I. MARKET ANALYSIS OF STOCKS ON JULY 29, 2025

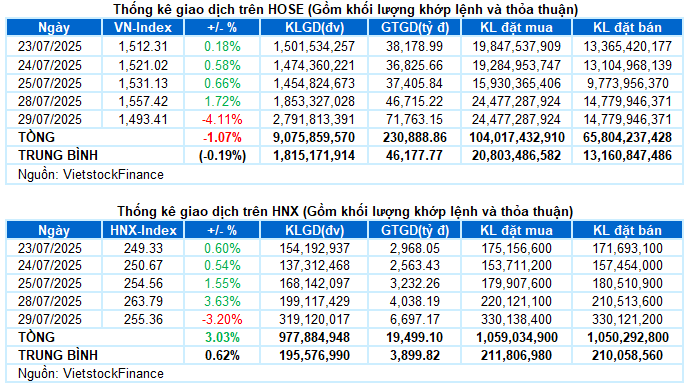

– The main indices unexpectedly plummeted during the trading session on July 29. Specifically, VN-Index evaporated by 4.11%, falling to 1,493.41 points; HNX-Index dropped to 255.36 points, a decrease of 3.2%.

– The panic selling triggered a surge in liquidity. The matched volume on the HOSE increased by 55.3%, reaching over 2.7 billion units. The HNX also recorded 315 million units, a significant 62.4% jump compared to the previous session.

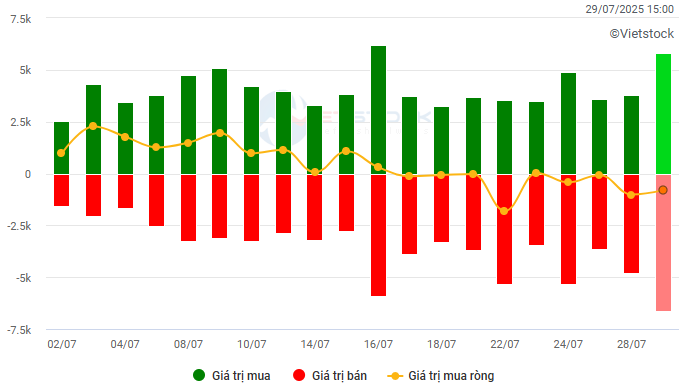

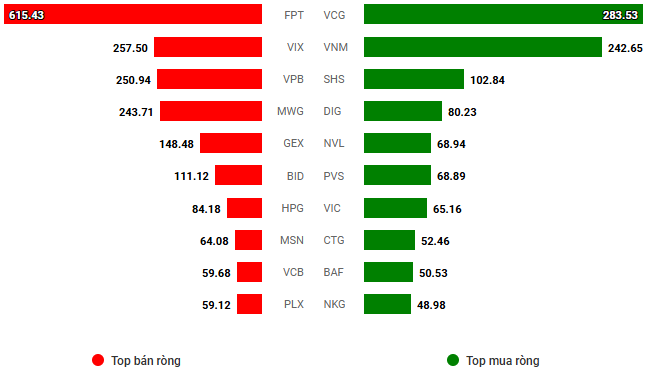

– Foreign investors net sold over VND 944 billion on the HOSE and net bought VND 259 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

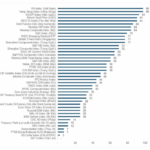

Net trading value by stock code. Unit: VND billion

– The trading session on July 29 opened with a pessimistic sentiment as selling pressure dominated from the early minutes. The index quickly lost the 1,550-point mark due to strong selling in pillar stocks, especially in the financial and real estate sectors. The mid-morning recovery efforts were feeble as selling pressure persisted, plunging the market into a sea of red. The downward trend continued in the afternoon session, with widespread selling causing the VN-Index to breach the crucial psychological support of 1,500 points. At the close, the VN-Index tumbled by more than 64 points to 1,493.41 points.

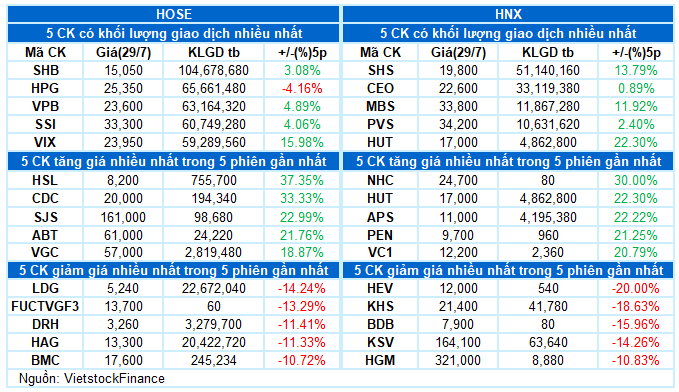

– In terms of impact, the top 10 negative-performing stocks wiped out a total of over 26 VN-Index points, with the most significant pressure coming from VCB, VHM, and BID. Meanwhile, the contribution of the 10 most positive stocks was not enough to lift the VN-Index by even half a point, demonstrating the absolute dominance of sellers.

