I. MARKET ANALYSIS OF STOCKS AS OF JULY 31, 2025

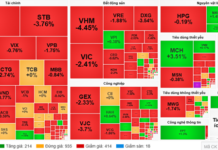

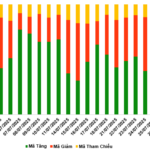

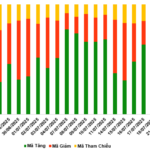

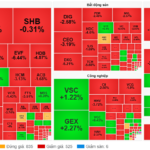

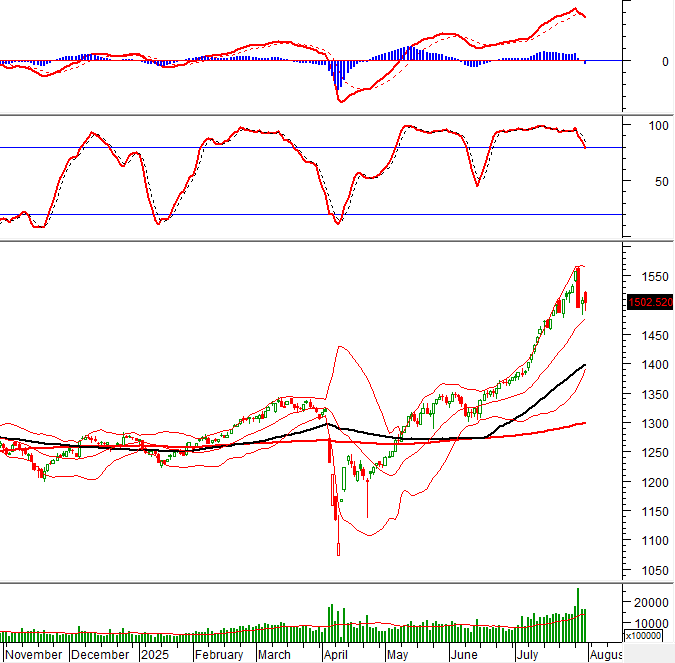

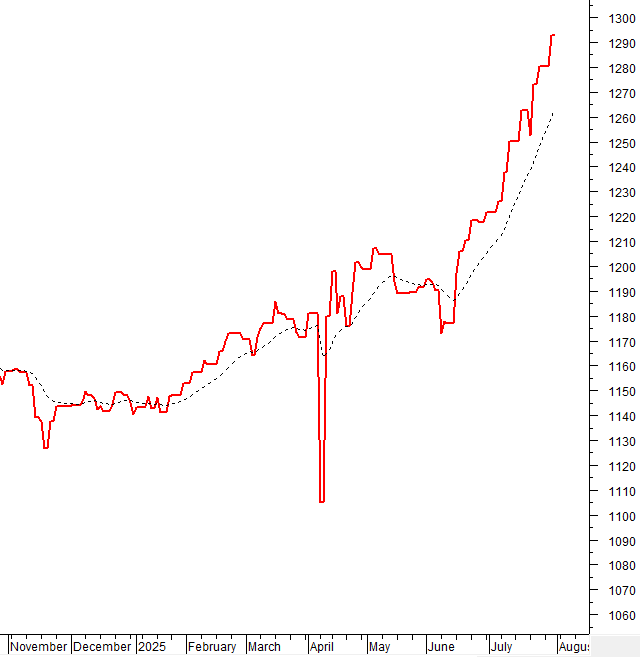

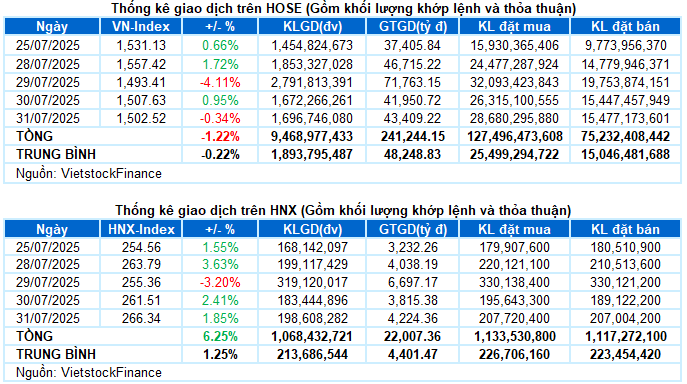

– The main indices moved in opposite directions during the trading session on July 31. Specifically, the VN-Index lost 5.11 points (-0.34%), falling to 1,502.52. In contrast, the HNX-Index increased by 1.85% to reach 266.34.

