“Many Banks Offer Lower Home Loan Interest Rates”

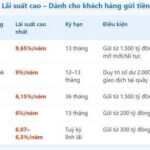

On July 28, VPBank announced new benefits for people aged 18 to 35 taking out a mortgage. The bank is offering a fixed interest rate of 6.1%/year for the first 12 months, instead of just three months as before. In addition, borrowers are offered a 24-month grace period on principal payments, with a loan term of up to 35 years and a maximum disbursement limit of 80% of the property value. The program is applicable in Hanoi, Danang, and Ho Chi Minh City.

On the same day, Vietcombank also announced a reduction in mortgage interest rates for borrowers under 35. Quoc Ngoc, a resident of Ho Chi Minh City, shared that he had just taken out a VND 1.5 billion loan from Vietcombank with a fixed interest rate of 5.5%/year for the first three years, followed by a floating rate of 9%/year. Now, the bank has further reduced the rate by 0.3 percentage points to 5.2%/year. According to Ngoc, this is a practical policy that helps young people access capital to buy a home more easily.

According to records, many other commercial banks, such as Agribank, BIDV, SHB, ACB, and Sacombank, have also launched promotional home loan packages for young people, as credit growth in this segment has been strong recently.

Many commercial banks are offering promotional home loan packages for young borrowers

|

A representative from Shinhan Bank Vietnam shared that in just over two months, the bank has disbursed nearly VND 90 billion to about 50 borrowers under 35 years old. The fixed interest rate ranges from 4.5%/year for the first six months or 6.9%/year fixed for 36 months, with an additional discount of 0.3 percentage points for young borrowers.

Why are home loan interest rates falling?

According to data from the State Bank of Vietnam, the average lending rate is currently at 6.23%/year, down 0.7 percentage points from the end of last year. Notably, from July 1 to the end of 2025, the lending rate for people under 35 years old buying social housing has been adjusted to 5.9%/year, 0.2 percentage points lower than the previous period.

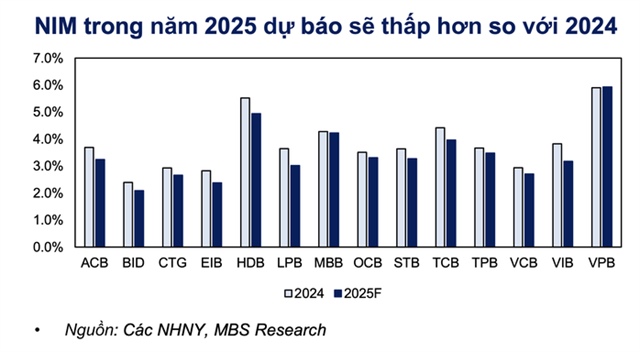

Interestingly, the trend of declining lending rates is occurring alongside a slight increase in deposit rates for short-term deposits since the beginning of July.

According to Mr. Nguyen The Minh, Director of Personal Analysis at Yuanta Vietnam Securities Company, the increase in deposit rates reflects the rising demand for credit. However, lending rates will remain low to support economic growth in line with the government’s direction.

Increasing deposit rates and decreasing lending rates are expected to compress banks’ net interest margins (NIM) this year. |

Thai Phuong, Photo: Lam Giang

– 4:45 PM, July 28, 2025

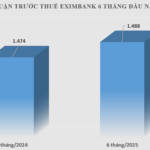

“Forex Trading Success: Eximbank’s Profits Soar to $1.488 Billion in H1 2025”

In the first half of 2025, Eximbank’s foreign exchange business soared, with an impressive net interest income of VND 364 billion, a 76% surge compared to the same period last year. The bank’s international payments business thrived, with a remarkable transaction volume of USD 3.9 billion.

Unlocking Financial Growth: BVBank’s Stellar Performance in H1

A small tweak to capture attention and showcase the impressive growth of BVBank.

(Ho Chi Minh City) – BVBank concludes the first half of 2025 on a high note, boasting impressive growth across key metrics. This testament to their successful strategy underscores the importance of a customer-centric, digital approach to retail banking, offering personalized experiences.

Real Estate Legal Landscape Brightens, Project M&A Gains Traction

The first half of 2025 saw a cautious pace in the real estate market as Vietnam navigated the recent merger of localities and adapted to new regulations from three related laws that came into force. However, in recent times, project legality has been gradually improving and becoming a core pricing criterion driving mergers and acquisitions.