The Business Confidence Report for 2025, conducted by Bank IV, paints a challenging picture for Vietnamese businesses. Based on a survey of 1,531 businesses nationwide, the report reveals a significant decline in optimism among enterprises.

STRUGGLING BUSINESSES PLAN TO DOWNSIZE

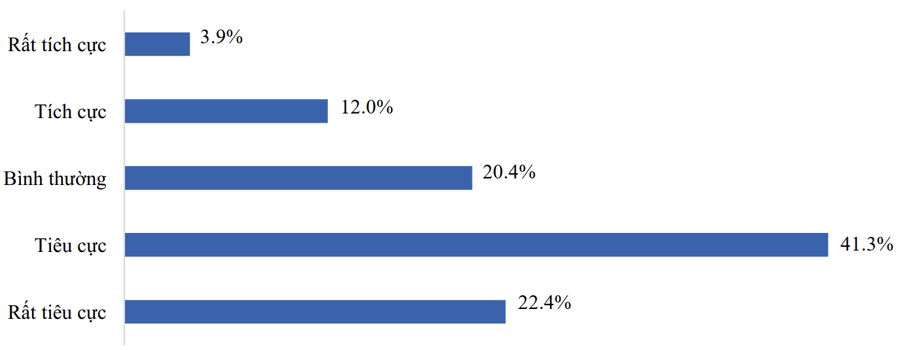

A worrying 63.7% of businesses view the current macroeconomic situation as negative or very negative compared to the previous year, and 56.8% share a similar outlook for the next 12 months. These sentiments are reflected in their future business plans, as an alarming 67.6% of businesses intend to downsize, temporarily cease operations, or dissolve within the next year.

Among these, 15.7% plan to cease operations and await dissolution, while 10.8% intend to temporarily halt business activities. Furthermore, 41.1% anticipate downsizing their operations to some degree. Consequently, these developments are expected to negatively impact the labor market and revenue streams. Of the businesses that plan to remain operational, 56.4% expect to reduce their workforce by more than 5%, and 61.6% predict a revenue decrease of over 5%.

Notably, the private sector, considered a vital driver of the economy, is struggling the most. According to Bank IV, over four consecutive survey periods, private enterprises consistently demonstrated lower evaluation scores, slower recovery rates, and less stable performance compared to state-owned and FDI enterprises. This reality presents a significant challenge in realizing the goals outlined in Resolution 68-NQ/TW for private sector development.

PERSISTENT CHALLENGES WEIGH ON BUSINESSES

In addition to external shocks, Vietnamese businesses continue to grapple with longstanding challenges highlighted in previous reports. Notably, “difficulties in administrative procedures and compliance with legal regulations” have surpassed other issues as the most significant hurdle, as indicated by 69.1% of respondents. This finding suggests that despite the government’s efforts to streamline and simplify procedures, effective implementation remains elusive.

In the context of institutional reform, Bank IV emphasizes the need to thoroughly address administrative reform and the two-tier administration, paying close attention to public-private cooperation. The second most pressing concern for businesses is the “risk of criminalization of economic transactions,” chosen by 42.8% of respondents. Despite the assurances in Resolution 68-NQ/TW against criminalization, this fear persists and remains unchanged from previous surveys. A cautious mindset among officials and a lack of clarity in certain legal provisions have fostered a risky business environment, stifling innovation and expansion initiatives.

The report underscores the urgency of translating the spirit of the Resolution into tangible actions to bolster business confidence. Additionally, the shock from the US tax policy change also poses a significant challenge, particularly for FDI enterprises and export-oriented industries. While only 27.1% of businesses cited this as an issue, a substantial 63.6% of them believe it will have a “serious/very serious” impact on their operations.

To adapt, businesses are proactively seeking alternatives, such as exploring new markets (nearly 30%) and increasing localization in production chains (20.5%). However, a notable proportion (24.2%) opt to temporarily halt operations, indicating a level of passivity and vulnerability to global trade policy fluctuations.