– The trading volume on the HOSE slightly increased by 1.9%, reaching 1.6 billion units. HNX recorded over 195 million units, a 9.5% increase compared to the previous session.

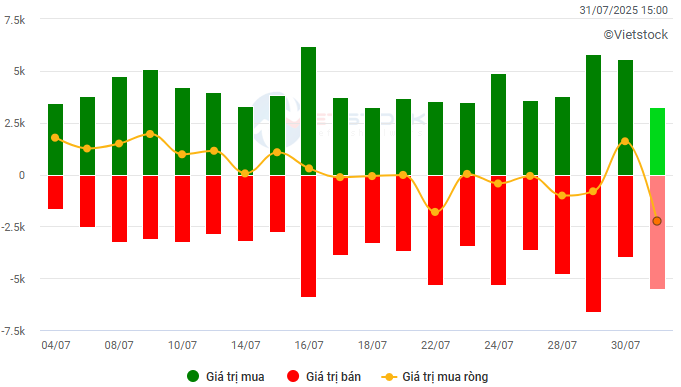

– Foreign investors turned to net sellers with a value of 1.9 trillion VND on the HOSE and 258 billion VND on the HNX.

Trading value of foreign investors on the HOSE, HNX, and UPCOM. Unit: Billion VND

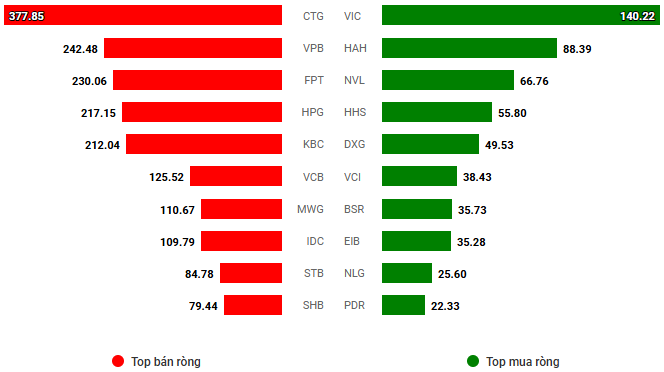

Net trading value by stock. Unit: Billion VND

– The stock market closed July with mixed performances. The VN-Index opened lower and quickly plunged due to increased selling pressure. Significant recovery efforts did not materialize as the index weakened and fell below the 1,490-point mark before noon. In the afternoon session, buying demand showed signs of returning, narrowing the decline. While the recovery was good for mid- and small-cap stocks, pressure remained on some large caps, causing the index to fluctuate around the 1,500-point level. At the close, the VN-Index decreased by 5.11 points to 1,502.52.

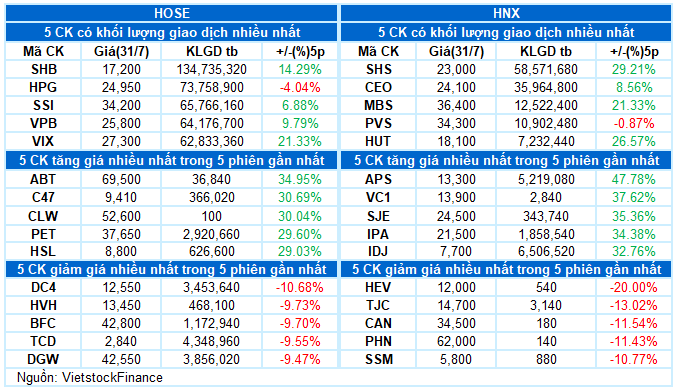

– In terms of impact, VIC was the stock that put the most pressure on the market today, causing the VN-Index to lose 3.5 points. Additionally, stocks such as VHM, VCB, and VPL also pulled the index down by nearly 4 points. On the other hand, SHB and VPB were the two most positive contributors, holding the index above the 2-point level.

