I. MARKET ANALYSIS OF STOCKS ON JULY 28, 2025

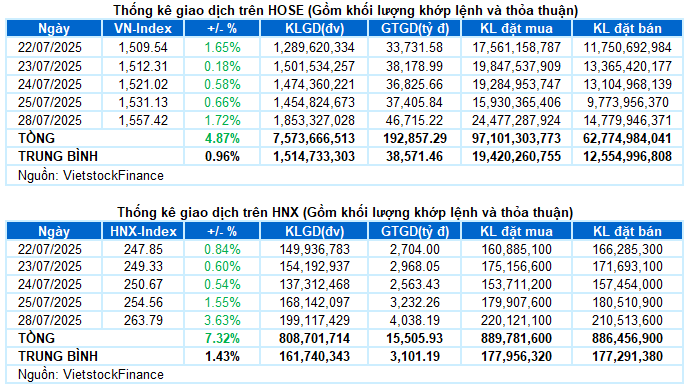

– The main indices simultaneously surged in the trading session on July 28. Specifically, VN-Index increased by 1.72% compared to the previous session, reaching 1,557.42 points; HNX-Index also rose sharply by 3.63%, ending the session at 263.79 points.

– Matching volume on the HOSE increased by 27.2%, exceeding 1.7 billion units. The HNX floor also recorded 194 million units, up 18.6% from the previous session.

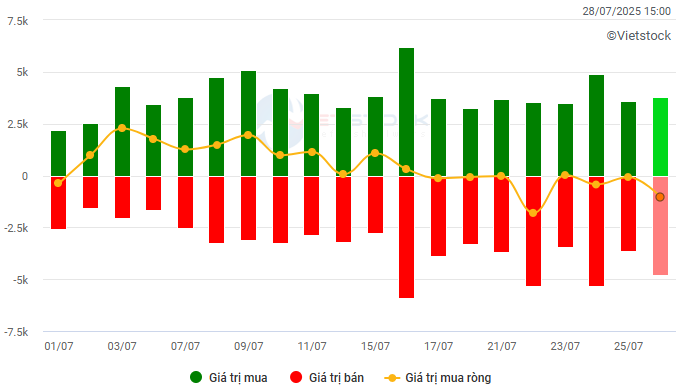

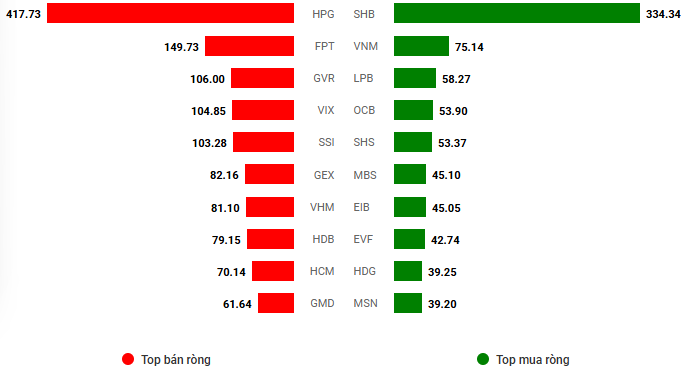

– Foreigners continued to sell a net of VND 1 trillion on the HOSE and bought a net of more than VND 107 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The stock market started the new trading week in positive territory. VN-Index surged from the beginning of the session and quickly expanded its gains thanks to strong demand in many sectors, especially banking and securities. In the afternoon session, buying pressure continued, while sellers did not cause significant pressure. At the end of the trading day, VN-Index rose sharply by 26.29 points (+1.72%), closing at 1,557.42 points.

– In terms of impact, VPB was the most positive contributor, bringing nearly 2 points to the VN-Index. This was followed by VHM, VCB, and VIC, which added a total of 4.7 points to the index. Meanwhile, there were no notable names on the opposite side. The total impact of the 10 most negative stocks was not enough to take away half a point from the index, indicating the dominance of buyers.

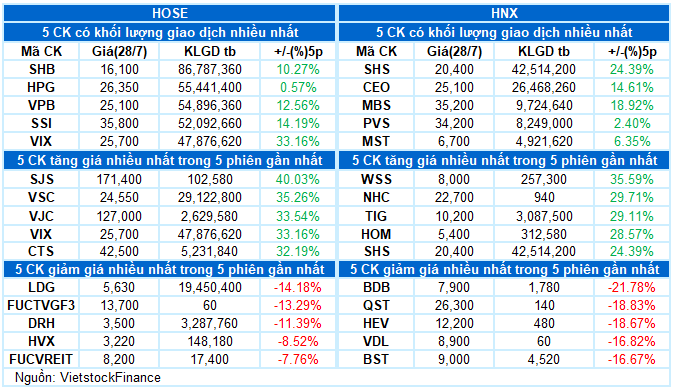

– VN30-Index broke through with a 26-point gain, reaching 1,695.63 points. The breadth of the basket tilted towards buyers with 26 gainers, 3 losers, and 1 unchanged stock. In addition to SHB leading the table with a ceiling price increase, TPB and SSI also recorded outstanding gains of over 5%. On the opposite side, the red-coded stocks all adjusted slightly with a decrease of less than 1%.

Green dominated most industry groups. The financial group became the main driver of the market as it witnessed a strong breakthrough from banking and securities stocks. A series of stocks turned purple, such as SHB, VIX, VND, SHS, MBS, OCB, ORS, VAB, AGR, SBS, APS, VIG, PSI, and DSC, along with several other stocks that increased by more than 5%, including SSI, HCM, TPB, EIB, and FTS.

