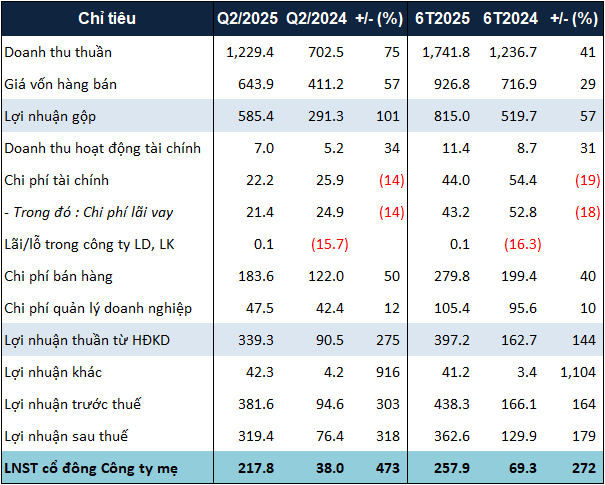

Specifically, according to the consolidated financial statements, DXS’s net revenue in Q2 2025 exceeded VND 1,200 billion, a 75% increase compared to the same period last year. This was also the quarter with the highest net revenue for the Company since Q3 2022.

In this period, revenue from the two main activities of service and real estate transfer doubled and increased by 67% respectively compared to the same period, reaching over VND 588 billion and VND 575 billion.

Accompanying the surge in revenue, DXS’s selling and management expenses also increased by 50% and 12%, respectively, due to a significant rise in salary expenses. In contrast, the Company reduced interest expenses by 14%, resulting in a total of over VND 21 billion.

Another notable aspect is the extraordinary other income of over VND 42 billion, ten times higher than the previous year. This was mainly attributed to the recognition of VND 43 billion in penalty income from contract violations.

Thanks to the surge in net revenue and other income, DXS recorded a net profit of nearly VND 218 billion in Q2 2025, 5.7 times higher than the same period last year. The Company attributed this remarkable result to the recovery of the real estate market since the end of 2024, which facilitated DXS’s expansion of its sales activities and enabled the recognition of revenue and profits with investors.

|

DXS’s Business Results for Q2 and the First Half of 2025. Unit: Billion VND

Source: VietstockFinance

|

On the other hand, combined with the results of Q1, the net profit for the first six months reached approximately VND 258 billion, 3.7 times higher than the first half of 2024. Compared to the target of VND 412 billion set for the full year of 2025, DXS’s net profit for the first half represents a completion rate of nearly 63%.

As of June 30, 2025, DXS’s total assets amounted to nearly VND 15,700 billion, a 4% increase from the beginning of the year. The two largest items, short-term receivables and inventory, increased by 5% and 3%, respectively, reaching VND 9,700 billion and VND 4,500 billion. Among these, land use rights, construction costs, and development expenses for projects such as Regal Legend, La Maison, Dat Quang Riverside, Tuyen Son, and others exceeded VND 2,100 billion, a 6% increase.

The company’s total liabilities also increased by 3%, amounting to nearly VND 7,000 billion. Borrowings increased by 5%, reaching over VND 2,300 billion, due to a significant rise in long-term bank loans. Notably, the amount of prepayments from customers for apartment and land lot purchases increased by 46%, totaling over VND 517 billion.

– 14:14 08/05/2025

The Power of Words: Crafting Captivating Headlines

“Second Quarter Revenue Down 99.6% Year-over-Year, Nhã Từ Liêm Remains Resilient with Modest Profit through Strategic Cost-Cutting and Investment Diversification”

The company’s Q2/2025 revenue plummeted due to a near standstill in business operations. However, NTL managed to record a slight profit of VND 2 billion, attributed to financial gains from interest income, investment in securities, and operational cost-cutting measures.

The Grand Residence – An Iconic Landmark in Ho Chi Minh City’s International Waterfront Metropolis

On the evening of July 31, 2025, the luxurious setting of the five-star Benthanh Princess cruise ship at Ben Nha Rong – a historic landmark in Ho Chi Minh City – played host to an event titled “Maison Grand – Power Wave – Power Up.” This event signaled a pivotal moment in the development journey of the Maison Grand commercial apartment complex.

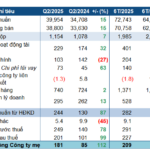

Profiting from the Rise in Oil Prices: PV OIL’s Quarterly Earnings Double

“PV OIL (UPCoM: OIL) witnessed a positive trend in the second quarter of 2025 with domestic base prices on an upward trajectory, a stark contrast to the downward trend experienced in the same quarter of 2024. This shift has resulted in a significant boost to the company’s financial performance for the current quarter compared to the previous year.”