– VN30-Index lost 74.34 points (-4.38%), settling at 1,621.29 points. All 30 stocks in the basket declined, with 4 stocks hitting the floor price: MSN, SSI, TPB, and HDB. VNM was a rare gainer, edging down by just 0.2%.

Unsurprisingly, all sectors were painted in red, with the energy sector losing the least at 1.22%. The media and communications services sector plunged by 5.55%, as large-cap stocks in the industry witnessed significant declines: VGI (-6.51%), FOX (-3.12%), CTR (-4.62%), and YEG hitting the floor price.

High-cap sectors, including finance, real estate, and industry, exerted substantial pressure on the overall index as they nosedived by over 3.5%. The majority of stocks plunged into a sea of red, and numerous tickers even faced a buying drought: SSI, VIX, VND, VCI, HCM, TPB, HDB, EIB; NVL, TCH, NLG, DXG, PDR; GEX, VSC, CII, PC1, to name a few.

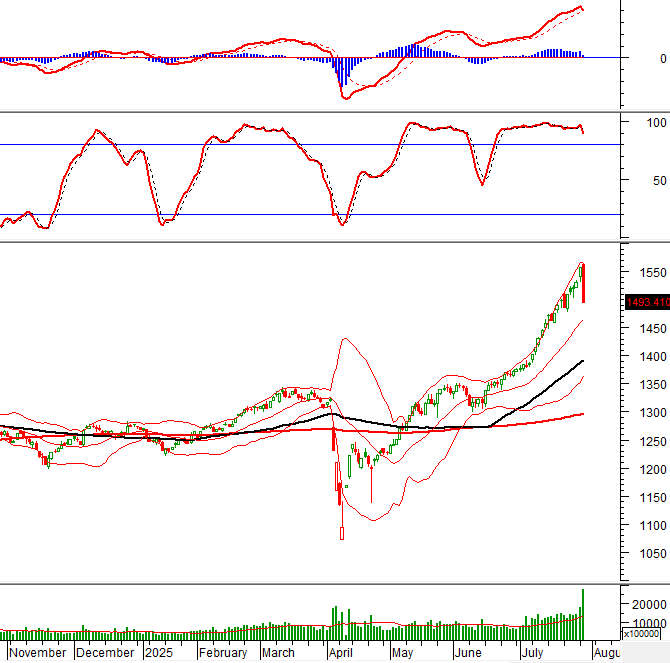

The VN-Index plummeted by more than 64 points, accompanied by the emergence of a Black Marubozu candlestick pattern. The trading volume skyrocketed to a record high, and the number of declining stocks overwhelmingly surpassed that of advancing ones, vividly illustrating the pervasive panic and selling pressure across the market. At present, the Stochastic Oscillator indicator has signaled a sell-off within the overbought zone. Meanwhile, the MACD indicator is narrowing its gap with the Signal line, and the outlook will turn even more pessimistic if a sell signal is confirmed in the upcoming sessions.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Black Marubozu Candlestick Pattern Emerges

The VN-Index plummeted by over 64 points, accompanied by the emergence of a Black Marubozu candlestick pattern. The trading volume skyrocketed to a record high, and the overwhelming number of declining stocks vividly illustrated the pervasive panic and selling pressure across the market.

Presently, the Stochastic Oscillator indicator has signaled a sell-off within the overbought zone. Meanwhile, the MACD indicator is narrowing its gap with the Signal line, and the outlook will grow increasingly pessimistic if a sell signal is confirmed in subsequent sessions.

