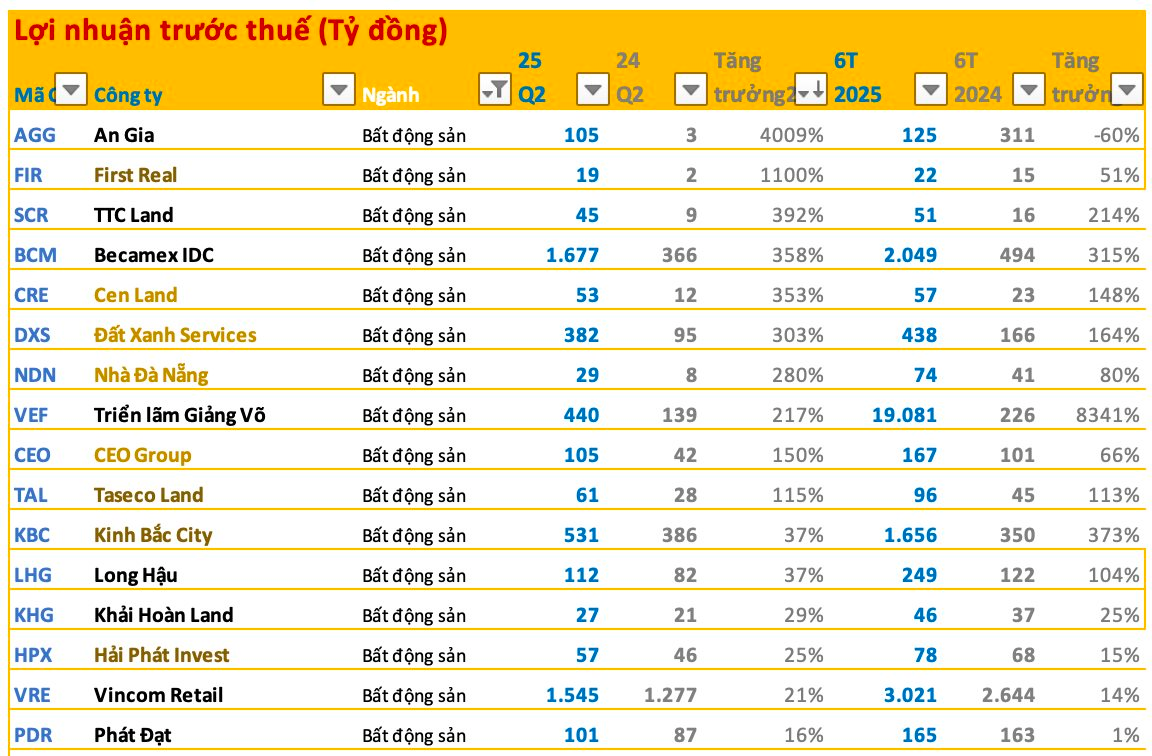

As of now, most listed real estate businesses have published their Q2 2025 financial statements. Notably, profit growth dominates, with the top-performing companies mainly attributing their success to their core operations.

On the other hand, a few businesses are still in the process of restructuring and reporting losses, notably Novaland (NVL) and LDG Joint Stock Company (LDG)…

This quarter’s standout performer is An Gia Investment and Real Estate Development Joint Stock Company (AGG). In Q2 2025, the company recorded net revenue of 194 billion VND, a 15% increase compared to the same period last year. In terms of structure, revenue from the sale and long-term lease of apartments accounted for nearly 75% of total revenue, reaching 145 billion VND. This was followed by revenue from consulting services, which contributed 23% or 45 billion VND, a fifteenfold increase compared to the previous year, and other services, which made up the remaining 2% with 3.3 billion VND.

After deducting expenses incurred during the period, An Gia earned 105 billion VND in pre-tax profits, a 4,009% increase, and 82 billion VND in after-tax profits, a significant surge compared to the 1.6 billion VND recorded in Q2 2024.

For the first six months of the year, An Gia reported net revenue of 386 billion VND and after-tax profits of 90 billion VND, a 58% decrease.

Another company that experienced massive growth is First Real Estate Joint Stock Company (FIR). In the third quarter of the fiscal year 2025, the company’s net revenue surpassed 43 billion VND, a 205% increase, and its pre-tax profits reached nearly 19 billion VND, a staggering 1,100% surge compared to the same period last year.

For the nine-month period from 1/10/2024 to 30/6/2025, FIR achieved pre-tax profits of 22 billion VND, a nearly 51% increase compared to the previous year. This growth is attributed to the significant recovery of the real estate market, especially in the Central region, where FIR has a competitive advantage in terms of land funds and project implementation capabilities.

TTC Land (SCR) ranked third in terms of growth, with revenue in the last quarter reaching 409 billion VND, 5.4 times higher than the same period last year. After expenses, the company’s pre-tax profit was 45 billion VND, a 392% increase compared to Q2 2024.

In the first six months of the year, TTC Land’s revenue reached 519 billion VND, 3.6 times higher, and its pre-tax profit exceeded 51 billion VND, a 214% increase.

