Dragon Capital, a prominent foreign investment fund, recently offloaded nearly 1.5 million MWG shares of Mobile World Investment Corporation during the trading session on July 31, 2025.

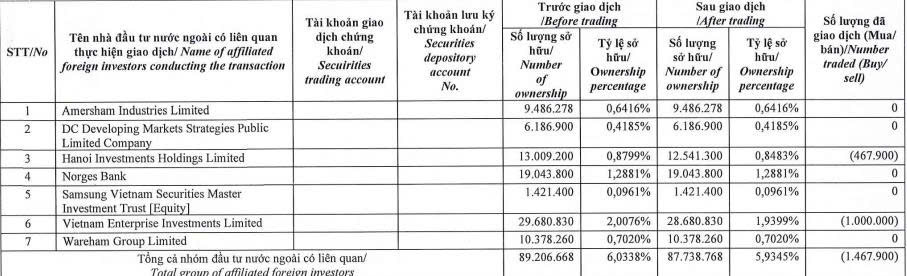

Specifically, Dragon Capital utilized two of its member funds to execute this transaction. Hanoi Investments Holdings Limited sold 467,900 shares, while Vietnam Enterprise Investments Limited offloaded one million shares.

As a consequence of this transaction, Dragon Capital’s ownership in Mobile World decreased from over 89.2 million shares to slightly above 87.7 million shares. This adjustment lowered their stake in the company from 6.0338% to 5.9345%.

Source: MWG

Based on the closing price of MWG shares on July 31, 2025, which stood at VND 65,300 per share, Dragon Capital is estimated to have garnered nearly VND 95.9 billion from this sale.

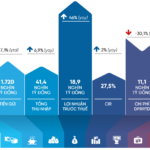

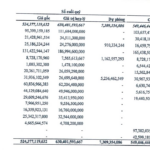

Turning to Mobile World’s financial performance, the company’s consolidated financial statements for Q2 2025 revealed encouraging results. Net revenue reached nearly VND 37,620 billion, marking a 10.2% increase compared to the same period last year. Gross profit surpassed VND 7,568.7 billion, reflecting a modest 3.6% uptick.

Additionally, financial income for the period exceeded VND 768.8 billion, representing a substantial 32.5% surge year-over-year. However, this was accompanied by rising financial expenses, which climbed from VND 293.7 billion to VND 402.5 billion. Similarly, administrative expenses increased by 47.8%, totaling nearly VND 1,201.7 billion. On a positive note, selling expenses decreased by 7%, settling at VND 4,703.3 billion.

Ultimately, after accounting for various taxes and expenses, Mobile World posted an impressive net profit of over VND 1,657.5 billion for the quarter, signifying a notable 41.4% improvement compared to the corresponding period in 2024.

For the first half of 2025, Mobile World’s cumulative performance remained robust. Net revenue surpassed VND 73,754.9 billion, indicating a 12.4% year-over-year increase. Meanwhile, net profit after tax approached VND 3,205.4 billion, representing an impressive 54.4% jump.

As of June 30, 2025, Mobile World’s total assets had grown by 15% since the beginning of the year, reaching nearly VND 81,001.4 billion. Inventory accounted for VND 23,691.7 billion, or 29.2% of total assets, while holdings to maturity exceeded VND 34,303.2 billion, constituting 42.3% of total assets.

On the liabilities side, the company’s total liabilities stood at over VND 50,985.2 billion, reflecting a 20.5% increase compared to the start of the year. Short-term borrowings amounted to nearly VND 31,538 billion, making up 61.9% of total liabilities.

The Banking Giant Slashes Its Physical Presence: Shuttering 66 Branches in an Unprecedented Move

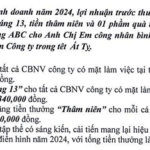

The recent wave of layoffs in the second quarter of 2025 has been a challenging time for many. With a focus on streamlining and cost-cutting measures, organizations across industries have had to part ways with valuable talent. As we move forward, it’s essential to reflect on the impact of these decisions and the potential consequences they may have on the future landscape of various sectors.

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

“Sacombank has been recognized as one of the top 10 most reputable commercial banks in Vietnam for 2025 by Vietnam Report and VietNamNet Newspaper. Not only has the bank climbed to the top 5 most reputable private joint-stock commercial banks, but it has also secured a spot in the top 50 public companies for trust and performance (VIX50). This achievement is a testament to Sacombank’s financial prowess, media reputation, and positive feedback from key stakeholders in the financial and banking markets, as evaluated through independent assessment criteria.”

The Evolution of Tan Dai Hung Plastics: Navigating Through Challenges for Profitable Growth

Tan Dai Hung Plastic Joint Stock Company (HOSE: TPC) returned to profitability in 2024, bouncing back from a significant loss the previous year. While the net profit of nearly VND 12 billion marked a turnaround, it remained below the company’s historical average.

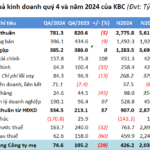

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.