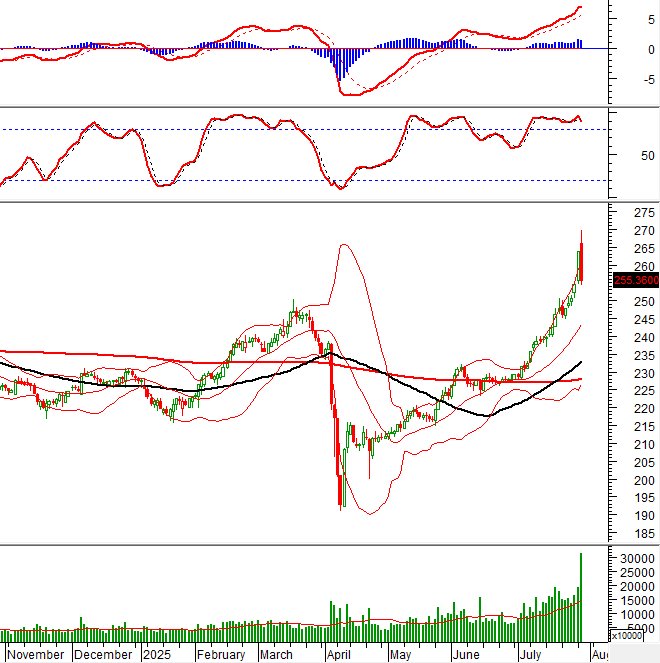

HNX-Index – Stochastic Oscillator Signals a Sell

The HNX-Index witnessed a sharp decline alongside a surge in trading volume, indicating widespread profit-taking. In the near term, the index needs to hold above the previous March 2025 high of 245-250 points to maintain its upward trajectory.

The Stochastic Oscillator indicator has signaled a sell-off within the overbought zone. Investors should be cautious if the indicator falls out of this region in the coming period.

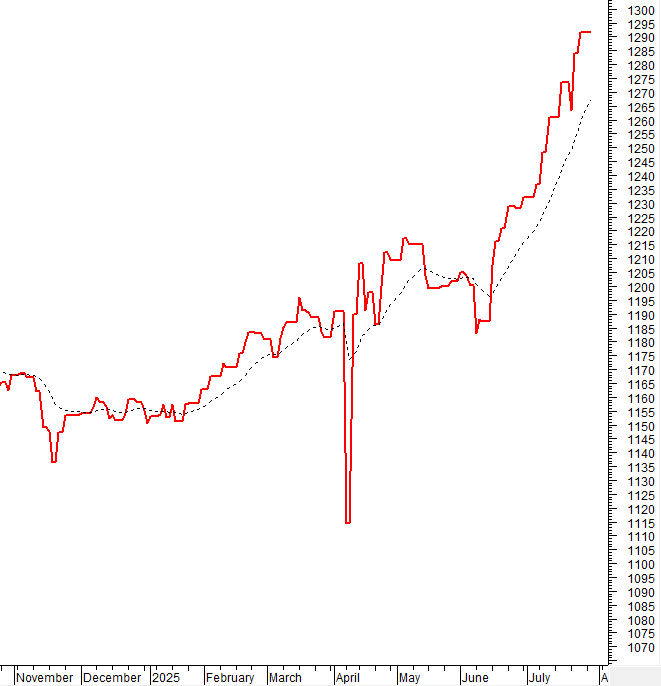

Analysis of Money Flow

Movement of Smart Money: The Negative Volume Index indicator of the VN-Index is currently above the 20-day EMA. If this status quo persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors continued to net sell in the July 29, 2025, trading session. If this trend persists in the upcoming sessions, the situation will become increasingly pessimistic.

III. MARKET STATISTICS ON JULY 29, 2025

Economic and Market Strategy Division, Vietstock Research

– 17:10 29/07/2025

Stock Market Week of July 21-25, 2025: Setting a New Historic High with a Six-Week Winning Streak

The VN-Index has been on a remarkable six-week streak of consecutive gains, accompanied by record-breaking liquidity. The persistent flow of funds and the unwavering confidence of investors have laid a solid foundation for the market’s upward trajectory. However, with the index reaching new historic highs, the recent selling spree by foreign investors and profit-taking at these elevated levels could trigger some technical fluctuations in the short term.

The Alluring Appeal of Bank Deposits: What’s Keeping Funds from Venturing Out?

Despite the low savings interest rates, banks continue to attract massive cash inflows. This phenomenon can be attributed to a combination of factors, including a cautious mindset, deep-rooted trust in the banking system, and traditional savings habits, which together create a strong pull for idle funds to remain within the confines of these financial institutions.

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

The Power of Differentiation: Small and Mid-Cap Stocks Make a Striking Comeback

While the blue-chip stocks dragged the broader index down, the mid and small-cap stocks surged. 21 stocks hit the roof, and nearly 100 others gained over 1%, an unusual phenomenon as the VN-Index dipped.