Fiera Capital (UK) Limited has just reported that it has become a major shareholder of Nam Long Investment Joint Stock Company (Ticker: NLG, HoSE exchange).

According to the report, Fiera Capital (UK) Limited purchased 10 million NLG shares, increasing its ownership to 5.71% of the company’s capital, thus becoming a major shareholder of Nam Long. The transaction that changed the ownership ratio was executed on July 25, 2025.

Nam Long welcomed its new major shareholder shortly after Ibeworth Pte. Ltd (a subsidiary of Keppel Land) completely divested its holdings. Specifically, on July 24, Ibeworth Pte. Ltd sold over 29.4 million NLG shares, equivalent to a 7.64% ownership stake in Nam Long.

The transaction was conducted via a matching method for the purpose of portfolio restructuring. Upon completion of the transaction, Ibeworth Pte. Ltd is no longer a shareholder of Nam Long.

On July 24, NLG shares closed at VND 40,450 per share. Based on this price, Ibeworth Pte. Ltd may have earned approximately VND 1,190 billion from this deal.

Keppel Land’s divestment from NLG is part of the Singapore-based real estate giant’s plan to restructure multiple investments in Vietnam.

The partnership between Keppel Land and Nam Long began in 2015 when the Singaporean group participated as a strategic partner, purchasing over 7 million privately issued shares. Additionally, the two parties signed a contract to purchase VND 500 billion in convertible bonds (par value of VND 1 billion per bond, with a four-year term) at a conversion price of VND 23,500 per share. Nam Long became the first company in Vietnam to receive an investment from Keppel Land in the form of capital contribution.

Following the complete divestment by Ibeworth Pte. Ltd, its representative, Mr. Joshep Low Kar Yew, resigned from Nam Long’s Board of Directors.

In his resignation letter, Mr. Joshep Low Kar Yew stated that due to the divestment orientation of Ibeworth Pte. Ltd and his personal wishes, he was resigning from his position as a member of the Board of Directors and the Audit Subcommittee in charge of production and business activities.

This decision was made to allow him to focus on new activities in line with the investor’s new orientation and to enable NLG to select a new member that aligns with the future shareholder structure.

Mr. Joshep Low Kar Yew holds a Master of Business Administration from the University of Hull and a Bachelor of Science (Real Estate Management) from the National University of Singapore.

He joined Nam Long’s Board of Directors in April 2021 as a representative of the major shareholder Ibeworth Pte. Ltd, which is 100% controlled by Keppel Land Limited (Keppel Land). He also served as the Chairman of Keppel Land Vietnam.

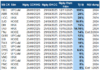

In terms of business results, according to the consolidated financial statements for the second quarter of 2025, Nam Long recorded a net revenue of VND 773 billion, a threefold increase compared to the same period last year. After deducting the cost of goods sold, gross profit increased by 158% to VND 332 billion.

During this period, NLG’s financial revenue plummeted by 83% to just over VND 43 billion. Profit from joint venture and associate companies also halved to over VND 20 billion. In contrast, selling expenses surged by 185% to VND 121 billion.

Consequently, Nam Long reported a post-tax profit of VND 97.5 billion, a 39% decrease compared to the previous year. NLG attributed the second-quarter revenue and profit to its real estate and apartment business, whereas the previous year’s profit was mainly derived from financial activities.

For the first six months of 2025, Nam Long achieved a net revenue of VND 2,064 billion and a post-tax profit of VND 207 billion, representing a fourfold and threefold increase, respectively, compared to the same period last year, thanks to positive results in the first quarter.

For the full year 2025, Nam Long targets a net revenue of VND 6,794 billion and a post-tax profit of VND 701 billion. Thus, after the first six months, the company has accomplished 30.4% of its revenue plan and 29.6% of its profit target.

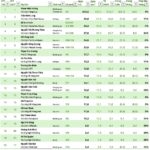

The Wealth of Vietnam’s Top 20 Stock Market Billionaires: Vietjet Chair Adds Another $29 Million, VPBank Chair’s Family Sees Largest Increase

As of Wednesday, August 6, 2025, Mr. Pham Nhat Vuong, Chairman of Vingroup, remains the wealthiest individual on the Vietnamese stock market. With a staggering net worth of 233,500 billion VND, Mr. Vuong’s wealth continues to be a testament to his success and influence in the country’s economy.

Proposed Title: A Luxury Proposition: The Vietnamese High-Roller’s Monthly Indulgence

The Ministry of Finance has proposed a unique proposition for Vietnamese citizens wishing to try their luck at local casinos. Under this proposal, locals will be required to purchase an entry ticket priced at 2.5 million VND, granting them access for a continuous 24-hour period. Alternatively, for frequent visitors, a monthly pass is offered at a cost of 50 million VND per person. This innovative approach aims to regulate and monetize the country’s casino industry while offering an exciting and exclusive experience to enthusiasts.