The Vietnamese stock market witnessed a tumultuous session with record trading volume on the HoSE, reaching nearly VND 73,000 billion. Shares of Hoa Phat (HPG) stood out with a remarkable trading volume of 216 million units, resulting in a transaction value of over VND 5,700 billion. This unprecedented level of liquidity for a single stock is historic.

Foreign investors’ activities on HPG were notably positive, with a net purchase of over 40 million shares worth nearly VND 1,100 billion, the highest on the exchange on August 5th. This momentum significantly contributed to the stock’s strong performance in the recent session. Although HPG couldn’t sustain the ceiling price, it still closed with an impressive gain of 4.35%.

Following the record trading volume, nearly 3% of Hoa Phat’s circulating shares changed hands. The corporation, led by billionaire Tran Dinh Long, currently boasts the largest chartered capital among non-financial enterprises listed on the stock exchange, amounting to VND 76,755 billion. Notably, its chartered capital surpasses that of prominent banks such as BIDV, VietinBank, and Techcombank.

In related news, towards the end of July, approximately 1.3 billion shares issued by Hoa Phat as a 2024 dividend (at a 20% ratio) became eligible for trading after their supplemental listing on July 22nd. As a result, the total number of circulating shares of the “steel king” has increased to over 7.67 billion units.

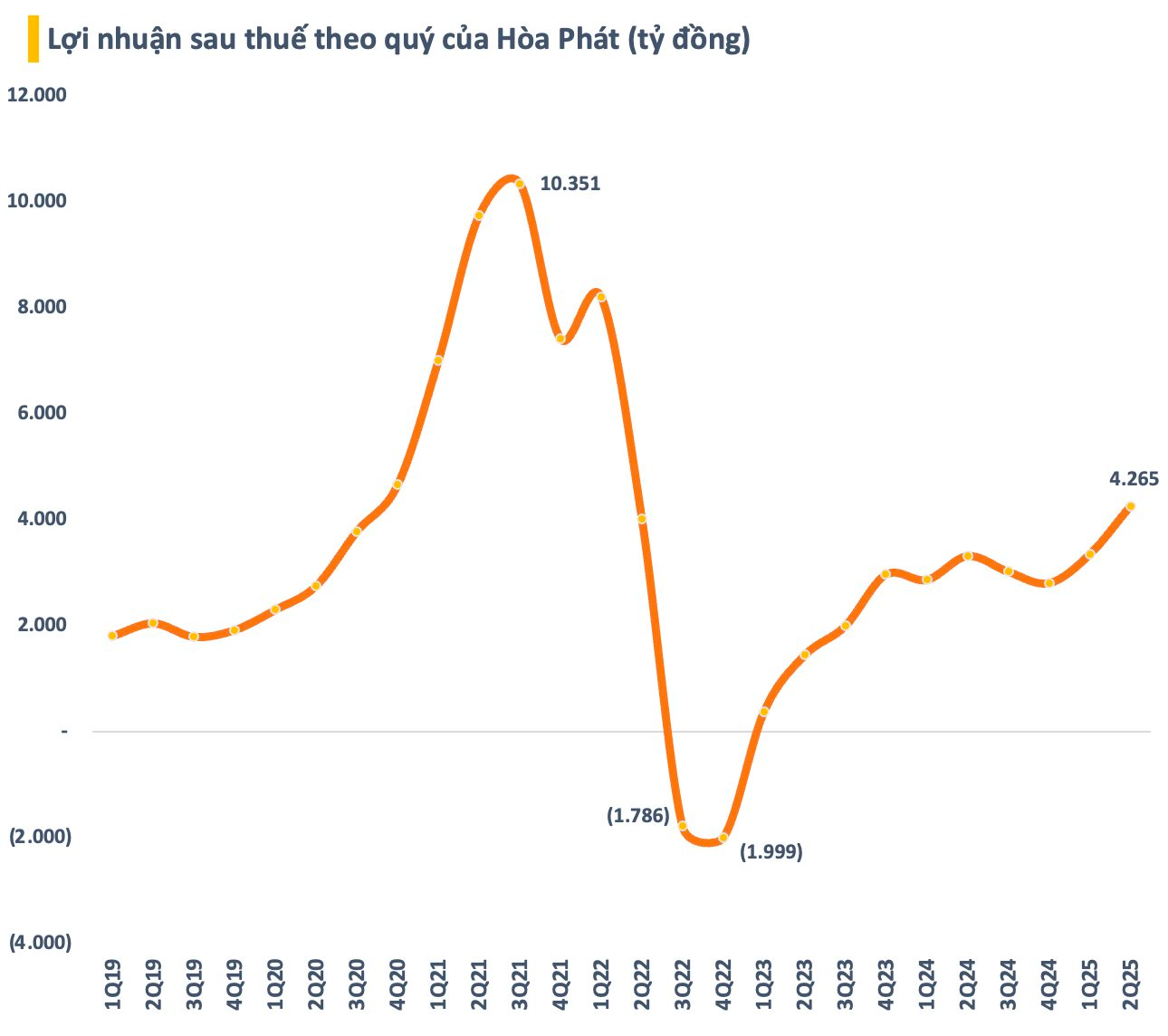

In Q2, Hoa Phat reported revenue of VND 36,286 billion, a 9% decrease compared to the same period in 2024. However, a more significant reduction in cost of goods sold resulted in a 28% increase in the group’s after-tax profit compared to the previous year, reaching VND 4,265 billion. This profit level is the highest the leading steel company has achieved in almost three years, since Q3 2022.

According to Hoa Phat, the decrease in Q2 revenue was due to lower steel product prices during certain periods of the quarter. However, their profits increased due to favorable cost structures and lower input costs, particularly for ore and coal.

In the past quarter, the corporation produced 2.5 million tons of crude steel, a 10% increase year-over-year. Sales volume for hot-rolled coil (HRC) steel, construction steel, high-quality steel, and steel billets reached 2.6 million tons, an 18% increase.

For the first six months of the year, Hoa Phat recorded revenue of VND 74,000 billion and after-tax profit of VND 7,600 billion, representing a 5% and 23% increase, respectively, compared to the previous year. With these results, the company has achieved 43% of its revenue plan and 51% of its profit target for the year. At the 2025 Annual General Meeting of Shareholders, Mr. Tran Dinh Long confirmed that there would be no adjustments to the business plan.

This year, Hoa Phat presented an ambitious business plan to its shareholders, targeting revenue of VND 170,000 billion, a roughly 21% increase from last year, and the highest ever for the company. The after-tax profit goal is set at VND 15,000 billion, a nearly 25% increase compared to 2024.

The Two Stock Symbols Unexpectedly Sold Off by Proprietary Trading Firms in Monday’s Session

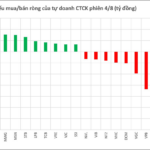

The HoSE witnessed a significant development as proprietary securities firms offloaded stocks en masse, resulting in a staggering net sell value of VND 296 billion.

The Stock Market is Smashing Records: Investors Rush to Open New Accounts

As of July 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). With almost 10.5 million accounts, the market experienced a substantial increase of 226.3 thousand accounts since June and an impressive year-to-date growth of nearly 1.2 million accounts.

A Frenetic Trading Frenzy: 216 Million HPG Shares Change Hands

The Hoa Phat Group Joint Stock Company (HOSE: HPG) witnessed a staggering trading volume of nearly 216 million shares changing hands in a single session.