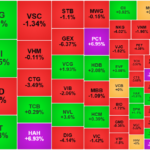

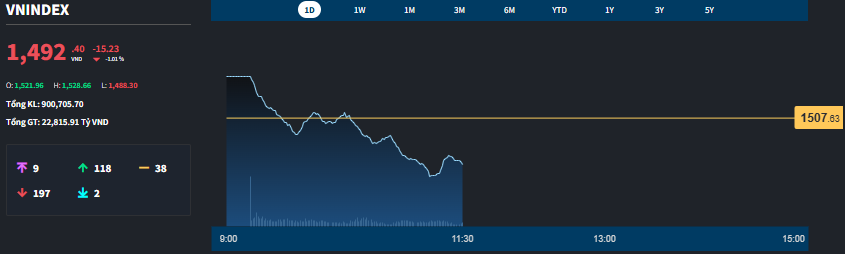

Market liquidity this morning remained high, with HoSE matching a slight increase of nearly 3%, but the trend reversed from yesterday morning. The stock plunge indicates a return of selling pressure, especially as foreign investors also sold a net of VND 1,372 billion, of which HoSE accounted for more than VND 1,200 billion.

The VN-Index opened the session with a gain of over 14.7 points (+0.98%) but subsequently declined continuously. The index closed 15.23 points (-1.01%) lower, a significant range but in a negative direction, at 1,492.4 points. HoSE’s breadth initially looked positive with 194 gainers and 36 losers, but it has since narrowed to 118 gainers and 197 losers. The 3% increase in liquidity compared to yesterday morning suggests that selling pressure is building.

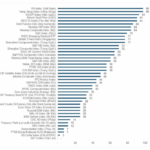

Large-cap stocks failed to support the index. The 10 stocks that dragged the VN-Index down the most (12.5 points out of the total 15.23 points) were all from the VN30 basket. The two worst performers were VHM, down 3.17%, and VIC, down 2.47%, which together lost 5.1 points. Additionally, TCB fell by 1.88%, CTG by 1.84%, BID by 1.31%, HPG by 1.97%, MBB by 1.28%, and VCB by 0.82%, all of which are among the top 10 capitalized stocks on the exchange.

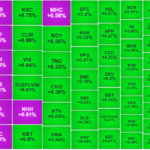

The VN30-Index ended the morning session down 1.49% with 10 gainers and 20 losers. The green codes were dominated by medium-capitalized stocks, with VPB’s 2.18% gain being the only large-cap stock. SHB officially hit a new all-time high this morning, rising 4.97%, but the highest price was reached at the start of the session, up 6.83%. In other words, this stock has also been under selling pressure, with the highest liquidity in the market at VND 1,660.2 billion. SSB rose 3.38%, GVR 2.54%, BCM 1.3%, and STB 1.1%, the strongest blue-chip stocks, faced similar pressure. These stocks have limited capitalization, so they didn’t significantly impact the VN-Index, and they couldn’t even offset VIC’s loss.

The data shows a clear pattern of price suppression in the VN30 group, with some stocks like HDB falling as much as 5.97% in the morning session, VJC sliding 4.39%, and CTG dropping 4.53%. BID, FPT, GAS, GVR, HPG, MBB, MWG, PLX, SSI, and LPB also declined by 2% to 3%. VN30 liquidity increased by 15% compared to yesterday morning, indicating increased selling pressure.

HoSE currently has 197 stocks in the red, with 131 falling by 1% or more. Most of these stocks have been gradually pushed down, and the decline has intensified towards the end of the session. This group accounts for approximately 55% of the total matched orders on the exchange. Many stocks with liquidity in the hundreds of billions of VND fell by more than 3%, including CII down 4.15%, DIG down 3.85%, HDG down 4.1%, MSB down 3.57%, EVF down 3.37%, and EIB down 3.01%…

Among the stocks bucking the trend, several stood out with impressive trading volumes. In addition to SHB and VPB, notable mentions include VIX up 1.37% with a liquidity of VND 692.8 billion, KBC up 6.41% with VND 535.2 billion, HHS up 5.21% with VND 439.8 billion, DXG up 1.04% with VND 354.9 billion, VSC up 2.25% with VND 343 billion, PC1 up 6.8% with VND 289.8 billion, and HAG up 1.47% with VND 112.3 billion. These stocks are also under selling pressure – except for PC1, which is at its ceiling price – but the buying support is strong enough to maintain their high levels.

Foreign investors surprised the market this morning by net selling over VND 1,200 billion on the HoSE after net buying nearly VND 1,057 billion in the previous morning session. The stocks that were heavily net sold include CTG (-VND 231.6 billion), FPT (-VND 140.8 billion), HPG (-VND 127.5 billion), KBC (-VND 91.7 billion), MWG (-77.7 billion), GEX (-VND 72.5 billion), and SHB (-VND 72.1 billion). On the buying side, VIC (+VND 91.2 billion) and HAH (+VND 42.7 billion) stood out.

Today’s decline indicates that many stocks formed a “bull trap” during yesterday’s recovery. Of course, the market still has the opportunity to turn the tables in the afternoon if capital inflows are strong and enthusiastic enough to push prices up.

Is the VN-Index Facing Major Adjustment Pressures?

From a technical standpoint, the near 490-point rally is likely over after an enormous volume surge failed to push prices higher, accompanied by volatile price action. This is a tell-tale sign of distribution in the market.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.

Stock Market Blog: Bide Your Time

The market witnessed bottom-fishing funds below the 1500-point mark of VNI, marking the third session hovering around this level, albeit with waning momentum. The ability to sustain this level remains uncertain, and liquidity signals are weakening.