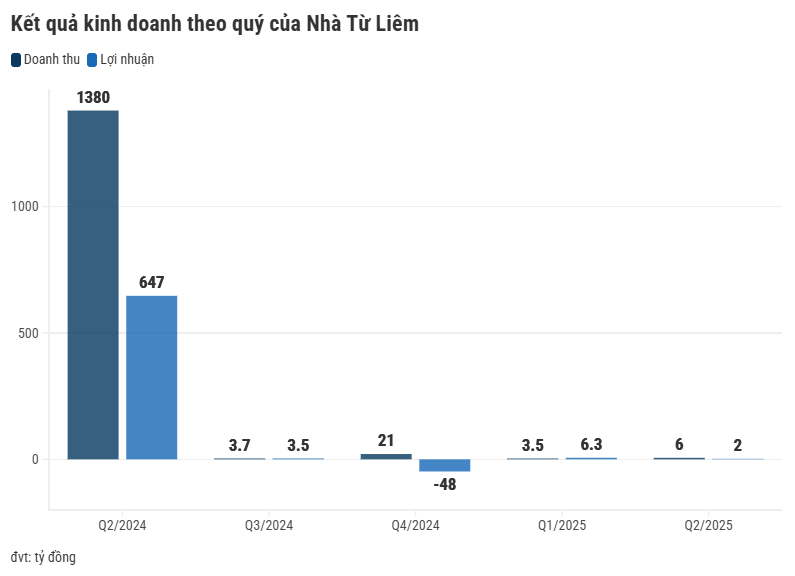

Urban Development JSC of Tu Liem has released disappointing Q2 2025 financial results. Revenue reached just over VND 6 billion, a significant 99.29% decrease from the previous year’s VND 1,380 billion. This decline is mainly due to the real estate sector’s negligible contribution of less than VND 3 billion.

As revenue failed to offset cost of goods sold, the company recorded a gross loss of VND 4.5 billion in Q2 2025, a stark contrast to the nearly VND 846 billion profit in the same period last year. However, thanks to a near 2.6-fold increase in financial revenue, primarily from interest income and securities investments, along with a 41% reduction in financial, sales, and management expenses (totaling VND 10 billion), the company avoided losses and posted a net profit of nearly VND 2 billion, albeit a 99.7% decrease.

According to explanations, real estate projects during this period are still in the process of finalizing legal procedures and, therefore, unable to recognize revenue. As a result, all revenue for this quarter came from financial activities.

For 2025, NTL sets a cautious target with a total revenue of VND 80 billion, a 95% decrease from 2024, and a net profit of only VND 24 billion, a 96% drop. With this plan, the company has achieved 54% and 35% in the first six months.

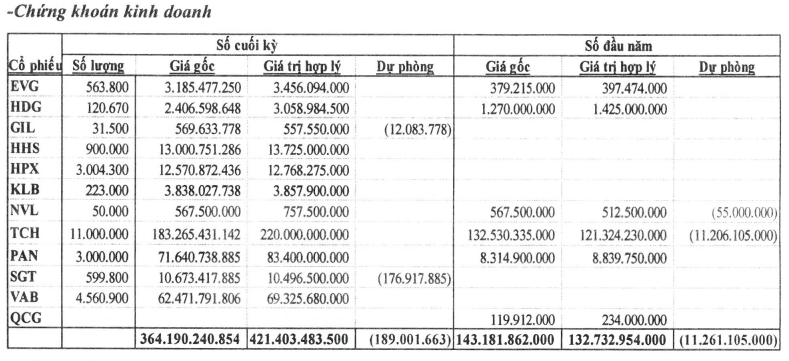

Trading securities portfolio rescues Nhà Từ Liêm’s profits

As of the end of June, NTL’s total assets were nearly VND 1,958 billion, a 10% decrease from the beginning of the year. This includes cash and cash equivalents of nearly VND 600 billion, a 4% increase. Short-term financial investments decreased by 29% to VND 644 billion; within this, trading securities accounted for over VND 364 billion, 2.5 times higher than the beginning of the year and comprising nearly 20% of total assets. Inventories stood at nearly VND 519 billion, a 4% increase, with the majority tied up in the Dich Vong project, amounting to over VND 484 billion.

Notably, payables decreased by 44% to nearly VND 235 billion due to the settlement of tax and fee obligations to the state, reducing them from over VND 195 billion to just over VND 3 billion. Furthermore, the company did not record any financial borrowings.

Profiting from the Rise in Oil Prices: PV OIL’s Quarterly Earnings Double

“PV OIL (UPCoM: OIL) witnessed a positive trend in the second quarter of 2025 with domestic base prices on an upward trajectory, a stark contrast to the downward trend experienced in the same quarter of 2024. This shift has resulted in a significant boost to the company’s financial performance for the current quarter compared to the previous year.”

“Cen Land Reports Significant Growth in Second Quarter After-Tax Profit”

Century Real Estate Joint Stock Company (Cen Land, HOSE: CRE) has unveiled impressive business results for the second quarter and the first half of 2025, showcasing a remarkable surge in post-tax profits.

“Saigonbank Reports a 22% Drop in Pre-Tax Profits: A Significant Rise in Provision Costs”

“Saigonbank’s latest quarterly report reveals a pre-tax profit of over VND 76 billion in Q2 of 2025, marking a 22% dip compared to the previous year’s figures. This decrease is attributed to a significant 79% surge in credit risk provisions, highlighting the bank’s cautious approach amidst economic uncertainties.”

KienlongBank Announces Q2 2025 Financial Results: Multiple Business Indicators Achieve Over 90% of Targets

KienlongBank (UPCoM: KLB) has announced its Q2 2025 financial results, boasting impressive performance. The bank’s consolidated pre-tax profit reached VND 565 billion, with key business indicators such as total assets, mobilized capital, and credit outstanding achieving over 90% of the year’s set plan.

“Digital Transformation Pays Off: HDBank Records Impressive 6-Month Profit of VND 10,068 Billion, with ROE Climbing to 26.5%”

“HDBank (HOSE: HDB) has announced its Q2 and H1 2025 financial results, boasting impressive profits exceeding VND 10,068 billion, a remarkable 23% increase compared to the same period last year. The bank continues to lead the industry with top-tier performance and operational efficiency, solidifying its position as a powerhouse in the Vietnamese banking sector.”