Services

Vietnam Commercial Joint Stock Bank (BVBank, stock code: BVB) has announced its Q2 2025 financial statements and business results for the first half of the year. Adhering to the direction of maintaining competitive interest rates to expand the customer base and investing in technology infrastructure development, BVBank achieved good growth in total assets and customer loan balances.

|

Credit growth reached nearly 14%, with loan balances increasing by 8% and total assets growing by 12%

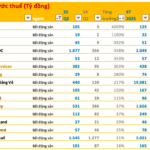

According to BVBank’s H1 2025 business results, total assets reached VND 115,500 billion, up nearly 12% from the beginning of the year. With this result, BVBank has achieved 95% of the plan for the year set by the Annual General Meeting of Shareholders. This result also reflects the effectiveness of the strategy to expand the scale, with the momentum coming from the retail and digitization strategy as the growth pillar.

Total credit balances reached VND 93,400 billion, up 29% over the same period in 2024 and nearly 14% compared to the beginning of the year. Of this, customer loan balances exceeded VND 73,400 billion, an increase of nearly 8% from the beginning of the year, with a focus on the individual and SME segments – two key customer groups in BVBank’s growth strategy.

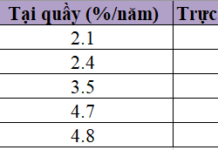

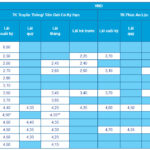

In terms of capital mobilization, BVBank recorded a scale of nearly VND 106,400 billion, up 28% over the same period and nearly 12% compared to the beginning of the year. Notably, nearly 80% of the capital came from individual and institutional customers (reaching more than VND 81,400 billion, up nearly 9% from the beginning of the year), indicating a significant improvement in BVBank’s brand reputation and the ability to attract long-term retail capital – an important foundation for liquidity safety and credit growth.

In the first six months of 2025, BVBank’s total income recorded more than VND 1,200 billion, of which net interest income reached nearly VND 1,150 billion, up 12% over the same period last year thanks to the strategy of proactively maintaining competitive interest rates, supporting customers and expanding the customer base after changing its brand identity.

In the first six months, BVBank recorded a pre-tax profit of VND 93 billion. The lower profit compared to the same period last year was mainly due to (1) BVBank proactively reducing lending rates and offering preferential credit packages to support individual and corporate customers in the spirit of the Government and the State Bank, (2) BVBank proactively made provisions to consolidate the safety buffer and control asset quality, and (3) operating expenses increased by 17% to expand business activities, especially investing in upgrading networks and technology infrastructure to serve the long-term digitization strategy and optimize operating procedures.

|

93% of new customers come from digital channels.

Focusing on individual customers, technology, and user experience, BVBank is creating a competitive advantage through the speed of implementation and the depth of its digital foundation. This is the strategic axis that drives the bank’s accelerated growth in retail on a comprehensive digital foundation.

Since 2021, BVBank has deployed the Digimi platform – a digital transaction channel that plays a central role in the retail ecosystem. By mid-2025, the number of transactions through Digimi continued to increase significantly, reflecting a clear shift from traditional channels to digital ones. Specifically, in the first six months, 93% of new customers came from digital channels, and the total number of transactions on Digimi increased by 51% over the same period in 2024, including a strong growth of 50% in capital mobilization through digital channels.

In parallel, BVBank has developed DigiStore – a comprehensive financial platform targeting household businesses, supporting this group in line with the orientation of the Government and the State Bank. This solution helps BVBank expand its customer base and accelerate service coverage in many niche markets. In six months of strong implementation, the number of customers and transaction turnover increased by 30 times and 23 times, respectively.

BVBank is also a pioneer in integrating eKYC VNeID authentication into the entire account opening process, helping to accelerate user experience and reduce dependence on physical channels. Notably, BVBank expanded its cashless payment acceptance network, deployed cross-border QR codes in Thailand, Cambodia, and Laos, and applied many attractive programs, free transaction promotions, spending incentives, and competitive interest rates to attract individual customers.

