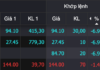

HPG shares closed at 26,400 VND at the end of the August 5 session, up over 4% from the previous session and even hitting the ceiling at one point. However, the most impressive was the massive trading volume of nearly 216 million shares, far surpassing the previous record set on November 18, 2022. In this session, foreign investors net bought nearly 45.6 million HPG shares.

This figure reflects the special interest of investors in the steel industry giant, especially after HPG announced its positive Q2 business results with a net profit of over VND 4,250 billion, up more than 28% over the same period, along with positive information about the construction of new plants and benefits from Vietnam’s mega projects.

The “roller coaster” market: VN30 fluctuates nearly 80 points

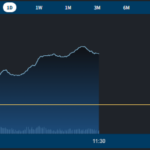

The trading session on August 5 witnessed the Vietnamese stock market fluctuating like a “roller coaster”. The VN-Index once soared more than 55 points at its peak, while VN30 broke through over 76 points. However, the upward momentum quickly reversed as the market approached the ATC session.

At its lowest point, the VN-Index fell nearly 9 points, and VN30 even returned to its previous closing level. Subsequently, the market unexpectedly rebounded strongly in the ATC session, helping the VN-Index close nearly 19 points higher, while VN30 gained 37 points.

| The wild fluctuations of VN-Index and VN30 |

|

Source: VietstockFinance

|

Along with HPG’s surge, the entire Vietnamese stock market also recorded a record liquidity of over 82,500 billion VND, equivalent to more than 3 billion USD. This is the second time in a week that the market has crossed the 3-billion-USD liquidity threshold.

Vu Hao

– 15:25 08/05/2025

The Liquidity Boom: VN-Index Hits All-Time High, Foreigners Sell Over VND 410 Billion

The market witnessed a second consecutive boom day with massive liquidity. VN-Index surged 2.41% this morning, reaching a new all-time high of 1565.03 points. Notably, the trading volume on the HoSE exchange surged by 109% compared to yesterday’s morning session, reaching VND 31,723 billion, just shy of the historical peak of VND 35,451 billion on the morning of July 29th.

The Vietstock Daily: Back on the Upward Trend

The VN-Index witnessed a robust surge and maintained its position above the middle line of the Bollinger Bands. However, a cautionary signal is flashing with the trading volume dipping below the 20-session average. Additionally, the Stochastic Oscillator is exhibiting continued weakness after issuing a sell signal and exiting the overbought territory. Investors should remain vigilant as the risk of volatility persists around the April 2022 peak levels of 1,480-1,530 points.

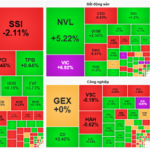

Market Pulse for August 4th: VIC Records Nearly 10,000 Billion VND in Trading Deals

The trading session ended on a positive note, with the VN-Index surging 32.98 points (+2.21%), reaching 1,528.19. The HNX-Index also witnessed a significant boost, climbing 3.41 points (+1.29%) to close at 268.34. The market breadth tilted heavily in favor of advancers, with 498 gainers overwhelming 257 decliners. This bullish sentiment was echoed in the VN30 basket, where 29 stocks advanced, dwarfing the solitary decliner.

Stock Market Update for July 28 – August 1, 2025: Navigating Foreign Outflows

The VN-Index witnessed a decline during the week’s final session, concluding the week’s trading below the 1,500-point mark. Despite the medium-term uptrend remaining technically intact, the index’s failure to hold the crucial psychological support level, coupled with sustained foreign net selling pressure, presents notable signals for investors. Should this trend persist, further market adjustments are likely on the horizon.