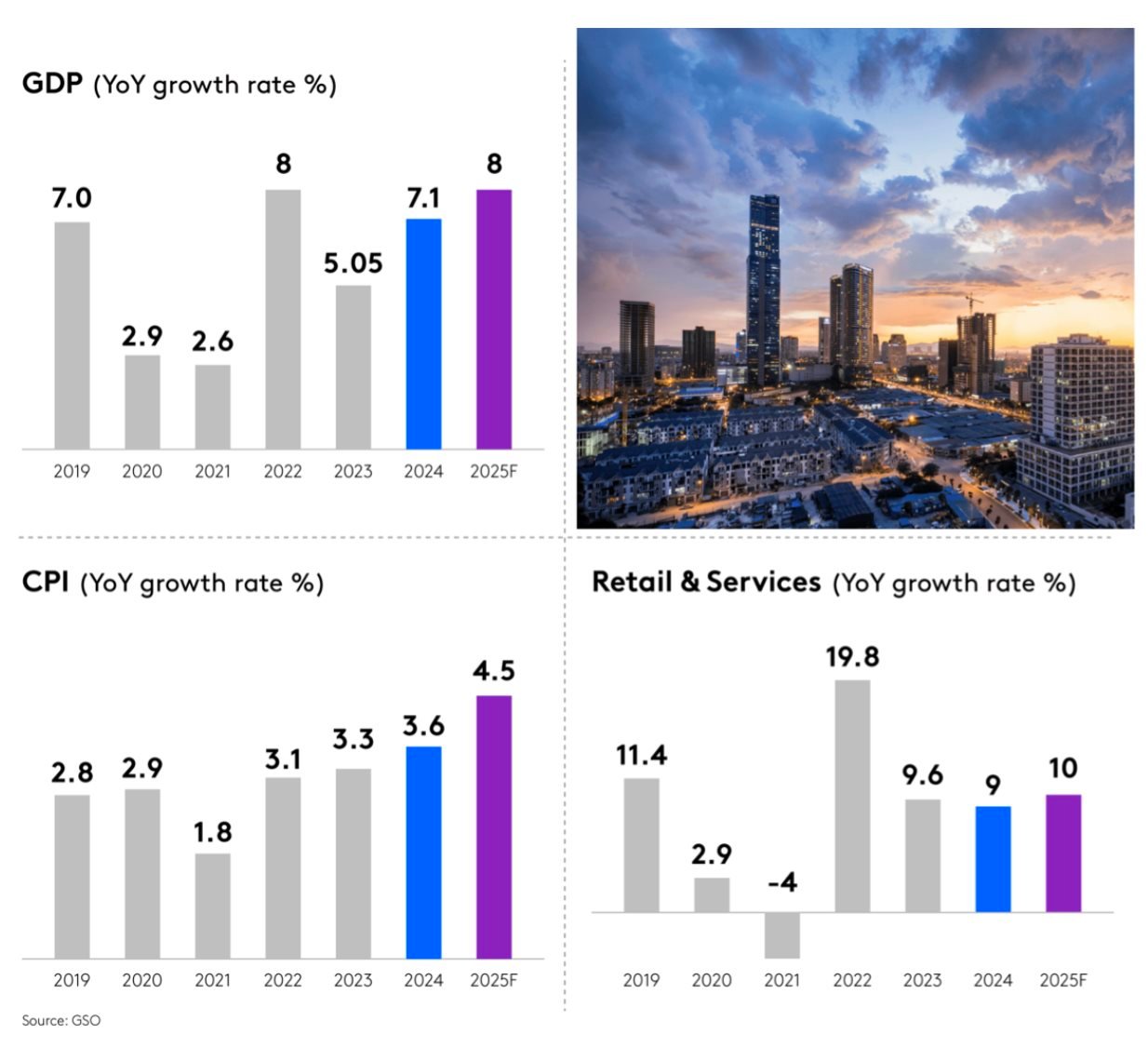

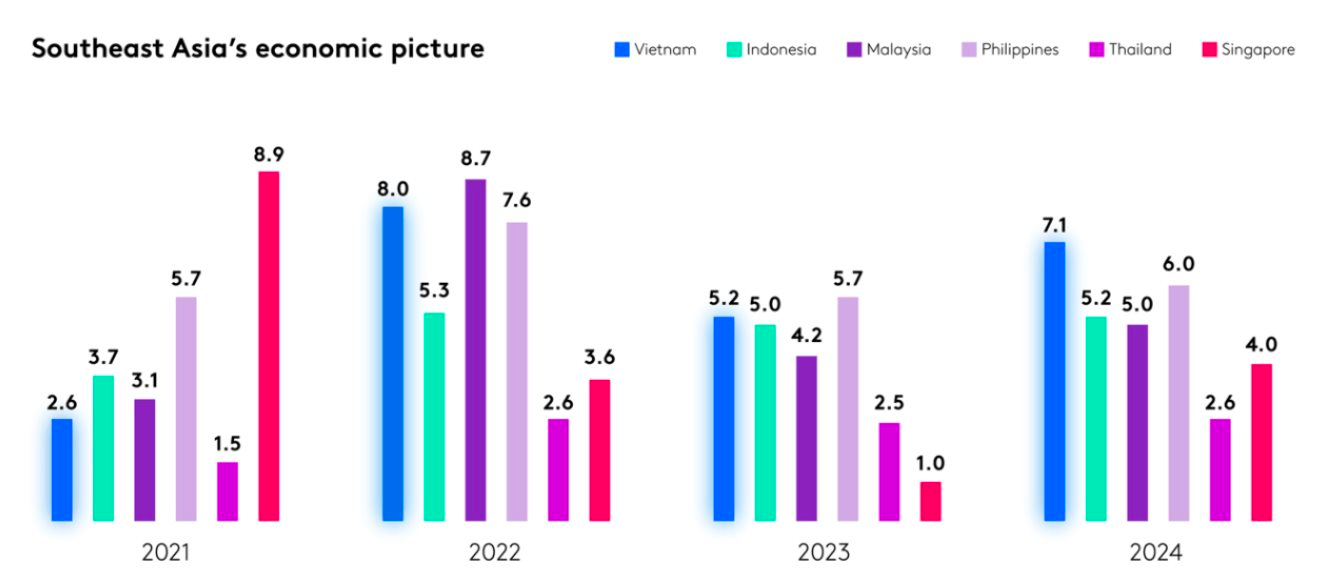

Vietnam, dubbed the “next Asian tiger,” has demonstrated economic resilience with a remarkable GDP growth rate of 7.1% in 2024, surpassing the government’s target while maintaining inflation in check. Per capita GDP increased from $4,346 in 2023 to $4,700, according to the latest report from Kantar Worldpanel, propelling the growth of the middle class.

The report also forecasts an economic boom for Vietnam starting in 2026. Citing data from the Centre for Economics and Business Research (CEBR), Vietnam’s GDP could reach $1.41 trillion by 2039, making it the 25th largest economy in the world and the 3rd largest in Southeast Asia. Consequently, Vietnam’s economy would surpass that of regional peers such as Thailand, Malaysia, and Singapore.

In tandem, the retail sector has maintained its robust growth trajectory despite economic downturns. Vietnam has emerged as the third-largest e-commerce market in Southeast Asia, surpassing the Philippines.

Image: Kantar Worldpanel Report

The Path to Achieving the 9% Growth Target

According to the Statistics Office (Ministry of Finance), in the first six months of 2025, total retail sales of goods and consumer services at constant prices were estimated at VND 3,416 trillion, up 9.3% compared to the same period last year.

Mr. Bui Nguyen Anh Tuan, Deputy Director of the Department of Domestic Market Development under the Ministry of Industry and Trade, shared in late April 2025 that to achieve an 8% GDP growth rate, total retail sales of goods and consumer services must grow by 12%.

Mr. Tuan added that with the total retail sales growth of 9% in 2024, each citizen and enterprise would need to spend one and a half times more than the previous year to achieve the 12% target.

On the business front, several significant plans are underway. Central Retail Vietnam recently inaugurated its 43rd GO! shopping center in Hung Yen with a total investment of VND 429 billion. AEON Vietnam’s new CEO, Mr. Tezuka Daisuke, also revealed their ambition to open four new shopping centers and ten MaxValue supermarkets this year.

Domestic players like Saigon Co.op aim to open more than 150 new sales points this year, bringing the total to nearly 1,000 nationwide. Bach Hoa Xanh had 2,180 stores as of May, opening an average of 2-3 stores per day in the first five months. WinCommerce also plans to expand to over 4,500 stores by the end of the year, with 70% in rural areas.

The “Double Punch” for Vietnamese Retail Businesses

While these long-term plans are impressive, FMCG companies are facing a “double punch” in the short term: the challenge of multi-channel growth and the pressure from global economic fluctuations.