RESOLUTIONS AS A SPRINGBOARD FOR BUSINESSES

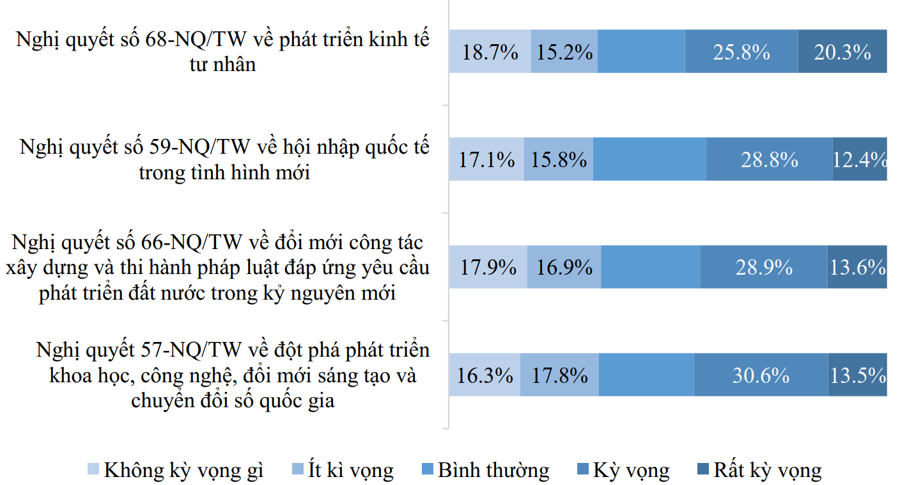

Amid the predominantly gloomy landscape, a glimmer of hope emerges from businesses’ expectations regarding the government’s strategic policies. Bank IV highlights the “quadruple pillar resolutions” and significant national reform and policy initiatives as pivotal in restoring and reinforcing businesses’ waning confidence. These resolutions provide the impetus for enterprises to overcome challenges, maintain, and expand their operations, thereby contributing to the growth targets for 2025.

The survey reveals a strong correlation between businesses’ plans and their expectations from the resolutions. Notably, enterprises with positive business plans have higher hopes for the effectiveness of these resolutions. In particular, Resolution 68-NQ/TW on private sector development is anticipated to bring about breakthrough results. Businesses planning a substantial expansion have expectation levels exceeding 4/5, significantly higher than those intending to downsize or cease operations.

This data underscores that the Party’s major directives are well-aligned with the aspirations of the business community. The core issue now lies not in the orientation but in the implementation capacity and effectiveness. Translating the spirit of these resolutions into tangible actions, transforming them into measurable and accessible support policies, holds the key to shoring up waning confidence and unlocking bottlenecks for businesses.

To navigate through these challenging times, Bank IV has recommended that the government intensify its pro-business stance at local government levels. Additionally, they should focus on enhancing fiscal policy effectiveness through tax breaks and reductions and boost public investment to stimulate the economy. Creating a substantive public-private partnership, where the private sector actively contributes to solving significant national challenges, will foster resilience and collectively drive Vietnam towards its goal of becoming a high-income nation by 2045.

“Techcombank – Revolving Leadership, Optimizing the Power of the Ecosystem”

As of August 1st, 2025, the Techcombank – One Mount – Masterise Group ecosystem underwent a strategic shift with a leadership transition. This move underscores the ecosystem’s commitment to harnessing the synergy of finance and technology, solidifying its pledge to accompany the nation’s digital transformation journey by leveraging the pillar of talent.

“Flexible Capital for Manufacturers: NCB Bank’s Mid-Term Financing Solutions”

National Citizen Bank (NCB) has launched a flexible mid-term business lending program for corporate customers with competitive interest rates. This program is designed to provide a solid foundation for businesses to thrive and boost their performance in the new year.