It is worth mentioning that, in addition to improved sales revenue, financial revenue significantly contributed to TTC Land’s business results, with 168 billion VND. This primarily consists of interest income from lending activities and investment profits. As of the end of Q2 2025, the company had over 500 billion VND in bank deposits, over 1,700 billion VND in loans to related parties, and over 900 billion VND invested in capital contributions to other entities.

These positive results are set against a backdrop of a gradually recovering market. Many large-scale projects are preparing to restart, and supply levels are beginning to increase again in both the North and the South, especially in the two major cities of Hanoi and Ho Chi Minh City.

Market Recovery and Expected Supply Increase

In a recently published market report, JLL forecasts that Ho Chi Minh City’s market will welcome approximately 5,000-5,500 new high-end apartments and 1,300 new landed properties in 2025. According to JLL, infrastructure projects such as the expanded Terminal 3, An Phu intersection, and Ring Road 3 are expected to boost the market this year. Additionally, the resolution of legal issues for key projects by the Ho Chi Minh City People’s Committee is anticipated to improve market conditions in the upcoming quarters of 2025.

However, JLL also notes that in the context of Vietnam’s ongoing restructuring of local administrative boundaries, investors and homebuyers in Ho Chi Minh City are likely to adopt a temporary cautious approach, awaiting greater certainty in policies related to land management, planning, and public investment in the coming period before making investment decisions. Meanwhile, satellite localities such as Binh Duong and Ba Ria-Vung Tau are expected to gain increased attention, with expectations of significant infrastructure and public utility investments to foster regional economic development following their integration with Ho Chi Minh City.

Regarding the Hanoi market, JLL emphasizes that the high-end apartment segment will become even more vibrant over the next 12 months, with a diverse range of projects under marketing, such as Sun Flezia Suites (by Sun Group), Westlake Residential (by Vinaenco), and The Jade Square (by Vimedimex). The scarcity of integrated utility projects and the overall market’s upward price trend further contribute to the premium pricing of these new offerings.

Consequently, competition within this segment has intensified, and at these price points, demand will predominantly come from genuine homebuyers rather than investors as seen in the 2023-2024 period.

Significant Losses for Some Due to Cost Burdens

On the other hand, Novaland continues to incur substantial losses due to cost pressures. According to the Q2 2025 consolidated financial statements, Novaland generated revenue of over 1,936 billion VND, a 22% increase compared to the same period. However, after expenses, the company reported a net loss of nearly 190 billion VND.

For the first six months of the year, Novaland’s net revenue from deliveries at large-scale projects such as NovaWorld Phan Thiet, Ho Tram, Aqua City, Sunrise Riverside, and Palm City, among others, reached nearly 3,423 billion VND. Service revenue added another 291 billion VND, bringing the total consolidated revenue to over 3,715 billion VND.

Nevertheless, the company recorded an after-tax loss of 666 billion VND, mainly due to foreign exchange losses and other expenses. This loss is significantly lower than the figure of over 7,300 billion VND in the same period last year.

Similarly, LDG Joint Stock Company reported a net loss of over 66 billion VND in Q2, despite a 118% surge in net revenue. For the first half of the year, the company’s net loss was nearly 54 billion VND. LDG has been in the spotlight recently as its former chairman, Mr. Nguyen Khanh Hung, resumed his leadership role after his release from prison, vowing to steer the company’s development in a new direction.

In 2025, LDG set ambitious plans, targeting revenue of over 1,800 billion VND, nearly ten times higher than last year, and an after-tax profit of 92 billion VND. The company is currently developing nine projects, five of which are large-scale: LDG Grand Da Nang, LDG Sky, and West/High Intela. These projects are expected to be transferred or divested.

The Looming Maturity Pressure on Real Estate Bonds in August Intensifies: Marking the Market’s Most Strained Period

“August sees a significant spike in the maturity value of non-bank group bonds, with an estimated face value of VND 27.4 trillion, a substantial 51.7% increase from the previous month’s value of VND 18.1 trillion. This surge in maturity value makes August the peak month for bond repayments in 2025.”

Dot Property Awards 2025: Celebrating Vietnam’s Real Estate Trailblazers

On July 31st, the Dot Property Vietnam Awards 2025 announcement ceremony took place at the prestigious The Reverie Saigon hotel. The event attracted over 200 guests, including prominent figures from the real estate industry, sector experts, award council advisors, and representatives from various media outlets.

The Future of Urbanization: E.City Tan Duc – A Strategic Leap Forward

On July 21, 2025, a strategic partnership was forged between the E.City Tan Duc project and reputable distribution companies. This momentous occasion took place at the Tan Tao Group’s office in Ho Chi Minh City, marking a pivotal step in the group’s real estate market expansion strategy and its journey towards realizing its vision of sustainable urban development.

Real Estate Legal Landscape Brightens, Project M&A Gains Traction

The first half of 2025 saw a cautious pace in the real estate market as Vietnam navigated the recent merger of localities and adapted to new regulations from three related laws that came into force. However, in recent times, project legality has been gradually improving and becoming a core pricing criterion driving mergers and acquisitions.