Rapidly changing consumer behavior demands that brands have a presence across all channels, including e-commerce, traditional stores, social media, and livestreaming. This requires continuous investment in channel expansion and customer engagement.

On the other hand, global economic uncertainties, such as the EU’s Carbon Border Adjustment Mechanism (CBAM), US import taxes, and tightening livestream regulations in China, exert significant pressure on costs, supply chains, and legal compliance for businesses.

The task at hand is not just about rapid growth but intelligent growth. From an insider’s perspective, DKSH – a market development services provider, views the real competition as adaptability: balancing investment and efficiency, expansion and resilience, and speed and sustainability.

Image: Mr. Kim Le Huy, Vice President of Consumer Goods, CEO of DKSH Vietnam

“The fast-moving consumer goods (FMCG) industry in Vietnam is entering a ‘dual race’: accelerating multi-channel growth to meet market demands and tackling global challenges such as inflation, geopolitical instability, and rising logistics costs,”

“DKSH perceives this as a ‘capability race,’ requiring businesses to not only optimize costs but also build flexible, adaptive, and sustainable strategies to maintain their competitive edge,”

said Mr. Kim Le Huy, Vice President of Consumer Goods and CEO of DKSH Vietnam, in a recent statement.

Mr. Huy added that with global inflation projected to reach 4.2% in 2025 and logistics costs increasing by double digits in key markets like China, India, and Japan, cost optimization has become a strategic priority for FMCG companies.

However, long-term competitive advantage lies not only in cost efficiency but also in flexibility. Building a data-driven operating model and enabling rapid response capabilities allow businesses to adapt to market fluctuations, shifting consumer behaviors, and new regulations. Many FMCG companies still struggle with fragmented data systems and disconnected customer touchpoints, hindering their ability to implement integrated strategies.

Therefore, Mr. Huy emphasized that balancing cost control and organizational flexibility is not an option but a prerequisite for sustainable growth in an increasingly volatile market.

The Ultimate Guide to Start-up Success: Surviving the First 3 Years Without a Salary, Living in a Warehouse

Douglas Tan, the charismatic and visionary entrepreneur, founded Magix after facing numerous setbacks in his pursuit of career re-entry. Despite possessing impressive credentials, expertise, and experience, his journey began with a series of unsuccessful attempts to reintegrate into the workforce.