Techcombank Securities’ IPO and Its Potential Impact on Vietnam’s Securities Industry

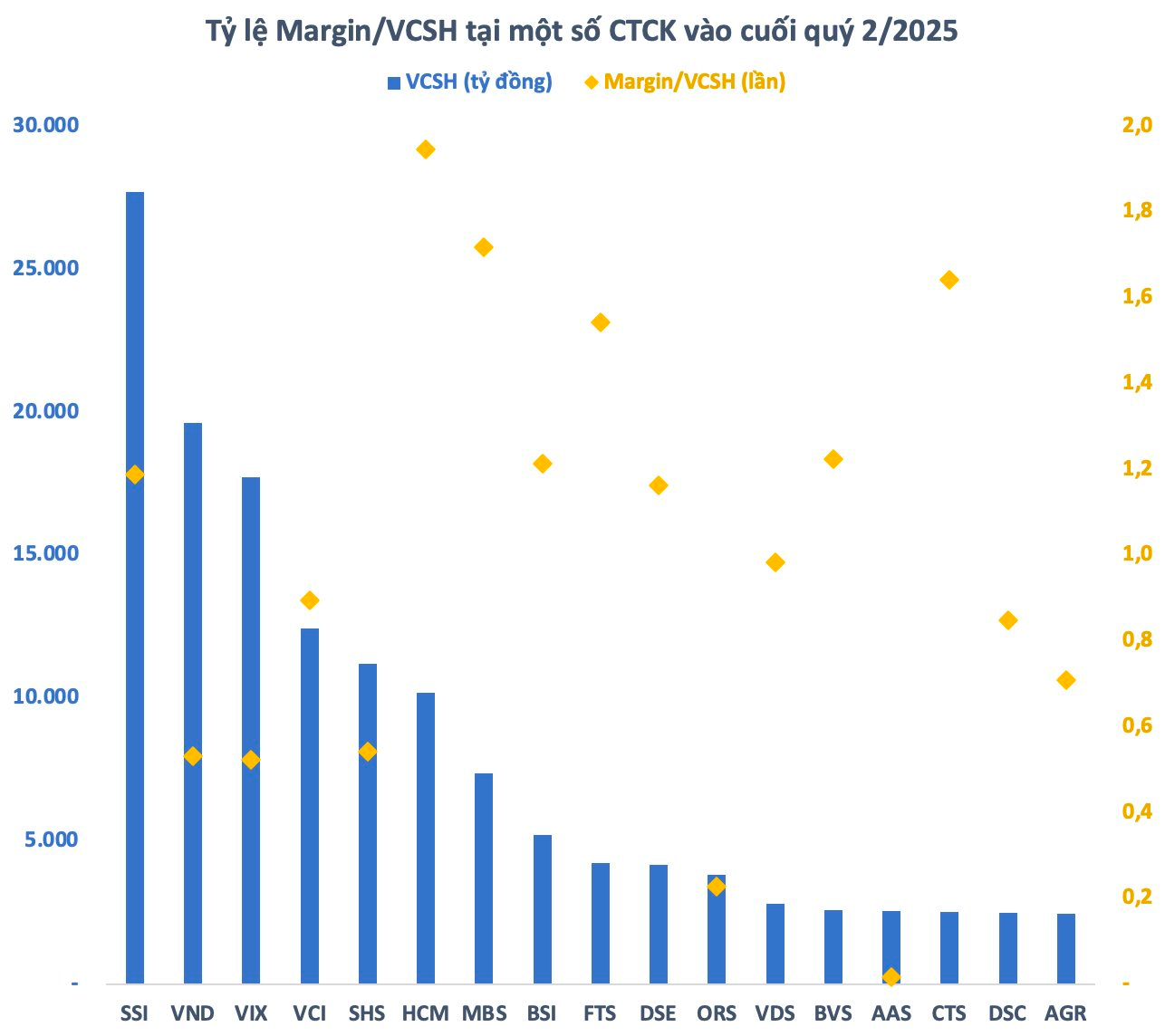

Techcombank Securities (TCBS) is in the final stages of its initial public offering (IPO), marking a significant step for the company and the Vietnamese securities industry. With its leading position in various metrics such as charter capital, loan outstanding, and a promising IPO, TCBS is expected to create a substantial boost for securities firm stocks.

