I. MARKET DEVELOPMENT OF WARRANTS

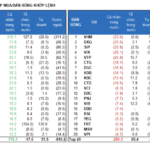

As of the trading session on July 21, 2025, the market closed with 95 advancing codes, 96 declining codes, and 32 reference codes.

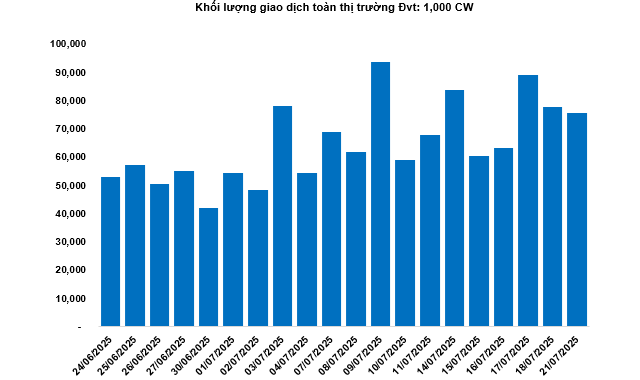

Market breadth in the last 20 sessions. Unit: Percentage

Source: VietstockFinance

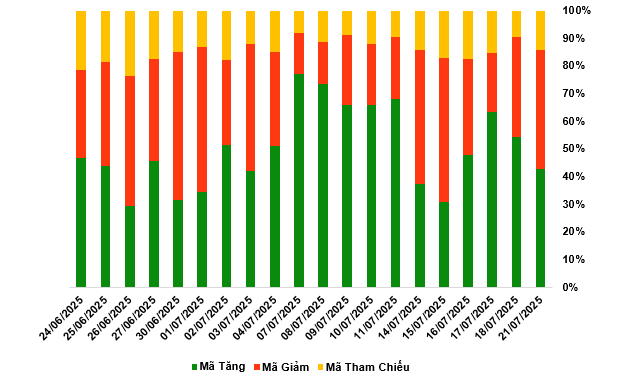

In the trading session on July 21, 2025, sellers regained control of the market, causing most of the warrant codes to decline. Specifically, the large cap warrants in the declining group were CVIC2406, CVHM2406, CSTB2515, and CVRE2505.

Source: VietstockFinance

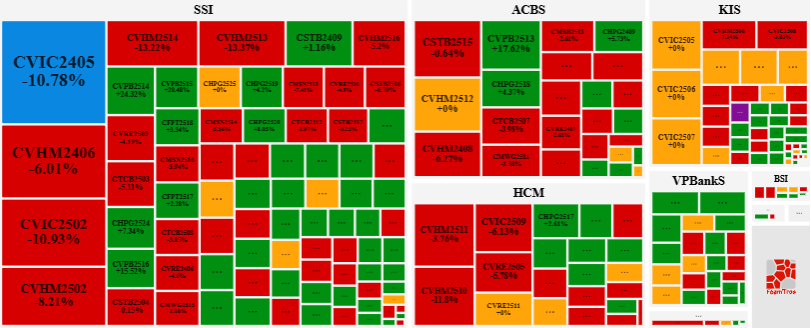

The total trading volume in the market in the July 21 session reached 75.8 million CWs, down 2.39%; the trading value reached VND 120.36 billion, down 4% compared to the July 18 session. Of which, CVPB2407 was the code with the highest volume in the market with 3.92 million CWs; CVHM2513 led in terms of trading value with VND 8.63 billion.

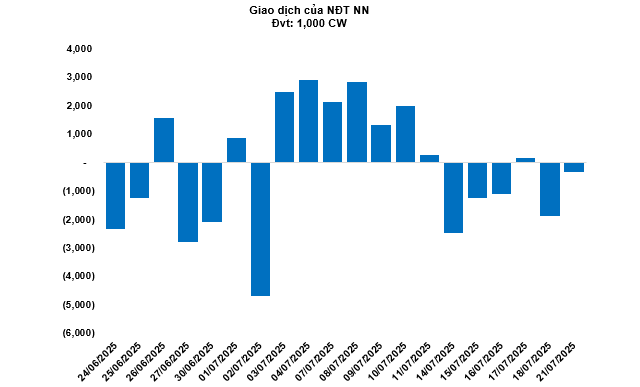

Foreign investors continued to be net sellers in the July 21 session with a total net selling volume of 320,000 CWs. In particular, CSSB2504 and CSHB2503 were the two codes that were net sold the most.

Securities companies SSI, ACBS, HCM, KIS, and VPBank currently are the warrant issuers with the most codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

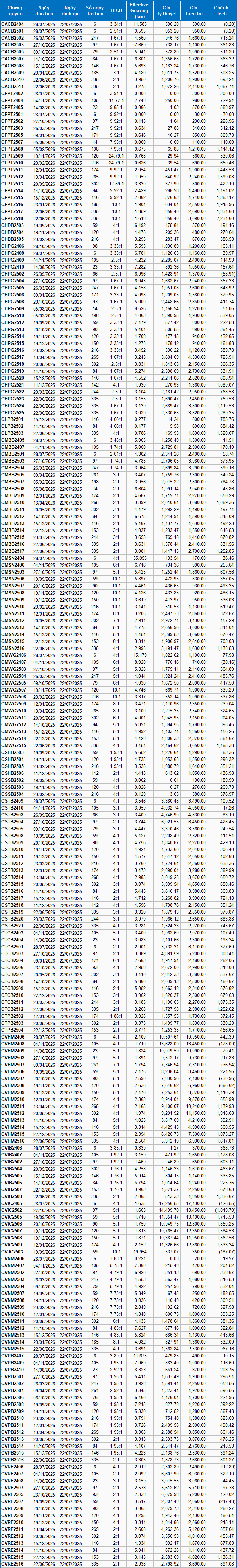

III. WARRANT VALUATION

Based on the valuation method suitable for the starting point of July 22, 2025, the reasonable prices of the warrants currently traded in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the interest rate on risk-free bills (government bills) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVIC2502 and CVHM2507 are currently the two warrant codes with the most attractive valuations.

Warrant codes with higher effective gearing will experience larger fluctuations in accordance with the underlying securities. Currently, CMSN2404 and CVJC2503 are the two warrant codes with the highest effective gearing in the market.

Vietstock Economics and Market Strategy Research Department, Consulting Division

– 18:58 21/07/2025

MBB Stock Surges Ahead of Dividend Payout

Military Commercial Joint Stock Bank (MB, HOSE: MBB) has announced that August 14th is the ex-dividend date for shareholders to receive a combination of stock and cash dividends for the fiscal year 2024. Ensure you are a shareholder by the end of the trading day on August 13th to be eligible for this dividend payment.

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the middle Bollinger Band. If the index manages to hold its ground above this level in upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.

Stock Market Blog: The Market is Accumulating Nicely

The market witnessed its second consecutive flat day following a robust surge on December 25th. The banking sector’s resilience helped anchor the index, while mid-cap and small-cap stocks experienced continued selling pressure. This shift in fund flow is likely to conclude by year-end, paving the way for fresh expectations in January 2025.