What’s next for the stock market in the coming weeks?

After a four-month uptrend, including six weeks of strong gains, the Vietnamese stock market experienced a volatile trading week at the end of July and the beginning of August. The VN-Index reached a peak of 1,565 points in the morning session of July 29th, only to close with a 64-point loss.

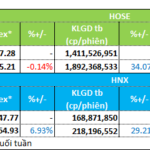

For the trading week from July 28th to August 1st, the VN-Index closed 36 points lower than the previous week, with an intra-week fluctuation of 78 points.

Will geopolitical conflicts hinder the VN-Index? Image: Đạt Thành |

Experts from Beta Securities Company (BSI) described the week’s market movement as a “stormy journey,” with investors experiencing a rollercoaster of emotions, from hope and expectation to worry and even panic.

Analysts from Saigon-Hanoi Securities Company (SHS) noted that the market breadth favored decliners, with a sudden increase in selling pressure after a strong rally. The selling pressure was concentrated in retail, technology and telecommunications, seafood, agriculture, steel, and real estate sectors. In contrast, securities and port-marine transportation stocks continued to rise and only faced strong selling pressure in the last trading session of the week.

Given that August is typically a quiet month for news, SHS experts predict that the Vietnamese stock market will witness strong differentiation before finding a new equilibrium following the recent rally fueled by Q2-2025 business results and trade negotiation updates.

As a result, the VN-Index is expected to maintain its growth trend, with short-term support around 1,480 points and psychological resistance at 1,500 points. However, if the index fails to hold the 1,480-point support level, the uptrend will likely come to an end.

“Market and corporate assessments will be based on updated Q2-2025 financial results and growth prospects for the latter half of the year,” said SHS analysts. “Additionally, the recently imposed tariffs will begin to directly impact businesses.”

Nguyen Phuong Nga, an analyst from Vietcombank Securities Company (VCBS), commented that the market had just experienced a volatile week and was in the process of balancing and accumulating momentum.

According to Ms. Nga, a positive aspect is that cash flow continues to show signs of investment, although there has been a differentiation between industry/stock groups with unique stories or positive Q2-2025 financial results. However, large-cap stocks lack consensus, so the risk of volatility and adjustment remains.

From a technical perspective, Ms. Nga noted that the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) continue to decline on the daily chart, indicating the possibility of further market fluctuations or consolidations in the short term.

Meanwhile, the Chaikin Money Flow (CMF) indicator remains high, reflecting active cash flow in the market. Furthermore, the recovery of the overall index from the 20-day moving average (MA20) at the end of the August 1st session suggests that the market is striving to find a balance around the 1,500-point mark.

On the hourly chart, the MACD is decreasing, but the RSI is forming a positive divergence. “There is a high probability that the VN-Index will continue to fluctuate in the upcoming sessions,” predicted Ms. Nga.

Prioritize short-term asset protection

The market adjustment coincides with a continuous rise in margin debt, which reached a historical peak of VND292 trillion in Q2-2025, according to data from the Ho Chi Minh City Stock Exchange (HoSE). This trend has continued in recent weeks.

Notably, the top ten securities companies in terms of margin debt in Q2-2025 had a total scale of more than VND186.8 trillion, accounting for 61% of the entire market. Many of these firms, including TCBS, SSI, MBS, ACBS, Vietcap, KIS, VIX, KAFI, KBSV, SHS, DNSE, and Yuanta, have actively expanded their margin lending and set new records.

It is necessary to prioritize risk management during the stock market adjustment phase. Image: T.Dao |

However, the rapid increase in margin debt also carries certain risks. Specifically, when a large proportion of investors use leverage, the market may become more sensitive to negative news, and any adjustments could be more pronounced due to forced liquidation.

For the Vietnamese stock market, which is heavily influenced by global fluctuations and rumors, a large margin debt could trigger a wave of forced selling and exert downward pressure on stock prices.

Therefore, Nguyen Phuong Nga recommends that investors maintain a safe level of margin and continue holding stocks that show recovery signs from support levels. They can also consider increasing their positions during market dips.

Additionally, investors with high cash balances can follow speculative cash flows and gradually invest in stocks that are attracting buying interest and still have room for growth compared to their nearest resistance levels.

Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities Company (VPBankS), emphasizes that “as the market heats up, investors should focus on fundamentals such as valuation, future expectations, and Q2-2025 financial results that accurately reflect expectations,” rather than chasing stocks that have already surged and exposing themselves to significant risks during minor corrections.

He suggests employing a short-term trading strategy to optimize capital efficiency during market fluctuations. This strategy involves adjusting the cash and stock proportions in each session and phase rather than holding cash and waiting for market corrections, as predicting minor adjustments within a significant growth cycle can be challenging.

Similarly, Mr. K.V.Cuong, an investor from Hanoi, believes that the short-term market movement is relatively unpredictable. Therefore, he advises a more cautious approach, avoiding buying stocks at high prices. He also recommends reducing margin ratios for accounts with high margin exposure and only holding stocks that maintain their upward trend.

For investors with substantial cash balances, Mr. Cuong suggests gradually buying stocks that are showing signs of an upward trend, especially as cash flow differentiates and rotates into late-cycle sectors such as rubber and industrial parks.

Additionally, Mr. Dao Hong Duong recommends determining trading strategies based on risk appetite. “There are currently many options for investors,” he says, “even within the VN30 group, there is significant differentiation, and not all stocks have risen sharply. Some companies have achieved impressive profit growth, but their stocks have not performed well in the past quarter.” He emphasizes the importance of focusing on the long-term prospects of stocks, especially after a strong market rally.

Van Phong

“VN-Index to End 2025 at a Modest 1,550 Points: Experts Highlight Two Attractive Options for Risk-Taking Investors”

For the intrepid investor, there are opportunities to be found in cyclical sectors and markets such as equities that benefit from cash flow, new product launches, and market upgrades. The tech sector is also a key area to consider, with long-term gains to be made from Resolution 57 on innovation, AI, semiconductors, and digital data.

“Liquidity Divides the Real Estate and Construction Group in Record-Breaking Week”

Liquidity boomed in the final week of July, marking a dynamic finish to the month’s trading. A notable trend emerged, revealing a distinct divergence in the flow of funds.

The Liquidity Boom: VN-Index Hits All-Time High, Foreigners Sell Over VND 410 Billion

The market witnessed a second consecutive boom day with massive liquidity. VN-Index surged 2.41% this morning, reaching a new all-time high of 1565.03 points. Notably, the trading volume on the HoSE exchange surged by 109% compared to yesterday’s morning session, reaching VND 31,723 billion, just shy of the historical peak of VND 35,451 billion on the morning of July 29th.