For three decades, under the close guidance of the Communist Party, the State, and the State Bank of Vietnam, along with the dedication of generations of leaders and officers, Co-opBank has established itself as the leading bank for the Network of People’s Credit Funds (PCFs). This network is an essential component of Vietnam’s microfinance and collective economic ecosystem.

Mission: The Pillar of the Cooperative Financial System

In the context of Vietnam’s renewal process, the PCF model was established to provide legal and safe credit to rural residents, households, and cooperatives. However, to operate effectively, PCFs need a focal organization to connect, harmonize capital, and lead the entire system, which has been Co-opBank’s mission for the past three decades. With a network of its Head Office, 32 branches, and 66 transaction offices, Co-opBank not only acts as a “companion” but also propels the sustainable development of nearly 1,200 PCFs. It performs core tasks such as capital harmonization, liquidity support, inspection and supervision, professional training, and assigning officers to participate in the restructuring of weak PCFs. These efforts contribute to maintaining system stability and enhancing safety in rural credit activities.

Leaders of the State Bank of Vietnam, former leaders of the State Bank, Co-opBank’s Board of Directors, and former leaders of Co-opBank take a commemorative photo at the 30th anniversary of Co-opBank’s establishment

Innovation, Modernization, and Digitization

In recent years, Co-opBank has actively promoted digital transformation and modernized its banking products and services for PCFs. This includes developing modern core banking systems, connecting nearly 1,000 PCFs to the interbank payment network, issuing Co-opBank Napas chip cards, providing 24/7 money transfer services, and introducing the Co-opBank Mobile Banking app…

Notably, the trio of digital platforms designed by Co-opBank specifically for PCFs has not only helped improve their operational efficiency but also transformed their management thinking and technology adoption in the modern financial environment. These efforts have earned Co-opBank recognition as the “Digital Transformation Organization of the Year” by the World Council of Credit Unions (WOCCU).

Co-opBank, together with the PCF System Safety Assurance Fund and the PCF Association, has developed a new brand identity to enhance the professional and modern image of PCFs. This initiative helps build sustainable trust within the local community, where each PCF serves as both a bank and a “Fund for Every Home.”

The Driving Force Behind the Numbers

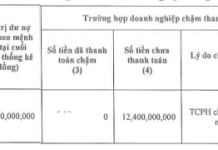

In the last decade, with Co-opBank’s support, the PCF system has made remarkable progress: PCF’s chartered capital increased by 165.2%; total assets grew by 156.7%; PCF’s loan growth rate increased by 190.5%; capital mobilization increased by 173.8%, and the bad debt ratio stood at 0.85%.

As for Co-opBank itself, from a modest scale in 1995, it has now reached nearly VND 70,000 billion in total assets, mobilized capital of nearly VND 64,000 billion, outstanding loans of almost VND 39,000 billion, and a bad debt ratio of 0.36%. These figures reflect not just financial strength but also the measure of trust, partnership, and commitment to the cooperative economy.

Journey of “Firm Steps, Far Reach”

As it enters a new phase of development, Co-opBank is clear about its strategy to become a leading bank in community microfinance. Its key solutions include: increasing charter capital and strengthening financial capacity; developing financial products and services, especially those dedicated to PCFs, their members, cooperatives, households, and small and micro-enterprises in rural, remote, and mountainous areas; enhancing organizational and human resource quality; promoting comprehensive digital transformation in infrastructure and services; perfecting the risk control system; and expanding international cooperation to access preferential capital and modern management experience.

Today, Co-opBank is not just a bank for PCFs but also a connecting, leading, and spreading cooperative spirit, contributing to building a strong, modern, and humane community microfinance system in Vietnam.

Officers of Ninh Giang PCF, Ninh Binh province, introducing Co-opBank’s 24/7 money transfer service to the Fund’s members

“TPBank: Leading the Way with Efficient Operations and a Pioneer Digital Ecosystem”

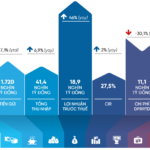

With a remarkable profit of over VND 4,100 billion in the first six months of 2025 and total assets reaching VND 428,600 billion, TPBank has not only sustained its robust growth but has also been recognized among the Top 10 most reputable private joint-stock commercial banks in Vietnam for 2025 by Vietnam Report. This testament solidifies TPBank’s standing as a frontrunner in the banking industry.

The Banking Giant Slashes Its Physical Presence: Shuttering 66 Branches in an Unprecedented Move

The recent wave of layoffs in the second quarter of 2025 has been a challenging time for many. With a focus on streamlining and cost-cutting measures, organizations across industries have had to part ways with valuable talent. As we move forward, it’s essential to reflect on the impact of these decisions and the potential consequences they may have on the future landscape of various sectors.

The CRM Machine and the Omnichannel Springboard: Santander to SHB’s Journey

In the quest for comprehensive digitalization, it is imperative to transform and seamlessly connect every service touchpoint. Automated transaction machines, or Cash Recycle Machines (CRMs), are pivotal in this journey. CRMs not only empower customers with self-service capabilities but also serve as a vital link in the construction of an omnichannel experience for the bank of the future.

“Techcombank – Revolving Leadership, Optimizing the Power of the Ecosystem”

As of August 1st, 2025, the Techcombank – One Mount – Masterise Group ecosystem underwent a strategic shift with a leadership transition. This move underscores the ecosystem’s commitment to harnessing the synergy of finance and technology, solidifying its pledge to accompany the nation’s digital transformation journey by leveraging the pillar of talent.

“Digital Transformation Pays Off: HDBank Records Impressive 6-Month Profit of VND 10,068 Billion, with ROE Climbing to 26.5%”

“HDBank (HOSE: HDB) has announced its Q2 and H1 2025 financial results, boasting impressive profits exceeding VND 10,068 billion, a remarkable 23% increase compared to the same period last year. The bank continues to lead the industry with top-tier performance and operational efficiency, solidifying its position as a powerhouse in the Vietnamese banking sector.”