The retail and digitization strategy has helped BVBank win many awards in the market. The bank has been honored with prestigious titles such as: Leading Bank in Card Transaction Growth Rate 2024; Leading Bank in Total Card Transaction Value 2024, … awarded by the international card organization JCB; and Top banks with good brand growth in ranking by Mibrand market research company.

About Vietnam Commercial Joint Stock Bank – BVBank

Vietnam Commercial Joint Stock Bank (BVBank) was established in 1992 and has, over 32 years of development and more than 10 years of renewal, firmly positioned itself in the financial market and brought satisfaction to customers, partners, and shareholders.

At the end of 2023, BVBank officially launched its new logo to synchronize its brand identity with its new name, “BVBank,” accelerating its journey towards “becoming a modern, multi-functional retail bank, focusing on customers, especially individual customers and small and medium-sized enterprises”.

In addition, BVBank also aims to become one of the banks with a fast and effective digital transformation, recognized by reputable organizations through awards such as: Best Digital Transformation Bank (by Global Banking & Finance Review); Most User-Friendly Mobile Banking Solution (by The Global Economics Magazine); Vietnam’s Initiative of the Year in Payments & Mobile Banking (by Asia Banking & Finance – Retail Banking Awards); Most Innovative Digital Bank (by Global Business Outlook); Best Technology Deployment Bank (by FinanceAsia Country Awards); and Leading Bank in NAPAS Card Transaction Growth in 2022.

Furthermore, BVBank was also honored as the Bank with the Best Brand Management System (by MiBrand Company) and received numerous other prestigious domestic awards.

In 2025, BVBank was proud to receive four significant awards in the field of cards from JCB Vietnam:

- Leading Licensee in Outstanding Spending Volume Growth 2024 – Recognizing the bank with the highest spending volume growth rate among JCB licensees in Vietnam.

- Leading Licensee in Spending Volume 2024 – Acknowledging the bank with the highest spending volume among JCB licensees in Vietnam.

- Leading Licensee in Credit Card Active Ratio 2024 – Awarded to the bank with the highest credit card activation ratio among JCB licensees in Vietnam.

- Leading Licensee in Card Activation Balance Increase 2024 – Presented to the bank with the highest increase in the balance of activated JCB cards in Vietnam.

Vietnam National Payment Corporation (Napas) also acknowledged BVBank’s efforts in deploying innovative payment solutions:

- Dynamic Bank 2024 – Recognizing the bank’s dynamism and proactive cooperation in project deployment with NAPAS.

- Outstanding Bank with Innovative Service – Awarded to the bank that has made remarkable contributions to the development of innovative and modern payment methods in Vietnam.

Media Contact:

Ngo Thuy – Director of Communications

A: HM Town Building – 412 Nguyen Thi Minh Khai, Ward 5, District 3, Ho Chi Minh City

T: (+84 28) 62 679 679, ext: 174 | F: (+84 28) 62 638 668 E: [email protected]

W: bvbank.net.vn | Hotline: 1900 555 596

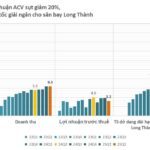

The Vietnamese Aviation ‘Bigwig’: Q2 2025 Profits Dip 20%, $780 Million Invested in Long Thanh Airport

As of the first half of 2025, net revenue reached VND 12,698 billion, a 13.6% increase compared to the same period in 2024. However, the after-tax profit for the first six months decreased by 6.9% to VND 5,724 billion year-over-year.

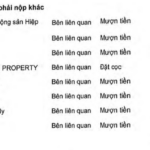

Real Estate Legal Landscape Brightens, Project M&A Gains Traction

The first half of 2025 saw a cautious pace in the real estate market as Vietnam navigated the recent merger of localities and adapted to new regulations from three related laws that came into force. However, in recent times, project legality has been gradually improving and becoming a core pricing criterion driving mergers and acquisitions.

“Retail Giant Fined for Breaching Information Disclosure Regulations”

The UBCKNN has issued a fine of 92.5 million VND to Tong Bach Hoa for failing to disclose information as required by regulations.