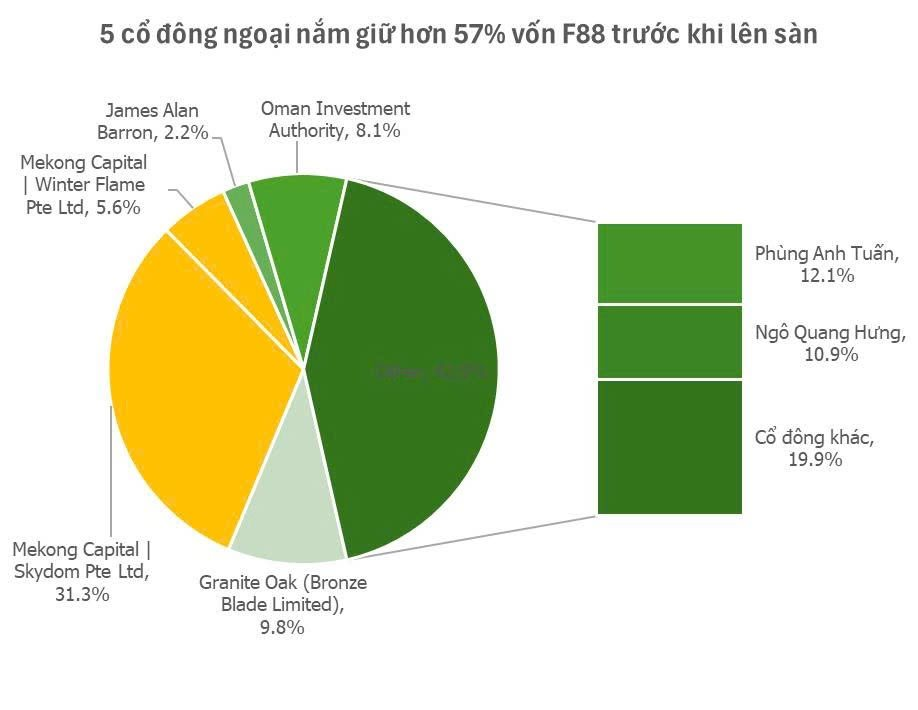

The ownership structure of F88 Investment Joint Stock Company (stock code: F88) reveals significant foreign influence, with foreign investors holding over 57% of the chartered capital, according to the management report and prospectus.

As of December 31, 2024, F88 had six foreign shareholders, including four institutional and two individual investors, holding nearly 4.8 million shares, equivalent to 57.52% of F88’s chartered capital, per the prospectus.

Mekong Capital, through Skydom Pte. Ltd. (the largest shareholder, holding nearly 2.6 million shares, or 31.32% of chartered capital) and Winter Flame Pte. Ltd. (holding over 466,000 shares, or 5.64%), owns nearly 37% of F88’s chartered capital.

Following closely is Granite Oak, with a stake of almost 9.83% through Bronze Blade Limited, holding nearly 813,000 shares.

Oman Investment Authority, through Asia Investment Company S.A R.L., holds over 699,000 shares, approximately 8.1% of F88’s chartered capital.

An individual shareholder, James Alan Barron, owns more than 183,000 shares, representing 2.22% of the company’s chartered capital.

These five foreign shareholders held over 57% of F88’s capital before its stock market debut. According to F88’s management report for the first half of 2025, Phung Anh Tuan, Chairman of the Board of Directors, held over 998,000 shares, or 12.1% of chartered capital, while Ngo Quang Hung, a member of the Board of Directors and the Audit Committee, owned over 903,000 shares, equivalent to 10.93%.

On August 8, F88 Investment Joint Stock Company will officially list over 8.26 million shares on the UPCoM exchange, with a reference price of VND 634,900 per share for the first trading session—the highest on Vietnam’s stock market. This values the company at VND 5,244 billion.

OTC trades for F88 shares are currently above and below VND 1 million per share, significantly higher than the reference price for the first trading session. With a possible daily price fluctuation of up to ±40% on the first day, the share price could reach over VND 888,800 if it hits the upper limit.

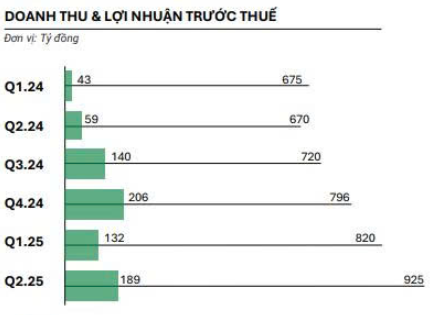

In Q2 2025, F88 reported impressive financial results, with revenue of VND 925 billion, up 30%, and pre-tax profits of VND 189 billion, a substantial increase of 220% compared to the same period last year.

This performance is attributed to the company’s strategic decision to increase disbursements by 47% and loan balances by approximately 45%, coupled with their sustained risk management discipline.

For the first half of 2025, F88 achieved remarkable operational milestones, including the opening of 888 stores—fulfilling its annual expansion plan—and a gross loan balance of VND 5,543 billion. The company also reported total revenue of VND 1,744 billion and pre-tax profits of VND 321 billion, equivalent to 48% of its annual plan.

“F88 to List on UPCoM on August 8, with a Share Price of VND 634,900”

The Hanoi Stock Exchange (HNX) has announced that August 8th will be the first trading day for the registered shares of F88 Investment Joint Stock Company (F88).

Vote for IR Awards 2025: Why Wait to ‘Hunt’ the Whirlpool WIO3T133P Dishwasher and Xiaomi X20 Pro Robot Vacuum?

“The IR Awards 2025 has witnessed an overwhelming response from individual investors across the nation during the two-day open nomination period for the finalist selection round. This enthusiastic participation highlights the growing importance that the investment community attaches to the quality of information disclosure and financial transparency among listed companies.”

The Billionaire’s Stock Surge: Nguyễn Đăng Quang and Nguyễn Thị Phương Thảo’s Unexpected End-of-Year Rally to New Heights

As of December 30, billionaire Nguyen Thi Phuong Thao’s HDB stock holdings were valued at nearly VND 3,485 billion, marking an increase of over VND 222 billion for the day.