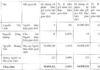

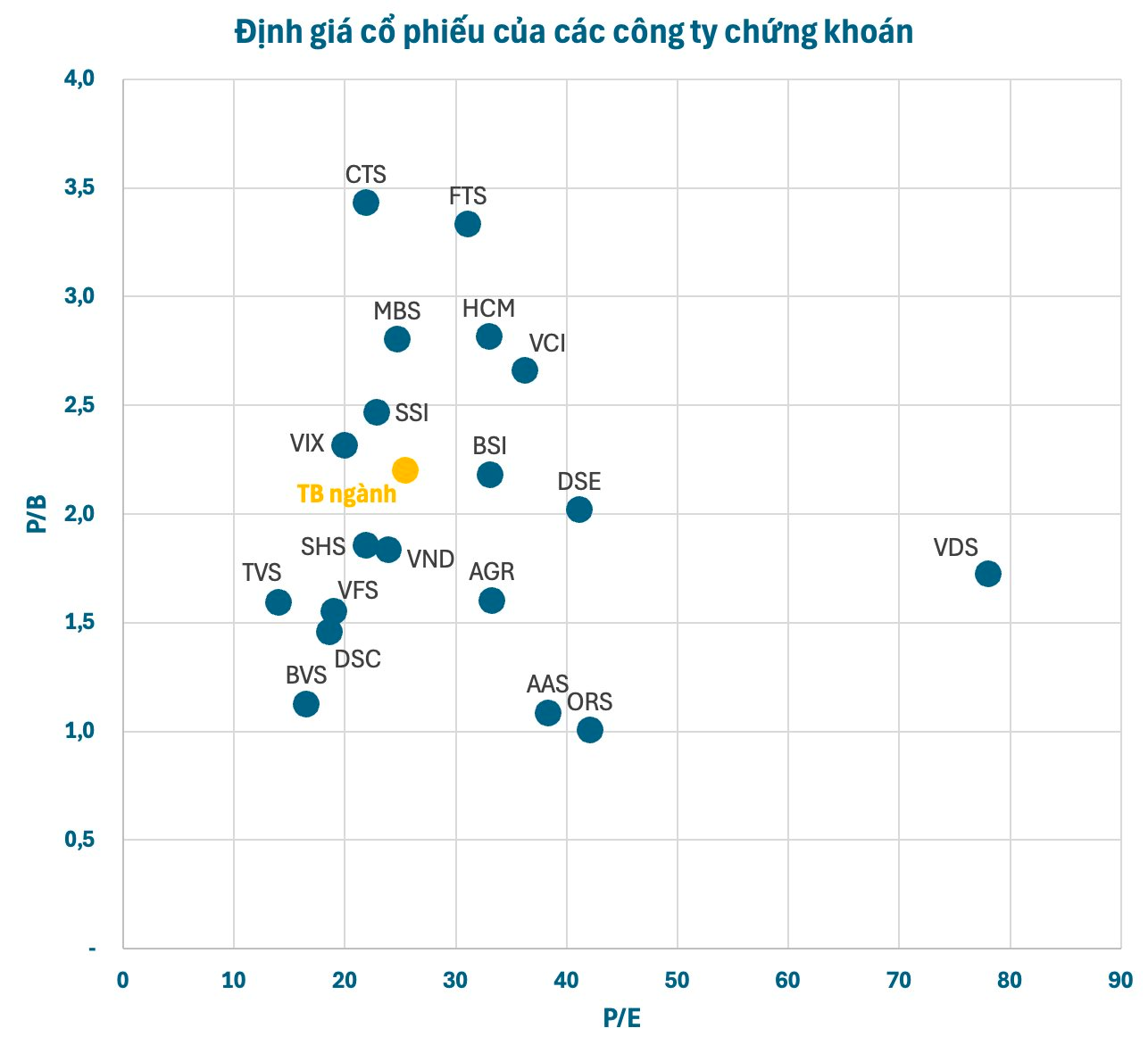

At present, after the recent strong gains and the market’s overall breakout, there are hardly any securities firms with a P/B ratio below 1. Major securities companies such as SSI, HCM, VCI, and VIX have P/B ratios ranging from 2-3 times. Meanwhile, SHS and VND, two of the top-performing firms, currently have P/B ratios below 2.

Securities firms with lower P/B ratios, ranging from 1-1.5 times, such as BVS, AAS DSC, and ORS, generally have a smaller scale, modest capital, and negligible market share. This group tends to focus on niche businesses and serves specific types of clients due to their limited competitive advantages.

Turning to the less commonly used P/E ratio for the financial sector, listed securities firms currently have P/E valuations ranging from 20-40 times. SSI, VIX, VND, and SHS are among the top performers with relatively low P/E ratios compared to their peers. On the other hand, HCM and VCI have relatively high P/E ratios, partly due to their significant profit decline in the second quarter.

It’s evident that securities firms with higher valuations possess certain competitive advantages, such as market share, capital scale, and growth potential. Conversely, some low-valuation stocks face challenges such as shrinking market share, underutilized loan facilities due to capital tied up in other investments, which may impact investors’ expectations.

Overall, while the valuation of securities firm stocks may not appear bargain-priced, there is still significant growth potential and compelling narratives to watch in the coming periods.

The TCBS IPO has the potential to create a valuation effect, significantly impacting securities firm stocks. With an expected offering price of VND 46,800 per share, TCBS is currently valued at over VND 97 trillion (USD 3.7 billion) pre-IPO, implying a P/B ratio of 3.2 times, which is higher than the industry average.

In reality, valuation is just one factor in determining a stock’s attractiveness. Investors should also consider their risk appetite, thoroughly research the intrinsic qualities of each securities firm, assess their capital strength, and evaluate their ability to seize opportunities as the market upgrades.

According to prominent domestic and foreign organizations, there is a high likelihood that FTSE Russell will upgrade Vietnam to an emerging market in the upcoming annual review later this year. This upgrade is expected to attract billions of dollars in foreign capital, boosting the market’s growth in terms of scale and liquidity.

In this context, securities firms are expected to be one of the direct beneficiaries. Additionally, the digital asset sector is gradually being regulated in Vietnam, and it is anticipated to become another attractive arena for securities firms, alongside the traditional stock market.

The Warrant Market on July 30, 2025: A Fiery Red Along with the Underlying Market

The trading session on July 29, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, 21 advanced, 196 declined, and 29 remained unchanged. Foreign investors continued their net-selling trend, offloading a total of 5.09 million covered warrants.

TCBS Announces IPO Price at VND 46,800 per Share, Valuing the Company at Over USD 4 Billion

The Board of Directors of Techcom Securities Joint Stock Company (TCBS) approved a resolution on August 5th to adjust and replace certain contents of the previous IPO plan outlined in the resolution of July 9th. Notably, the company announced a sale price of VND 46,800 per share, corresponding to a valuation of approximately 4.1 billion USD.