– The VN30-Index closed down 0.95% to 1,615.23. The breadth was negative with 16 declining stocks, 11 advancing stocks, and 3 unchanged stocks. VIC led the losers with a decrease of nearly 3.7%. This was followed by VNM, MWG, and FPT, which also adjusted more than 2%. Meanwhile, SHB stood out at the top with a purple hue.

Sectors showed clear differentiation. Energy led the market with a 1.17% gain, thanks mainly to BSR (+3.82%), OIL (+1.65%), VIP (+0.75%), and GSP (+0.76%). However, many stocks in this sector only reached the reference level or were dominated by red, such as PVS (-2.28%), PVC (-3.17%), VTO (-1.19%), and PVB (-1.3%).

In contrast, the industrial sector also traded positively, with many stocks attracting strong buying demand, typically VSC, PC1, VC2, and SJE hitting the ceiling price, GEX (+4.92%), VJC (+2.11%), HAH (+2.04%), VCG (+1.97%), HHV (+2.81%), GEE (+1.6%), and CTD (+2.27%).

Conversely, the information technology sector was the worst performer today, falling by 1.58%, mainly influenced by the adjustment of the “big brother” FPT (-1.98%). Similarly, selling pressure on CTR (-3.01%), VGI (-1.76%), FOX (-1.51%), and VNB (-2.96%) also caused a 1.41% drop in the media and publishing sector.

The VN-Index fell again after strong fluctuations in the session. Currently, the index remains above the Middle line of the Bollinger Bands, which will be an important support level for the index to maintain its upward trend. Meanwhile, the Stochastic Oscillator indicator has started to exit the overbought zone, indicating that the short-term outlook may face challenges.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator exits the overbought zone

The VN-Index fell again after strong fluctuations in the session. Currently, the index remains above the Middle line of the Bollinger Bands, which is an important support level for the index to maintain its upward trend.

Meanwhile, the Stochastic Oscillator indicator has started to exit the overbought zone, suggesting that the short-term outlook may face challenges.

HNX-Index – MACD continues to widen the gap with the Signal line

The HNX-Index increased after a period of fluctuation and formed a candle pattern similar to a hammer, indicating that buyers still held the upper hand.

At present, the MACD continues to widen the gap with the Signal line after giving a buy signal since the beginning of July, suggesting that the positive short-term outlook for the index is being maintained.

Money Flow Analysis

Movement of smart money: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this state continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign capital flow: Foreign investors turned to net sellers in the trading session on July 31, 2025. If foreign investors continue this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS AS OF JULY 31, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:17 31/07/2025

“Market Mayhem: The Wild Ride”

The VN-Index witnessed a volatile session, forming a Doji candlestick pattern, which indicates a tug-of-war between buyers and sellers at higher levels. Trading volume continued to set new records, reflecting the vibrant participation of cash flow. Currently, the Stochastic Oscillator has provided a fresh buy signal, while the MACD is narrowing its gap with the Signal line. If the buy signal is validated in the upcoming sessions, the positive outlook in the short term is likely to prevail.

The Warrant Market on July 22, 2025: A Tale of Diverging Fortunes

The market closed on July 21st, 2025, with a mixed performance; 95 tickers advanced, 96 declined, and 32 remained unchanged. Foreign investors continued net selling, offloading a total of 320,000 covered warrants.

Market Beat July 29: Profit-taking Pressure Mounts, VN-Index Down 64 Points

The selling pressure intensified during the afternoon session, driving the market deeper into negative territory. The downward trend gained momentum towards the closing bell, with the VN-Index plunging 64 points to close at 1,493.41. The HNX-Index also witnessed a sharp decline, falling over 8 points to end the day at 255.36.

Market Beat Aug 01: Caution Creeps In, VN-Index Wobbles at 1,500 Mark

The trading session concluded with the VN-Index shedding 7.31 points (-0.49%), settling at 1,495.21. Likewise, the HNX-Index witnessed a decline of 1.41 points (-0.53%), closing at 264.93. The market breadth tilted towards decliners, as 423 stocks closed in the red versus 366 advancers. The VN30 basket echoed a similar sentiment, with 15 stocks losing ground, 10 advancing, and 5 remaining unchanged.