This was followed by the industrial and real estate groups, which also rose by more than 1% with many notable names, including GEX, VSC, VGC, CII, and IPA, which hit the ceiling price, ACV (+1.23%), VJC (+4.18%), VEA (+1.05%), GEE (+4.47%), VCG (+2.53%); VIC (+1.31%), VHM (+2.03%), NVL (+2.34%), KDH (+2.09%), KBC (+2.57%), and PDR, SJS, CEO, and DIG, which also hit the ceiling price.

In contrast, the energy group was at the bottom with a decrease of 0.12% as selling pressure dominated the large-cap stocks in the industry, such as PLX (-0.66%), PVS (-0.29%), OIL (-0.83%), and PVT (-0.27%).

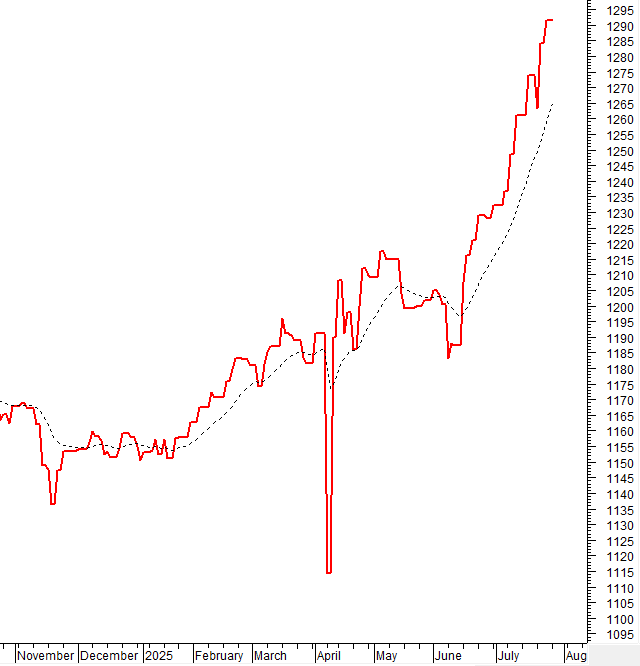

VN-Index continued to thrive in the trading session commemorating the 25th anniversary of the establishment of the Vietnamese stock market. Trading volume remained high above the 20-session average, indicating strong momentum despite the impressive recent gains. With the MACD indicator continuing to widen the gap with the Signal line after giving a buy signal in mid-June 2025, the VN-Index is likely to further expand its upward momentum with a strong support zone around the 1,500-point threshold.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Liquidity shows no signs of cooling down

VN-Index continued to break strongly with the 5th consecutive gaining session. Trading volume remained high above the 20-session average, indicating strong momentum despite the impressive recent gains.

With the MACD indicator continuing to widen the gap with the Signal line after giving a buy signal in mid-June 2025, the VN-Index is likely to further expand its upward momentum with a strong support zone around the 1,500-point threshold.

HNX-Index – A candle pattern similar to White Marubozu appears

HNX-Index surged impressively with the appearance of a candle pattern similar to White Marubozu, simultaneously surpassing the old peak of September 2023 (corresponding to 252-260 points).

Currently, the MACD and Stochastic Oscillator indicators continue to rise after giving buy signals, indicating that the short-term upward momentum of the index is likely to continue in the next sessions.

Analysis of Money Flow

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index is above the EMA 20 days. If this state continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Fluctuation of foreign capital flow: Foreigners continued to sell a net in the trading session on July 28, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON JULY 28, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:32 28/07/2025

Stock Market Insights: Has the Tide Turned?

The VN-Index retreated, forming a Bearish Engulfing candlestick pattern as it encountered resistance at the psychological level of 1,500 points. This retreat indicates significant profit-taking pressure. Additionally, the Stochastic Oscillator has provided a sell signal within the overbought territory. Investors should exercise caution in the near term as a fall below this level could trigger increased short-term corrective pressure.

Market Beat: VN-Index Soars Over 26 Points, Setting a New Record High

The trading session concluded with significant gains, as the VN-Index surged by 26.29 points (+1.72%), closing at 1,557.42. Simultaneously, the HNX-Index displayed robust performance, climbing 9.23 points (+3.63%) to finish at 263.79. The market breadth was overwhelmingly positive, with 537 advancing stocks versus 247 declining ones. This bullish sentiment was echoed in the VN30 basket, where 26 constituents rose, 3 fell, and 1 remained unchanged, painting a predominantly green picture for the day’s trading activities.

Market Pulse for July 21: Foreign Investors Turn Net Buyers, VN-Index Hovers Near 1,500 Points

The market closed with the VN-Index down 12.23 points (-0.82%), settling at 1,485.05. The HNX-Index also witnessed a decline of 1.98 points (-0.8%), ending the day at 245.79. The market breadth inclined towards the bears with 435 declining stocks against 331 advancing stocks. Within the VN30 basket, 17 stocks lost ground, 12 advanced, and 1 remained unchanged, reflecting a similar bearish sentiment.

Vietstock Daily: Embracing Challenges, August 1st, 2025

The VN-Index retreated after a volatile session, relinquishing early gains. Despite this pullback, the index remains above the middle Bollinger Band, a critical support level to sustain its upward trajectory. Meanwhile, the Stochastic Oscillator has begun to descend from overbought territory, indicating that the short-term outlook may encounter challenges ahead.

Market Beat: VN-Index Makes a Dramatic U-Turn, Soaring Nearly 9 Points at the Close

The market opened the afternoon session on a shaky note, with the index dropping more than 9 points at one point and flirting with the 1,500-point threshold. However, the latter half of the afternoon painted a different picture, as the index staged a steady recovery, erasing the losses from earlier in the day.