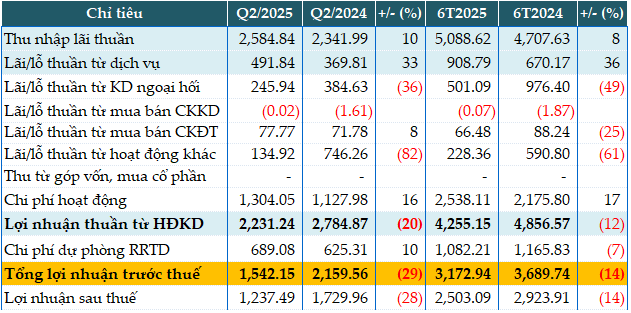

In the first half of the year, MSB’s net interest income increased by 8% year-on-year to nearly VND 5,089 billion. Net income from services increased sharply by 36% to VND 909 billion, driven by the growth of services such as payments, treasury, trade finance, and digital banking…

Profit from foreign exchange trading decreased by 49% to VND 501 billion due to lower revenue from currency-related financial derivatives.

Some other non-interest income also declined, including income from proprietary trading, investment securities, and other activities.

In addition, operating expenses increased by 17% to VND 2,538 billion. As a result, net income from business activities decreased by 12% to VND 4,255 billion. MSB also reduced its credit risk provisions by 7%, setting aside only VND 1,082 billion.

Consequently, MSB’s pre-tax profit was nearly VND 3,173 billion in the first six months, a 14% decrease year-on-year. In Q2 alone, the bank’s pre-tax profit decreased by 29% to VND 1,542 billion.

Compared to the full-year pre-tax profit target of VND 8,000 billion, MSB achieved 40% after the first two quarters.

Commenting on the results, a representative of MSB said: “MSB’s business results and key safety indicators remained stable in the first half of 2025. We do not pursue high growth at all costs, but focus on sustainability, safety, and long-term profitability. In the last six months, MSB will continue to develop integrated financial products, promote green credit, enhance digital service quality, and expand cooperation in the value chain to create long-term competitive advantages.”

|

MSB’s Q2 and six-month business results for 2025 in VND billion

Source: VietstockFinance

|

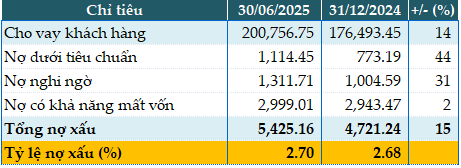

MSB’s total assets as of the end of Q2 increased by 7% from the beginning of the year to VND 341,331 billion. Loans to customers increased by 14% to VND 200,756 billion, with balanced growth between individual and corporate lending, fluctuating around the 13-14% mark. Individual loan balances reached more than VND 52,140 billion, while corporate loan balances stood at nearly VND 148,617 billion. In the corporate segment, the bank prioritized key sectors, including pharmaceuticals and healthcare, metal product manufacturing and processing, transportation, and building materials production…

Customer deposits reached nearly VND 174,430 billion, a 13% increase compared to the beginning of the year. Of this, individual customer deposits accounted for VND 87,580 billion, an 11% increase, while economic organization deposits totaled approximately VND 86,850 billion, a 15% increase. Notably, non-term deposits exceeded VND 46,700 billion, up from over VND 40,800 billion at the beginning of the year, bringing the CASA ratio to 26.78%.

The loan quality was not very promising, as total non-performing loans as of June 30, 2025, reached VND 5,425 billion, a 15% increase compared to the beginning of the year. Accordingly, the non-performing loan ratio edged up slightly from 2.68% at the beginning of the year to 2.7%. The individual non-performing loan ratio (according to Circular 31) stood at 1.86%.

|

MSB’s loan quality as of June 30, 2025, in VND billion

Source: VietstockFinance

|

Other capital adequacy ratios remained stable, with the loan-to-deposit ratio (LDR) at 73.91%, the short-term capital for medium and long-term loans (MTLT) at 26.57%, and the capital adequacy ratio (CAR) at 12.28%.

Han Dong

– 11:13 31/07/2025

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.

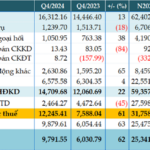

The Powerhouse Performer: VietinBank’s Stellar Growth with a Near 2.4 Million Billion Dong Total Asset Portfolio, Witnessing a 61% Surge in Pre-Tax Profit for Q4/2024

For the fourth quarter of 2024, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) reported a remarkable performance with a pre-tax profit of over VND 12,245 billion, surging by 61% year-on-year. This impressive growth is attributed to a significant reduction in credit risk provisions.

The Secret to VIB’s 9,000 Billion VND Profit in 2024: Unveiling the Strategies for Success

Vietnam International Commercial Joint Stock Bank (HOSE: VIB) has announced its consolidated financial statements, reporting a pre-tax profit of over VND 9,004 billion in 2024, a 16% decrease compared to the previous year. This comes amidst a 22% growth in credit.