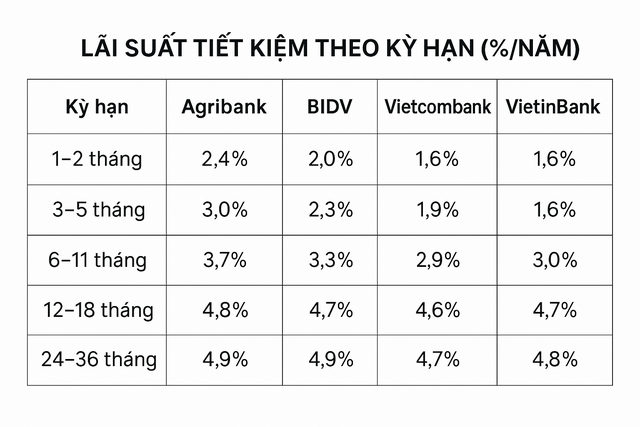

State-owned commercial banks have maintained their savings deposit interest rates at the counter for August 2025, keeping them unchanged from the beginning of July 2025.

At Vietcombank, online savings interest rates range from 1.6% to 4.7% per annum, the lowest among the “Big 4” state-owned commercial banks. Specifically, the 1-month term earns an interest rate of 1.6% per annum; the 3-month term is 1.9%, and the 6–9-month term enjoys a rate of 2.9%. For deposits of 12 months and above, the interest rate increases to 4.6% per annum, peaking at 4.7% for the 24–36-month term.

Agribank offers a maximum online interest rate of 4.9% per annum for deposits of 24 months and longer. For shorter terms, the bank applies interest rates of 2.4% per annum for 1–2-month deposits, 3% for 3–5-month deposits, and 3.7% for 6–11-month deposits. The 12 to 18-month deposits earn an interest rate of 4.8%. Non-term and payment account deposits attract a much lower rate of 0.2% per annum.

VietinBank’s online savings interest rates range from 1.6% to 4.8% per annum. Non-term and less-than-1-month deposits earn interest rates of 0.1% and 0.2% per annum, respectively. For terms of 1 to less than 3 months, customers earn 1.6% per annum; from 3 to less than 6 months, the rate is 1.9%. The 6 to less than 12-month term offers a 3% interest rate, while the 12 to less than 24-month term earns 4.7%. The highest rate of 4.8% is applicable for terms of 24 months and above.

BIDV offers individual customers online savings interest rates ranging from 2% to 4.9% per annum. Specifically, deposits with a term of 1–2 months earn an interest rate of 2% per annum; 2.3% for 3–5 months; and 3.3% for 6–11 months. The 12 to 18-month deposits are listed at 4.7%, while the highest rate of 4.9% is offered for the 24–36-month term.

Consolidated savings interest rates of the 4 “Big 4” state-owned commercial banks at different terms.

A survey of the market shows that state-owned banks are maintaining low-interest rates. In contrast, some private commercial banks offer rates as high as 6-6.1% per annum, but only for long-term deposits. For example, currently, only two banks offer interest rates of 6% per annum or higher for 18-month terms: Vikki Bank at 6% and HDBank at 6.1%.

For the 12-month term, no bank offers an interest rate of 6% or higher. Some banks with the highest interest rates for this term include Cake by VPBank, GPBank, and Vikki Bank. Cake by VPBank offers a maximum of 6% per annum if customers choose to receive interest at the end of the term; if they opt for monthly, quarterly, or early interest payments, the rates are 5.53%, 5.73%, and 5.76%, respectively. GPBank lists an interest rate of 5.95% per annum for 12-month electronic deposits, with the highest rate of 5.95% for 13–36-month terms. Vikki Bank currently applies a rate of 5.95% for the 12-month term and offers a maximum of 6% for online deposits with interest paid at maturity.

“Top 10 Banks With the Highest Profit in Q2 2025: A New Leader Emerges as VietinBank, Vietcombank, and BIDV Claim Over One-Third of the Banking Sector’s Profit on the Stock Exchange”

As of the morning of July 31st, all 27 banks listed on the stock exchange had released their financial reports for the second quarter of 2025. Impressively, these banks collectively raked in a total profit of 89,341 billion VND in Q2 2025, marking an 18% increase compared to the same period in 2024.

Vietcombank Reports 9% Rise in Q2 Pre-Tax Profit, Attributed to Reduced Provisions

The recently released consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Foreign Trade of Vietnam, commonly known as Vietcombank (HOSE: VCB). The bank reported a remarkable pre-tax profit of over VND 11,034 billion, reflecting a 9% increase compared to the same period last year. This outstanding performance is attributed to a significant reduction in risk provisions.

Captivated by the Bank’s Notification on ‘Expiring Reward Points’

Cybercriminals are employing a new tactic to deceive unsuspecting individuals. They are sending SMS messages, pretending to be from a bank, informing recipients about reward points expiration and providing instructions on how to redeem gifts. However, the link included in the message redirects victims to a fake website mimicking the bank’s official site.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”