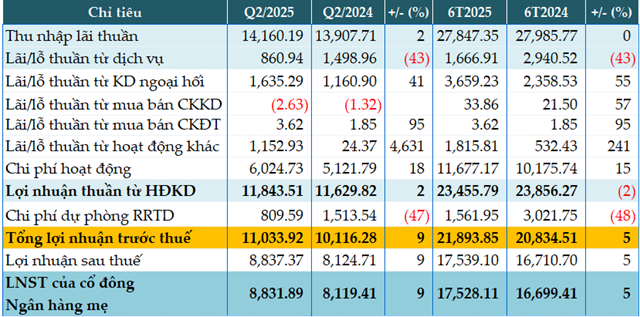

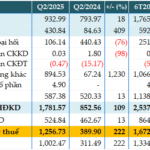

Vietcombank’s net interest income for the second quarter reached VND 14,160 billion, a modest 2% increase year-on-year.

Service income witnessed a significant drop of 43%, settling at VND 861 billion. In contrast, foreign exchange business activities displayed robust growth of 41%, yielding VND 1,635 billion in interest. Other activities also drew attention, generating VND 1,153 billion in interest compared to just over VND 24 billion in the same period last year.

Operating expenses for the period surged by 18% to VND 6,024 billion. Consequently, profit from business operations rose slightly by 2% to VND 11,843 billion.

During the quarter, Vietcombank substantially reduced its risk provision expenses by 47%, amounting to nearly VND 810 billion. This resulted in a 9% increase in pre-tax profit, reaching VND 11,033 billion.

For the first half of the year, net profit from business operations stood at VND 23,455 billion, a 2% decrease year-on-year. Pre-tax profit reached nearly VND 21,894 billion, a 5% increase compared to the previous year, attributable to a significant 48% reduction in credit risk provisions.

|

VCB’s Q2 and 6M 2025 business results. Unit: VND billion

Source: VietstockFinance

|

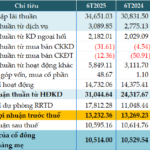

As of the end of the second quarter, Vietcombank’s total assets exceeded VND 2.2 quadrillion, marking a 6% increase since the beginning of the year. Customer lending and deposits reached nearly VND 1.56 quadrillion and VND 1.59 quadrillion, respectively, reflecting a 7% and 8% year-to-date growth.

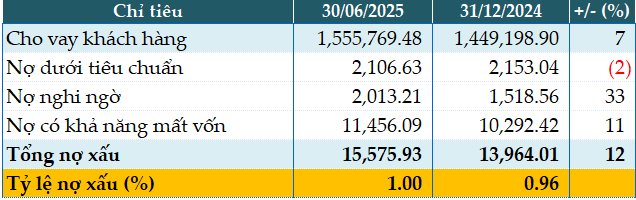

As of June 30, 2025, Vietcombank’s total non-performing loans amounted to VND 15,576 billion, representing a 12% increase since the start of the year. The non-performing loan ratio also witnessed a slight uptick from 0.96% to 1% during this period.

|

VCB’s loan quality as of June 30, 2025. Unit: VND billion

Source: VietstockFinance

|

Han Dong

– 20:19 30/07/2025

BIDV Posts 6% Pre-Tax Profit Increase in Q2, Total Assets Near VND 3 Quadrillion

The consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Investment and Development of Vietnam, better known as BIDV (HOSE: BID). The bank posted a remarkable pre-tax profit of nearly VND 8,625 billion, reflecting a 6% increase compared to the same period last year. As of the end of the second quarter, BIDV’s total assets stood at over VND 2.99 million billion.

Captivated by the Bank’s Notification on ‘Expiring Reward Points’

Cybercriminals are employing a new tactic to deceive unsuspecting individuals. They are sending SMS messages, pretending to be from a bank, informing recipients about reward points expiration and providing instructions on how to redeem gifts. However, the link included in the message redirects victims to a fake website mimicking the bank’s official site.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”

Profits Soar and Bad Debt Declines: ABBank’s Impressive First Half of the Year

The recently released Q2 2025 consolidated financial statements reveal that An Binh Joint Stock Commercial Bank (ABBank) posted a remarkable performance with a pre-tax profit of VND 1,257 billion, tripling its figure from the previous year. This outstanding result brings the bank’s half-year pre-tax profit to VND 1,672 billion, achieving 92% of its annual target.

Agribank’s Pre-Tax Profit for H1 2025 Exceeds VND 13,232 Billion, with Improved Non-Performing Loan Ratio

The consolidated financial statements for the first half of 2025 reveal that the Vietnam Bank for Agriculture and Rural Development (Agribank) recorded a pre-tax profit of over VND 13,232 billion for the period, a figure almost identical to the same period last year. Non-performing loans at the end of the second quarter showed improvement compared to the beginning of the year.